picture alliance/dpa/picture alliance via Getty Images

Welcome back! Stock market futures are surging after the US and China said on Monday they agreed to reduce tariffs for 90 days following trade talks in Switzerland. The US is set to cut tariffs on Chinese goods to 30% during this period, while China is set to lower tariffs on American imports to 10% in the same timeframe.

In today’s newsletter, consumers are shifting spending habits to make themselves more resilient if a recession hits.

Tech Memo, a weekly BI newsletter from Alistair Barr, is coming soon! Sign up here!

What’s on deck

Markets: Here’s another barrier to getting a job on Wall Street: your university’s finance club.

Tech: Our annual list of the best early-stage investors: the Seed 100.

Business: Donald Trump Jr. is cashing in on his dad’s presidency as a partner in a new investment fund.

But first, we’re cutting back on that.

If this was forwarded to you, sign up here.

The big story

Smart spending

davidgoldmanphoto/Getty Images/Image Source

In a world full of economic uncertainty, consumers just want some guarantees regarding where they spend their money.

We might not be in a recession, but Americans don’t want to take any chances with their budgets. Cruises. Streaming subscription services. All-inclusive vacation packages. Consumers want fixed-price options that are clear and upfront about how much they’ll cost, writes BI’s Juliana Kaplan.

Meanwhile, anything where the price might vary is a no-go. That two-week backpacking trip in Europe? No thanks. A concert with an unknown number of cocktails (and where they might not play the hits)? Maybe next summer.

As depressing as consumers’ lack of spontaneity sounds, it’s not necessarily bad for all businesses. After all, plenty of companies have spent years desperate for us to join their subscription services that’ll offer a bit more stability to their balance sheets.

With businesses and customers in the dark about what might happen to the economy, everyone might benefit from a bit of lock-in.

Jennifer Sor/BI

One market is taking consumers’ new spending habits on the chin.

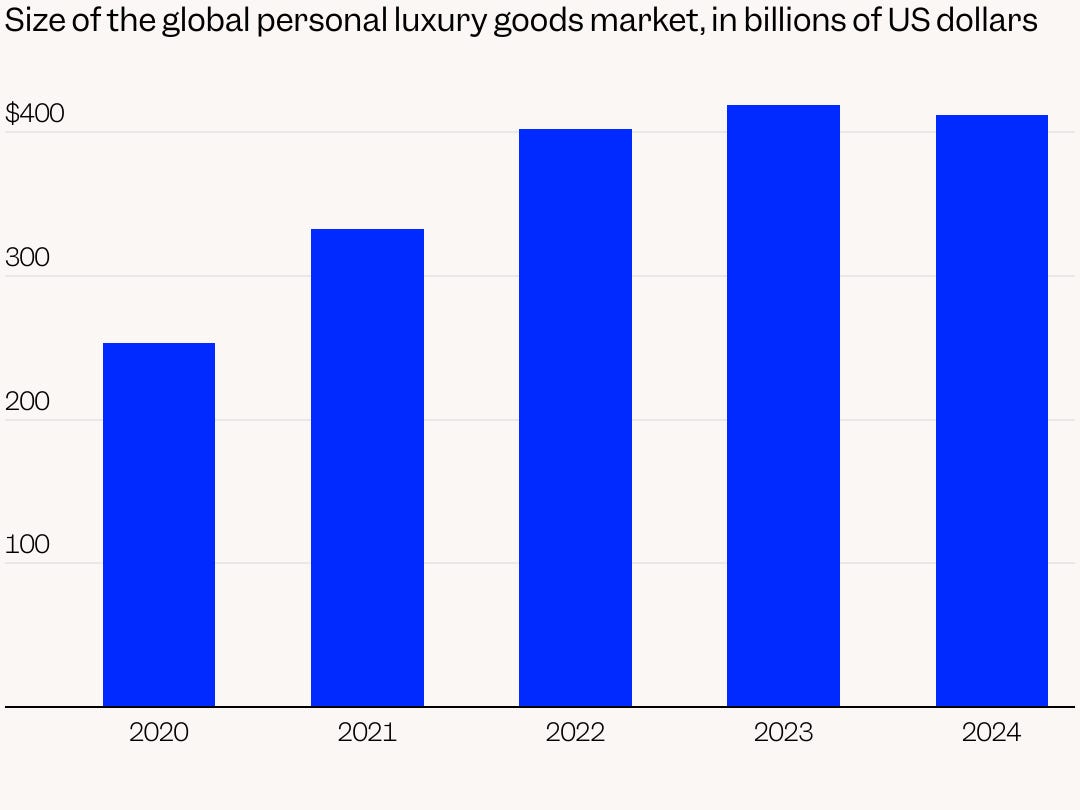

The luxury market, which boomed when middle-class households increased spending during the pandemic, is feeling the pullback, writes BI’s Jennifer Sor. For the first time in 15 years, the global luxury market shrank last year, decreasing by 2%.

