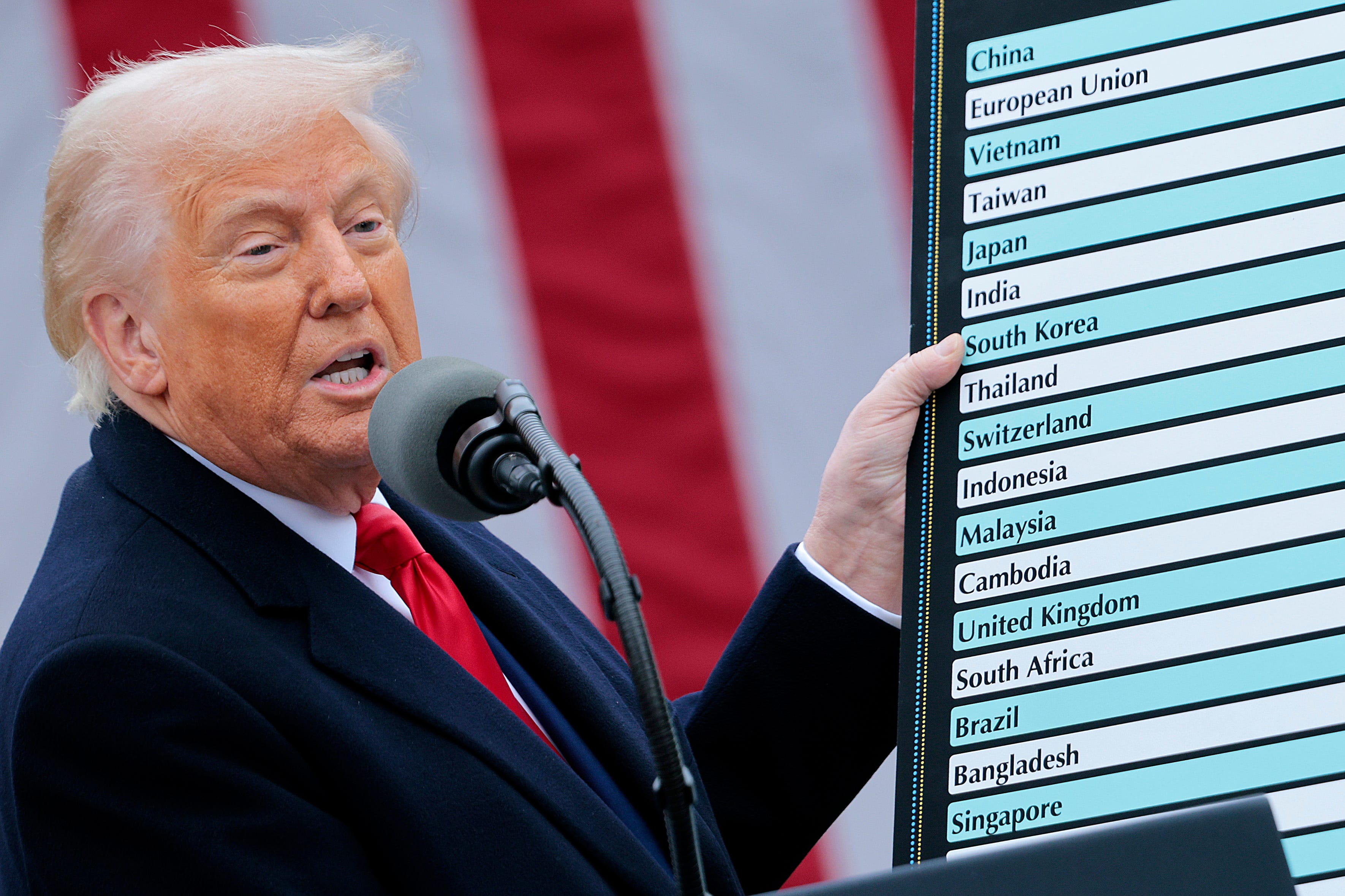

Chip Somodevilla/Getty Images

There’s been a common refrain in recent company earnings calls and interviews with executives: Businesses are facing extreme economic “uncertainty” and struggling to understand the impact of tariffs on their bottom line.

Some companies are raising prices, a few are absorbing the increased costs themselves (at least for now), and others are still figuring out what they’ll do in response to the ever-changing tariffs announcements.

Here’s what major companies’ CEOs have said about how tariffs are affecting their businesses, and your wallet:

Amazon

CEO Andy Jassy expects Amazon sellers to pass costs on to consumers, he told CNBC.

“Depending on which country you’re in, you don’t have 50% extra margin that you can play with,” Jassy said. “I think they’ll try and pass the cost on.”

Noah Berger/Noah Berger

American Airlines

Asked about tariffs and subsequent increases in the cost of aircraft on the company’s latest earnings call, American CEO Robert Isom said, “Certainly, it’s not something we would intend to absorb. And I’ll tell you, it’s not something that I would expect our customers to welcome. So we’ve got to work on this.”

