Justin Sullivan/Getty Images

Good morning. This is my last morning writing to you for a while, as Dan DeFrancesco returns from leave on Monday! But I’ll still be around: After a brief staycation (the lawn needs tending to), I’ll be back behind the scenes editing each edition from London.

In today’s big story, we’re looking at the key details from Apple’s earnings report — and why the company’s huge stream of App Store revenue could be at risk.

Newsletter alert: BI Tech Memo is a weekly newsletter where Silicon Valley secrets go public. Launching soon — sign up here now!

What’s on deck

Markets: One market strategist thinks the US stock market’s best times are behind it.

Tech: CEO Andy Jassy said Amazon is focusing on keeping prices low ahead of tariffs.

Business: Spotify was great at helping users discover new music. Then it laid off staff.

But first, Apple has been through the wringer.

If this was forwarded to you, sign up here.

The big story

Apple faces a major change

Sean Gallup/ Getty Images

A federal judge slapped Apple around.

Referring to Apple’s court case with Epic Games, the judge said on Wednesday that Apple “outright lied under oath” and that she would refer the company for possible criminal prosecution.

In 2020, Epic accused Apple of anticompetitive practices tied to the App Store and in-app payments.

The judge ruled against Epic in 2021 on almost all counts. But Epic did salvage one win: Apple had to let developers tell customers that they could leave the app and head to another website — where, theoretically, they could get more for their money if Apple isn’t taking a cut.

This week, the judge ruled that Apple was in “willful violation” of that ruling.

Apple said it will comply with the court order — and they’ll appeal it. BI’s Peter Kafka has broken down why this could be an enormous issue for Apple.

Then came the earnings report.

It was a mixed bag. Apple beat revenue and EPS estimates, but also said it expects the cost of Donald Trump’s tariffs to be $900 million in the current quarter. Sales in China were worse than expected. The stock is down 3% in premarket trading.

CEO Tim Cook opened the earnings call by touting a recently announced $500 billion investment to boost US manufacturing over the next four years.

In the more immediate term, Cook said he expects the majority of iPhones sold in the US during the June quarter to have “India as their country of origin.” Nearly all of the company’s other products entering the US will come from Vietnam, he said.

Cook also spoke about consumer behaviours and Siri’s newest features being delayed again. BI has the six most important takeaways.

3 things in markets

Spencer Platt/Getty Images

1. The best may be over for US stocks. Jefferies’ Chris Wood says the stock market has already peaked, partly due to President Trump’s tariffs damaging the US brand. Now, Wood has some advice for investors: Look abroad.

2. Scott Bessent calls on the Fed to cut rates. The US Treasury Secretary pointed to bond yields as a reason Jerome Powell and the Fed should lower interest rates. The Trump administration has been clamoring for rates to come down, though Powell hasn’t budged.

3. So long, “Liberation Day” tech losses. Meta and Microsoft led a tech-stock comeback on Wednesday after AI dominated their earnings calls. Meta raised its 2025 capex guidance, indicating that AI infrastructure growth isn’t slowing down.

