New home sales surged in March, offering a rare glimmer of optimism for the U.S. housing market, but the boost may be short-lived as builders face mounting pressures from rising costs and economic uncertainty.

Why It Matters

Inventory of new homes increased to 503,000 in March, representing an 8.3-month supply, according to the National Association of Home Builders (NAHB). Yet much of that inventory includes homes not yet completed. The Census Bureau reported that the median sales price for new homes fell to $403,600 in March, down 7.5 percent from the previous year — a signal that buyers are gravitating toward more affordable options.

Sales for homes priced under $300,000 rose 33 percent, and those priced between $300,000 and $400,000 climbed 28 percent, the NAHB reported.

What To Know

Sales of newly built single-family homes climbed 7.4 percent to a seasonally adjusted annual rate of 724,000 units in March, up 6 percent from the same time last year, according to data from the U.S. Census Bureau and the Department of Housing and Urban Development.

NAHB Chief Economist Robert Dietz called the uptick a “bright spot” in otherwise mixed economic data.

However, with affordability at multidecade lows, construction costs rising, and builder sentiment still subdued, analysts and industry leaders warn that the momentum is unlikely to last into April and beyond, according to Dietz.

The March increase came as mortgage rates declined slightly, offering some relief to prospective buyers.

“Lower mortgage interest rates helped boost the pace of new home sales in March,” Dietz said in a statement. “In February, the average 30-year fixed rate mortgage was 6.84 percent, while in March it fell to 6.65 percent”

In contrast, existing home sales declined 5.9 percent in March to an annual rate of 4.02 million, down 2.4 percent year-over-year, with prices exceeding $400,000 on average.

Housing affordability fell to its lowest level since 2020, with first-quarter homeownership rates dropping to 65.1 percent, a decline felt most acutely among buyers under 35, according to the NAHB’s April economic update.

Material costs are also increasing, with tariff-related building expenses adding roughly $10,900 to each new home, according to the NAHB. Sixty-one percent of builders are relying on sales incentives to close deals.

“An increase in economic certainty would be a big boost to future sales conditions,” said Buddy Hughes, NAHB chairman and a developer based in Lexington, North Carolina, in a press release.

What People Are Saying

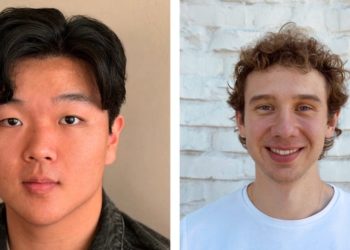

Adam Pretorius, an Iowa City luxury real estate agent with Lepic Kroeger Realtor, told Newsweek: “March’s uptick in new home sales is less about a housing boom and more about a housing shortage. We’re not seeing a surge in buyer demand—we’re seeing a reshuffling of limited inventory. Existing homeowners are sitting tight, many locked into ultra-low interest rates and hesitant to list. That leaves buyers with fewer choices, and builders are stepping in to fill the gap.”

Nationwide title and escrow expert Alan Chang told Newsweek: “Spring has always been the traditional ramp up of the real estate market as seasonality has always slowed down sales in winter months. Interest rates have been on a slight roller coaster in recent weeks with economic drivers pushing rates down and back up again. I have seen transactional volume up over same time last year and expect to see a better 2025 vs. 2024 as buyers have seen they can no longer wait out the normalized interest rates.”

Michael Ryan, a finance expert and the founder of MichaelRyanMoney.com, told Newsweek: “New home sales aren’t surging because of robust market health. They’re rising because they’re the only game in town…”

“Look at the regional breakdown and you’ll see this isn’t a rising tide. The South saw sales jump while the Northeast and West are posting double-digit declines. That’s not recovery, that’s migration. People aren’t buying because the market’s great; they’re buying where they can actually afford to live.”

Kevin Thompson, the CEO of 9i Capital and the host of the 9innings podcast, told Newsweek: “I expect higher rates to persist, even if the Fed cuts. It’s important to remember: the Fed only directly influences short-term rates through the Fed Funds. Long-term rates, on the other hand, are shaped by market forces and global confidence in U.S. fiscal responsibility. If that confidence erodes, bond vigilantes’ step in, driving up long-term borrowing costs.”

What’s Next

While March data reflects a positive blip, forward-looking indicators suggest weakening demand.

“There’s an undercurrent of uncertainty,” Pretorius said. “Tariffs are the newest ‘big bad wolf’ looming over the industry. While we haven’t seen broad pricing impacts yet, the fear of cost spikes and supply chain issues is already affecting sentiment. April could very well reflect that pause—especially with buyers and sellers bracing for what’s next.”

Port traffic is expected to fall sharply in the coming weeks, and tariff impacts on construction materials are already straining margins. The NAHB projects sub-1 percent GDP growth through the first three quarters of the year.

“…Souring consumer sentiment and ongoing uncertainty will take a toll on consumer spending and business investment in 2025, or at least until the threat of tariffs is diminished,” Dietz said in the April economic update.

The post ‘Bright Spot’ in Housing Market Expected to Be Short Lived appeared first on Newsweek.