It’s not entirely surprising that pricey items are no longer at the top of most consumers’ shopping lists. When the times get tough, the Rolexes and Louboutins are typically the first to go.

But one does wonder when they’ll make their comeback.

A major premise of the trend Juliana highlighted is the concept of “affordable luxury.” Giving yourself that high-end feeling without breaking the bank. That could mean a more permanent reprieve from the finer things in life.

On the other hand, the rich don’t seem to be slowing down. The departure of lower- and middle-income consumers from the luxury market could eventually just increase the exclusivity and value of the items. After all, if everyone can afford it, is it really that luxurious at all?

3 things in markets

Getty Images; Alyssa Powell/BI

1. The secret back door to a Wall Street career: student finance clubs. At elite schools, finance clubs offer invaluable training and access to recruiters. But they’ve also created a cutthroat race for membership, leading some students to start prepping before they even arrive on campus.

2. Forget “sell in May and go away.” Historically, summer months tend to be slow for the stock market. Tariff changes, tax policy, and debt ceiling risks could shake up seasonal advice.

3. Recession-proof trades may not work. Now what? Traditional defensive stocks — like those in the consumer staples and utilities sectors — won’t necessarily do the trick in this current market environment. They aren’t the only options to protect your portfolio, though.

3 things in tech

Courtesy of Ben Ling, Ann DeWitt, Meltem Demirors, Kevin Mahaffey, Alexis Ohanian, Ava Horton/BI

1. The best early-stage investors of 2025. Every year, BI highlights the top seed-stage investors who give young startups the push they need to become some of the most successful companies in the tech world. See who made BI’s fifth annual Seed 100 list.

2. Salesforce’s Marc Benioff on his angel-investing “side hustle.” Benioff sat down with BI to discuss his investing strategy for Salesforce Ventures and Time Ventures. His founder-mode approach is a lesson from his early experience with Steve Jobs.

3. Who could replace Elon Musk at Tesla? In May, The Wall Street Journal reported that the EV giant reached out to recruitment firms to begin the search for a new CEO, which Tesla’s board chair and Musk quickly denied. Tesla analysts and investors told BI that Musk would be nearly impossible to replace, but they shared a small list of prime candidates.

3 things in business

Getty Images; Matt Rourke/AP Photo; Alyssa Powell/BI

1. Don Jr. is the new Hunter Biden. Days after his father’s election victory, Donald Trump Jr. joined 1789 Capital, a tiny venture capital fund. Since his arrival, the firm has invested in companies being awarded lucrative defense contracts — and been cut in on deals offered only to a select few. There’s no evidence 1789’s deals break the law, but the potential conflict of interest has alarmed DC insiders, writes Bethany McLean. It’s also eerily similar to what Trump blasted Hunter Biden for: trading on his father’s name to win lucrative business deals.

2. He created a pencil-thin skyscraper — and a thick collection of lawsuits. Michael Stern has contributed to remaking New York City’s skyline, but he also has a history of lawsuits filed against him by former business partners, investors, contractors, and his own mother, according to a BI review. Now, his legal issues have followed him to Miami, but Stern says it’s just part of the job.

3. The politics of beer. A few years ago, Mexican-made Modelo became the top-selling beer in the US. Now, President Trump’s tariff and immigration policies could threaten its reign. Here’s how politics can affect your favorite brew.

In other news

- Tesla tells Model Y and Cybertruck workers to stay home for a week.

- Diddy’s Hail Mary: Convincing a sex-trafficking jury he, too, is a domestic violence victim.

- A business owner tested if customers would pay more for American-made. The results were ‘sobering.’

- Forget SEO. The new hot thing is “AEO.” Here are the startups chasing this AI marketing phenomenon.

- Gen Z’s ‘conscious unbossing’ should be a wake-up call for businesses.

What’s happening today

- Opening statements begin in trial for Sean “Diddy” Combs.

-

Fox Corp reports earnings.

The Business Insider Today team: Dan DeFrancesco, deputy editor and anchor, in New York. Hallam Bullock, senior editor, in London. Grace Lett, editor, in Chicago. Amanda Yen, associate editor, in New York. Lisa Ryan, executive editor, in New York. Ella Hopkins, associate editor, in London. Elizabeth Casolo, fellow, in Chicago.

The post Consumers’ new spending habits show they’re preparing for the worst, and the luxury market is taking the brunt of it appeared first on Business Insider.