3 things in tech

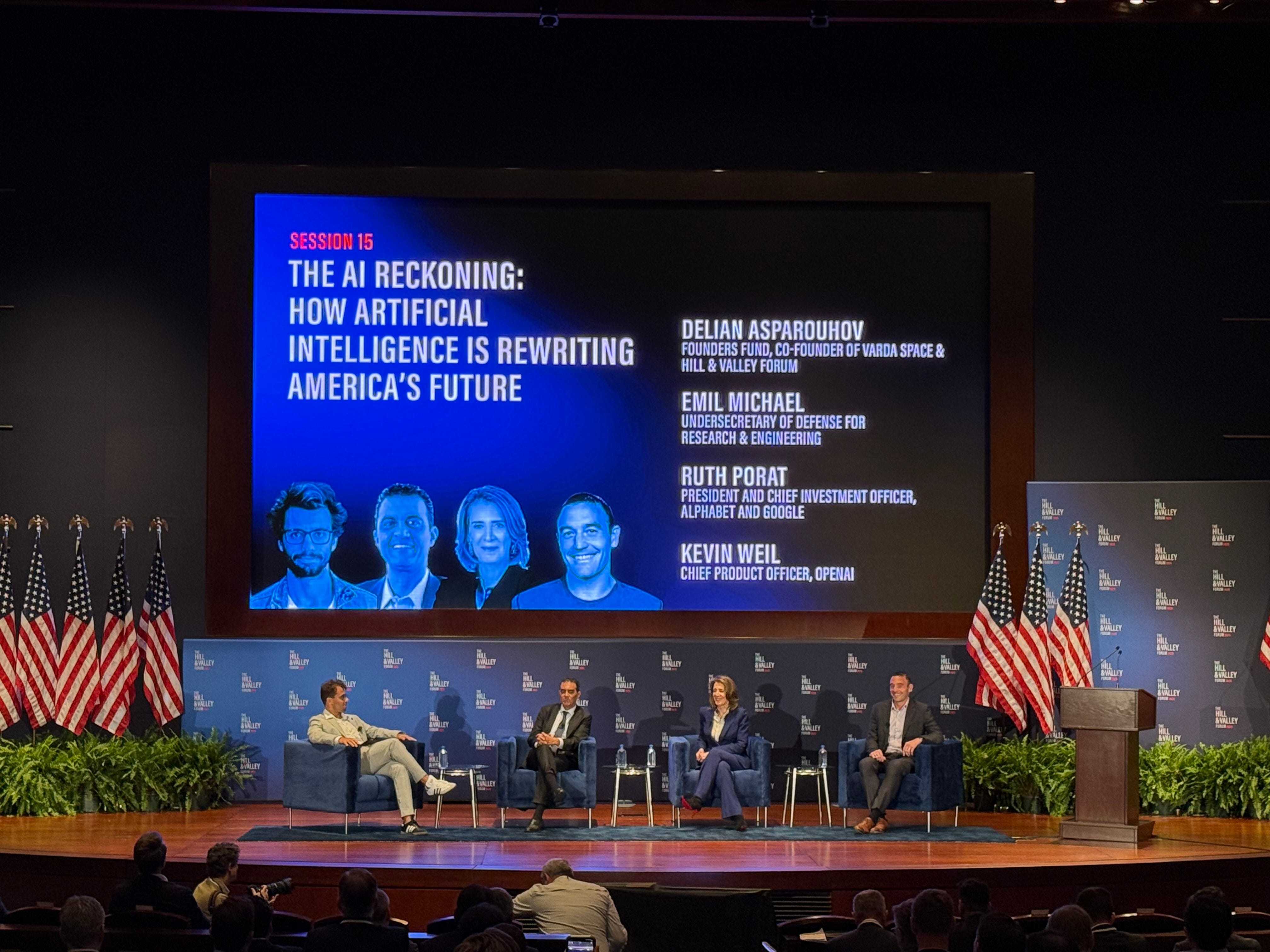

Julia Hornstein/BI

1. Inside the “Conclave of Silicon Valley.” Tech titans and political power players descended on Capitol Hill for the hush-hush gathering known as the Hill and Valley Forum. BI had a writer in attendance; she said the forum showed just how tight tech’s hold on DC is.

2. Amazon narrowly beat expectations. The e-commerce giant’s stock fell as much as 5% in after-hours trading as it reported weaker-than-expected earnings for Q2. On the earnings call, CEO Andy Jassy said Amazon was focused on keeping prices low as tariffs take effect.

3. The new Meta AI app shows you other people’s chats. The stand-alone version of the Meta AI assistant can come up with funny images and answer your questions. You can also scroll through other users’ public AI chats — and that’s where it gets weird.

3 things in business

Edmon de Haro for BI

1. Why Spotify’s music discovery went downhill. Personalized playlists like Discover Weekly and Release Radar used to bring new music straight to your ears. After the company reoriented its priorities — and laid off some employees — its music discovery function fell off the deep end.

2. McDonald’s isn’t lovin’ its sales. The chain reported that US same-store sales were down 3.6% in Q1, the biggest decline since COVID lockdowns. Even as McDonald’s tries to lure customers with its new value menu, the CEO said customers just aren’t visiting as often.

3. Advertisers are sticking with Meta, even with content moderation changes. The company’s advertisers aren’t too shaken up by the lax rules and shift to community notes. One former ad agency exec shared why he thinks Meta’s ad business is still booming.

In other news

- Trump’s advice to new grads: ‘Find your limits and then smash through everything.’

- I scammed my bank. All it took was an AI voice generator and a phone call.

- I attended LlamaCon, Meta’s first event for AI developers. It was “kinda mid.”

- From Paul Weiss to DLA Piper, five lawyers share how they’re using AI at work.

- The US Army plans to flood its forces with drones, making sure every division has them by next year.

- A fight is brewing in Indiana over who should pay Big Tech’s energy bills. Spoiler: It’s you.

- Reddit’s stock jumps as much as 19% after first quarter earnings report.

- Kohl’s fires its CEO months after he started the job.

- Warren Buffett disciples want to know what he plans to do with all that cash.

What’s happening today

- Bureau of Labor Statistics releases monthly employment report.

- US judge holds hearing to decide remedies after ruling Google has illegal monopoly in online ads.

- ExxonMobil, Chevron, Shell, and Wendy’s report earnings.

The Insider Today team: Dan DeFrancesco, deputy editor and anchor, in New York (on parental leave). Hallam Bullock, senior editor, in London. Grace Lett, editor, in Chicago. Amanda Yen, associate editor, in New York. Lisa Ryan, executive editor, in New York. Lina Batarags, bureau chief, in Singapore. Ella Hopkins, associate editor, in London. Elizabeth Casolo, fellow, in Chicago.

The post The key details from Apple’s earnings report as the company faces a major change appeared first on Business Insider.