Nathan Posner/Anadolu via Getty Images

AutoZone

AutoZone CEO Philip Daniele said on a September earnings call that “we will pass those tariff costs back to the consumer” in the event of new tariff announcements.

“We generally raise prices ahead of that,” Daniele said, referring to tariff policies over the years. “That’s historically what we’ve done.”

Prices would gradually settle with time, he added.

Best Buy

Best Buy CEO Corie Barry said on a recent earnings call said that price increases on imported products are now “highly likely” and that “we’ve never seen this kind of breadth of tariffs.”

“Tariffs at this level will result in price increases,” she said. “I think it is very difficult to say — given the backdrop that we’re in — exactly, precisely how big that is.”

Chipotle

“In February, we began to see that the elevated level of uncertainty felt by consumers starting to impact their spending habits,” interim CEO Scott Boatwright said on the company’s recent earnings call. “We could see this in our visitation study where saving money because of concerns around the economy was the overwhelming reason consumers were reducing the frequency of restaurant visits.”

This trend continued into April, he added.

Boatwright has said the company plans for now to absorb increased costs from the tariffs, rather than pass them off to the customer.

“We don’t understand which components of the tariffs are transitory and which will be permanent,” Boatwright told Fortune in April. “And I think it’s unfair to the consumer to pass those costs off to the consumer, because pricing is permanent.”

In a separate interview with NBC Nightly News, he said while “it is our intent as we sit here today to absorb those costs,” price hikes could occur later if increased costs became a “significant headwind.”

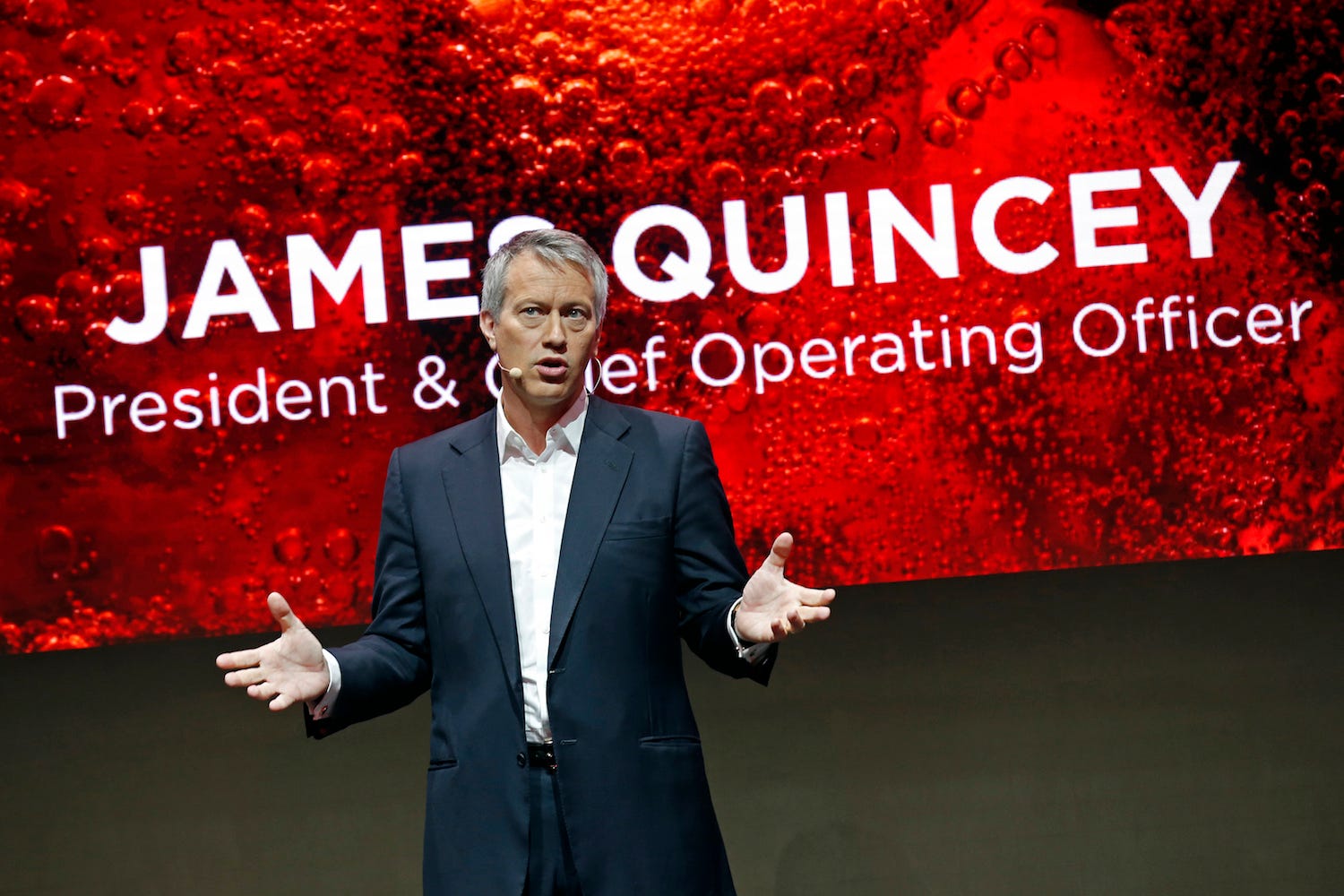

Coca-Cola

Coca-Cola CEO James Quincey told Yahoo Finance the company wouldn’t raise prices “out of cycle.”

