Bettmann/Bettmann Archive

The Roaring Twenties — an era of great economic growth in the United States — halted on Thursday, October 24, 1929, when stock prices began plummeting.

Influenced by a variety of factors, from banks’ role in speculative stock lending to changing monetary policies, the market crash of 1929 marked the start of the Great Depression that would shape American life for the following decade.

With recent market movements in response to President Donald Trump’s tariff announcements sparking fears of an incoming recession, history shows how market crashes have influenced American life in the past.

These 20 vintage photos show how the 1929 market crash, marked by dramatic stock price drops on Black Thursday, Black Monday, and Black Tuesday, unfolded on Wall Street and beyond.

The Roaring Twenties came to a sudden halt in October 1929.

New York Daily News Archive/NY Daily News via Getty Images

The 1920s were a decade of great economic growth. Industries boomed, and economic optimism led many everyday Americans to invest in the stock market, which had become more accessible thanks to loans offered by banks.

From 1922 to 1929, the value of stocks as measured by the Dow Jones Industrial Average rose by 218.7%, according to the Economic History Association.

Over the decade, many had begun investing in the stock market through margin loans.

New York Daily News Archive/NY Daily News via Getty Images

At the time, people could buy stocks by paying as little as 10% of the purchase price and financing the rest from brokerage firms through what became known as margin buying, according to Federal Reserve History. This meant that many people who could not afford the up-front expense of investing in the stock market had access to buy and trade stocks.

By 1929, two-fifths of loans issued by banks went toward the purchase of stocks, Time reported.

On October 24, the US markets began to crash.

ullstein bild Dtl./ullstein bild via Getty Images

The crash began on Thursday, October 24. On the day that later became known as Black Thursday, the market opened 11% lower than the previous day, as reported by Barron. Despite moderately picking back up by that afternoon, the drastic drop began sounding the alarms for stockholders.

The crash came after market speculation reached a historic high.

MPI/Getty Images

With many Americans investing in the stock market through margin purchases of stocks, the speculation for high prices, which would provide a profit on their loan, reached a historic high. This led to the Federal Reserve making an effort to limit banks’ lending to speculative stock purchases, according to Federal Reserve History.

Stock prices peaked right before the crash.

DEA PICTURE LIBRARY/De Agostini via Getty Images

On September 3, 1929, less than two months before the market crash, stock prices had reached a historic peak, with the Dow Jones averaging 381.17, over 27% higher than the previous year.

With many owning stocks through margin loans, fears spread that stock prices had become overvalued, a concern that slowly led to doubts about the stability of the market, the Economic History Association wrote.

On Black Monday, brokers rushed to sell as prices plummeted.

ullstein bild Dtl./ullstein bild via Getty Images

When markets opened on Monday, October 28, 1929, stock prices immediately began to plummet as stockholders rushed to sell based on the panic that had begun the previous week.

As mass panic spread, sell transactions overwhelmed the markets, leading to the crash.

