WASHINGTON — Republican lawmakers from Democratic states are locked in tense closed-door talks over state and local tax (SALT) deductions — seeking an annual cap of between $30,000 and $100,000 to include in President Trump’s “big, beautiful bill,” sources say.

GOPers from New York, New Jersey and California met Wednesday with House Speaker Mike Johnson (R-La.) and House Ways and Means Chairman Committee Chairman Jason Smith (R-Mo.) on Capitol Hill to hash out an agreement to stick in a multi-trillion dollar tax package.

Three sources familiar with the meeting told The Post that members sought consensus as they batted around figures of $30,000, $40,000 or $60,000 — and still others suggested a deduction cap of “$100,000 or bust.”

Rep. Jeff Van Drew (R-NJ) has previously said roughly $30,000 per individual filer is “a good number” and “still reasonable.”

An unidentified California Republican suggested a $60,000 cap, one source close to the talks said, which roughly matches legislation introduced in the last Congress by Long Island Rep. Nick LaLota to set that deduction level for single filers and $120,000 for joint filers.

Rockland County Rep. Mike Lawler has also floated a bill hoping for a $100,000 deduction for individuals and a $200,000 cap for married couples, which would also eliminate the so-called “marriage penalty” that previously set the same levels for individual and joint filers.

The current maximum cap for those filing federal returns is $10,000 for individuals and married couples, a level set by Trump’s 2017 Tax Cuts and Jobs Act and scheduled to expire at the end of this year.

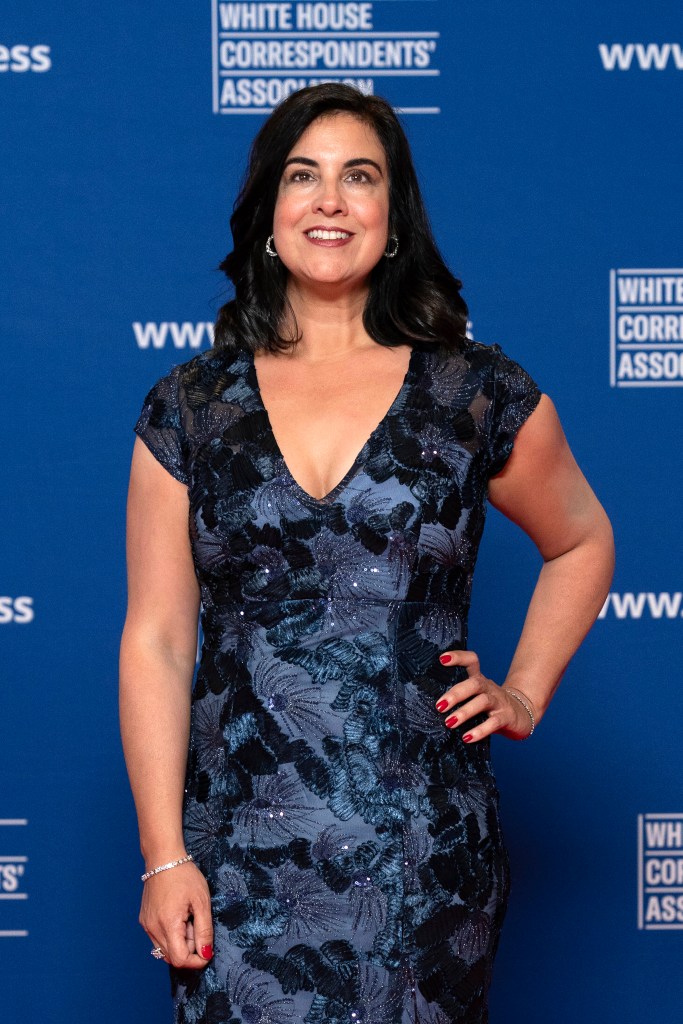

Staten Island Rep. Nicole Malliotakis and others have said that the current maximum deduction is not enough — nor would doubling the amount to $20,000 do.

“We’re working on identifying a number that will cover the middle-class families we represent,” Malliotakis said.

“It’s going to come down to what provides relief for the middle-class, what can we get consensus on in the committee and what is palatable for the entire conference,” she added.

“The president, the speaker, Chairman Jason Smith and my colleagues on the [Ways and Means] committee — they understand the dilemma facing New York members.”

The panel is expected to finalize the tax bill’s provisions next week — with Treasury Secretary Scott Bessent setting a July 4 passage deadline.

Bessent told reporters Tuesday that if the “big, beautiful” package — which also includes hikes to the national defense budget and border security funding — “doesn’t pass, we’ll have the largest tax hike in history.”

If the current $10,000 cap level is made permanent, SALT deductions are estimated to add more than $1 trillion to the federal deficit over the next 10 years, according to the nonpartisan Tax Foundation.

The Committee for a Responsible Federal Budget projected even higher deficit-busting effects, with Lawler’s $100,000 for singles and $200,000 for joint filers cap cutting nearly $1 trillion in additional revenue on top of that by 2035.

Some of the package’s details will have to be ironed out by the Joint Committee on Taxation or the Congressional Budget Office (CBO) to ensure it is eligible to pass the Senate with just 51 votes through reconciliation.

“Our final bill will not only extend the 2017 tax relief for hardworking Americans, it will make it permanent,” Senate Majority Leader John Thune (R-SD) said in a Tuesday floor speech.

Johnson has been optimistic that the whole bill will reach the president’s desk around Memorial Day.

The Post reached out to Johnson, Smith, Lawler, LaLota, Van Drew and Reps. Andrew Garbarino (R-NY) and Young Kim (R-Calif.) for comment.

The post NY, NJ homeowners facing major SALT deduction changes as blue state GOPers duke it over new cap appeared first on New York Post.