“Obviously prices went up because of a whole set of normal things — last year’s inflation — that’s already happened,” he said. “But we’re sticking to our current pricing plan because, you know, some things are more expensive and some things are less expensive. And it all goes into the bundle.”

Benoit Tessier/Reuters

Columbia Sportswear

Columbia Sportswear CEO Tim Boyle told analysts on an October earnings call that “trade wars are not good and not easy to win.”

Boyle also told The Washington Post in October that the company was “set to raise prices.”

“It’s going to be very, very difficult to keep products affordable for Americans,” he told The Post.

In February, he told CNBC that “Tariffs are designed to raise the price of imported products. It’s a dampening effect.”

Conagra

Conagra Brands CEO Sean Connolly told Reuters in early April that the food company may raise prices to offset the cost of tariffs but said it was too early to know how much prices would go up.

And on a recent earnings call, he said the trade situation remained “volatile.”

Costco

Costco CEO Ron Vachris said on a recent earnings call that it’s “difficult to predict the impact of tariffs but our team remains agile and our goal will be to minimize the impact of related cost increases to our members.”

He expressed confidence that the company will be able to “rise to this challenge by leveraging our global buying power, strong supplier relationships, and innovation” to keep prices steady.

Costco

Kraft Heinz

The company’s CFO, Andre Maciel, said on a recent earnings call that they “are trying to do everything we possibly can to minimize the amount of price necessary.”

“But pricing might be necessary,” he added.

Levi Strauss & Co.

CEO Michelle Gass expressed some confidence on a recent earnings call. “As we look at pricing, we do believe that the brand, especially given the health of the brand, that there is pricing power there,” she said. “But if we do anything, it will be very surgical.”

She also noted in the call that tariff situation is “fluid” and the denim company is just “getting our arms around it.”

PepsiCo

“As we look ahead, we expect more volatility and uncertainty, particularly related to global trade developments, which we expect will increase our supply chain costs,” CEO Ramon Laguarta said in the company’s earnings release. “At the same time, consumer conditions in many markets remain subdued and similarly have an uncertain outlook.”

Pfizer

Pfizer CEO Albert Bourla said the pharmaceutical giant might be making “tremendous investments” in the US if not for tariffs.

“If I know that there will not be tariffs and a heavy certainty, then there are tremendous investments that can happen in this country, both in R&D and manufacturing,” he said in a first-quarter earnings call. “In periods of uncertainty, everybody is controlling their cost as we are doing.”

Steven Ferdman/Getty Images

Procter & Gamble

In the company’s earnings release, CEO Jon Moeller said it’s a “challenging and volatile consumer and geopolitical environment” and that the company is “making appropriate adjustments to our near-term outlook to reflect underlying market conditions.”

Moeller also told CNBC price hikes were “likely.”

Stanley Black & Decker

Stanley Black & Decker CEO Donald Allan said on a February earnings call that “our approach to any tariff scenario will be to offset the impacts with a mix of supply chain and pricing actions, which might lag the formalization of tariffs by two to three months.”

And last October, Allan said, “Obviously, coming out of the gate, there would be price increases associated with tariffs that we put into the market.”

Target

Target CEO Brian Cornell told CNBC in March that consumers could see price increases in grocery, particularly fresh foods that are often imported from Mexico.

“Those are categories where we’ll try to protect pricing, but the consumer will likely see price increases over the next couple of days,” he said.

Andrew Burton/Getty Images

Walmart

Walmart CEO Doug McMillan has sounded more confident than many of his peers, saying on an earnings call in February that “tariffs are something we’ve managed for many years, and we’ll just continue to manage that.”

And at a recent investment community meeting, he said while Walmart is “not immune” to the effects of tariffs, it is “positioned to play offense,”

“Nothing about the current environment impacts our confidence in our business or our strategy,” he said.

Yum! Brands

Yum! Brands, the company behind fast food chains like Taco Bell and Pizza Hut, expects little impact from tariffs on its supply chain, CFO Chris Turner said on a recent earnings call.

“In general, our business has minimal supply chain related tariff risk as most markets source within their country or with countries where there is not currently tariff risk,” he said. “As a result, we expect tariffs to have an immaterial impact on our system wide supply chain.”

The post What CEOs are saying about how tariffs will impact their businesses — and your wallet appeared first on Business Insider.