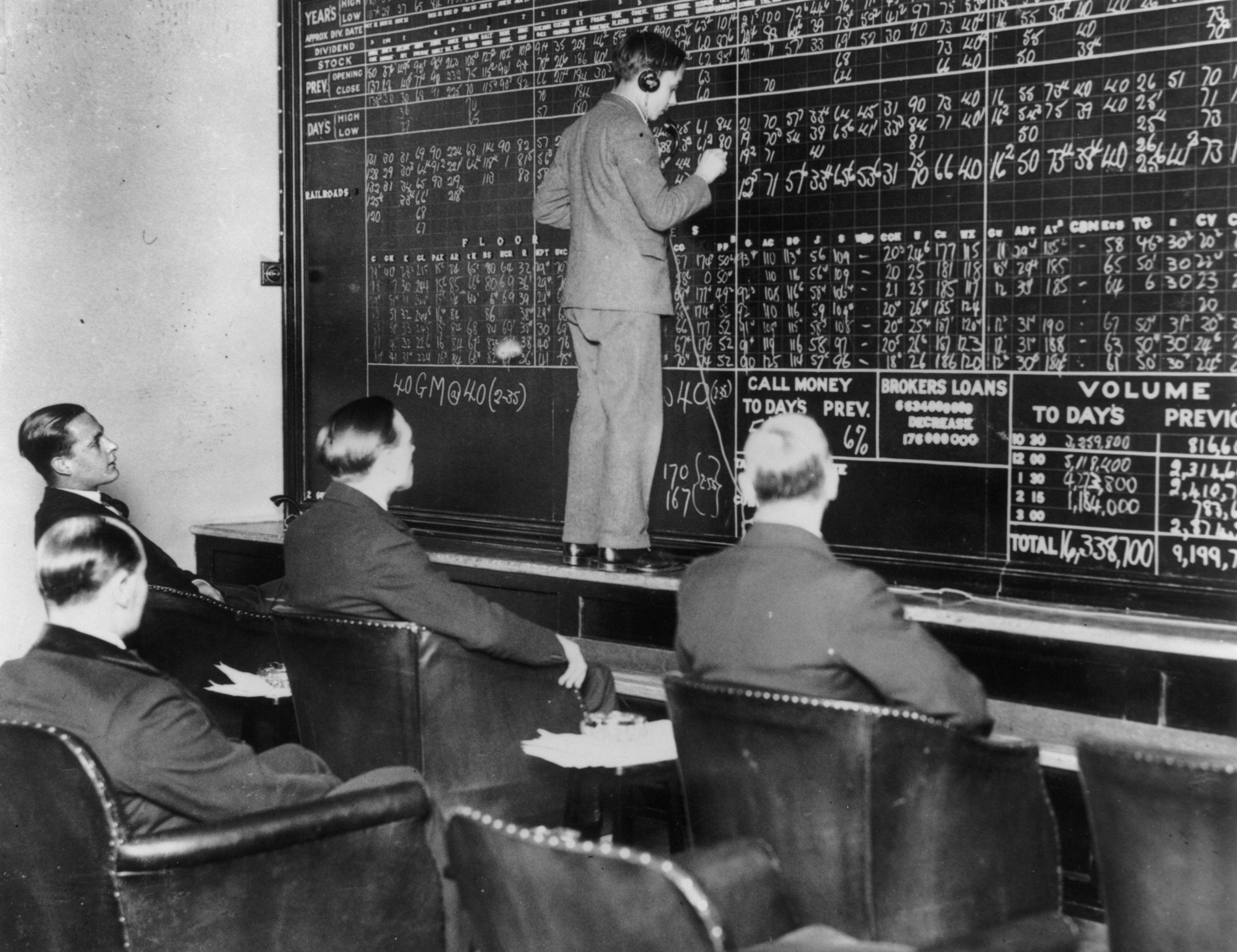

Bettmann/Bettmann Archive

By the end of the day on Black Monday, the Dow Jones had dropped nearly 13% and showed no signs of slowing down, as reported by Time.

Outside the New York Stock Exchange, crowds tried to get updates on prices.

New York Daily News Archive/NY Daily News via Getty Images

In New York, people rushed to the Stock Exchange building in an effort to get updates on the stocks to ensure their investments remained safe.

“For so many months so many people had saved money and borrowed money and borrowed on their borrowings to possess themselves of the little pieces of paper by virtue of which they became partners with the US industry,” Time reported in November 1929. “Now they were trying to get rid of them even more frantically than they had tried to get them.”

Without access to real-time information, many relied on the newspapers to inform them.

New York Daily News Archive/NY Daily News via Getty Images

As the crowds tried to get an image of what was going on inside Wall Street, newspapers became a hot commodity, with many flocking to buy the most updated information as it came out.

Meanwhile, brokers’ offices were overwhelmed trying to complete sell orders.

New York Daily News Archive/NY Daily News via Getty Images

As prices plummeted on Black Monday and Black Tuesday, stock brokers witnessed sell orders coming in at rates they knew wouldn’t be replicated in their lifetime.

“Wall Street was a street of vanished hopes, of curiously silent apprehension and of a sort of paralyzed hypnosis yesterday. Men and women crowded the brokerage offices, even those who have been long since wiped out, and followed the figures on the tape,” The New York Times reported on October 30, 1929. “It was the consensus of bankers and brokers alike that no such scenes ever again will be witnessed by this generation.”

The dissemination of information was limited by the technologies of the time.

New York Daily News Archive/NY Daily News via Getty Images

As chaos unfolded on Wall Street, communication to outlets across the country relied on telegrams and ticker tape, which could not keep up with the sheer volume of transactions being made as prices continued to plummet. As Time reported, “although people knew they were losing money, they didn’t know how much.”

Stock brokers worked around the clock during the critical hours of the market crash.

Bettmann/Bettmann Archive

To keep up with the mass volume of transactions, stock traders worked through the night, catching up on sleep in the area near Wall Street, turning offices or school gyms into sleeping quarters in preparation for the chaos that was all but certain to come on Tuesday, October 29, 1929.

Abroad, businessmen closely monitored the situation unfolding in the New York markets.

London Express/Getty Images

The crash spread to international markets as US consumers rushed to withdraw their capital from investments abroad, according to the International Monetary Fund. In the following months and years, the financial depression that shook American markets spread to other countries, leading to a worldwide financial downturn in which each country’s domestic markets aimed to regulate themselves.

As the news about the crash spread, panic grew even more, peaking on Black Tuesday.

New York Daily News Archive/NY Daily News via Getty Images

By 1932, when the Great Depression ended, stocks had lost nearly 90% of their pre-crash value, per the Economic History Association.

Hearing of the chaos on Wall Street, thousands rushed to withdraw their accounts from the banks.

Bettmann/Bettmann Archive

On Black Tuesday, as the news spread, people rushed to their banks to withdraw their savings, as panic and financial uncertainty influenced mass decisions.

Banks across the nation began failing, causing people to lose their savings.

Hulton Archive/Getty Images

The crash showed the fragility of economic systems, as banks, which used deposited money to issue loans, started failing. As people in the midst of the panic rushed the banks to withdraw their savings, banks ran out of money to cover the transactions.

The Social Security Administration reported that 9,000 banks failed after the crash, virtually disappearing $7 billion in assets for those who had stored their capital in them.

People’s savings virtually disappeared overnight.

FPG/Getty Images

As the market crash led to banks failing, a distrust in financial institutions began to rise, leading to the popularity of practices like stashing cash under mattresses or buying gold as an investment.

Following the crash, banks decreased lending, affecting businesses across the country.

New York Daily News Archive/NY Daily News via Getty Images

In response to the market crash and the droves of people rushing to the banks to withdraw their capital, many banks stopped or decreased their lending, which greatly affected businesses.

Americans soon began to feel the economic downturn.

Bettmann/Bettmann Archive

The effects of the Great Depression were felt soon after the crash. Americans faced the sudden loss of savings and investments. Banks failed and lending stopped, so businesses had to cut costs by lowering production and laying off employees, which led to a drastic rise in unemployment, reaching a high of 24.9% in 1933, according to the National Archives.

The Great Depression lasted for the next decade.

Visual Studies Workshop/Getty Images

While the market crash didn’t singlehandedly cause the recession, it was a sign of the crumbling economy that would greatly impact people for the decade after.

The post 20 vintage photos show the 1929 stock market crash that set off the Great Depression appeared first on Business Insider.