Brendan SMIALOWSKI / AFP via Getty Images

Many soothsayers throughout Wall Street’s C-suites had bet that a new administration, with values ostensibly more amicable to the business community, would shock the life back into a comatose market for dealmaking.

They may have spoken too soon.

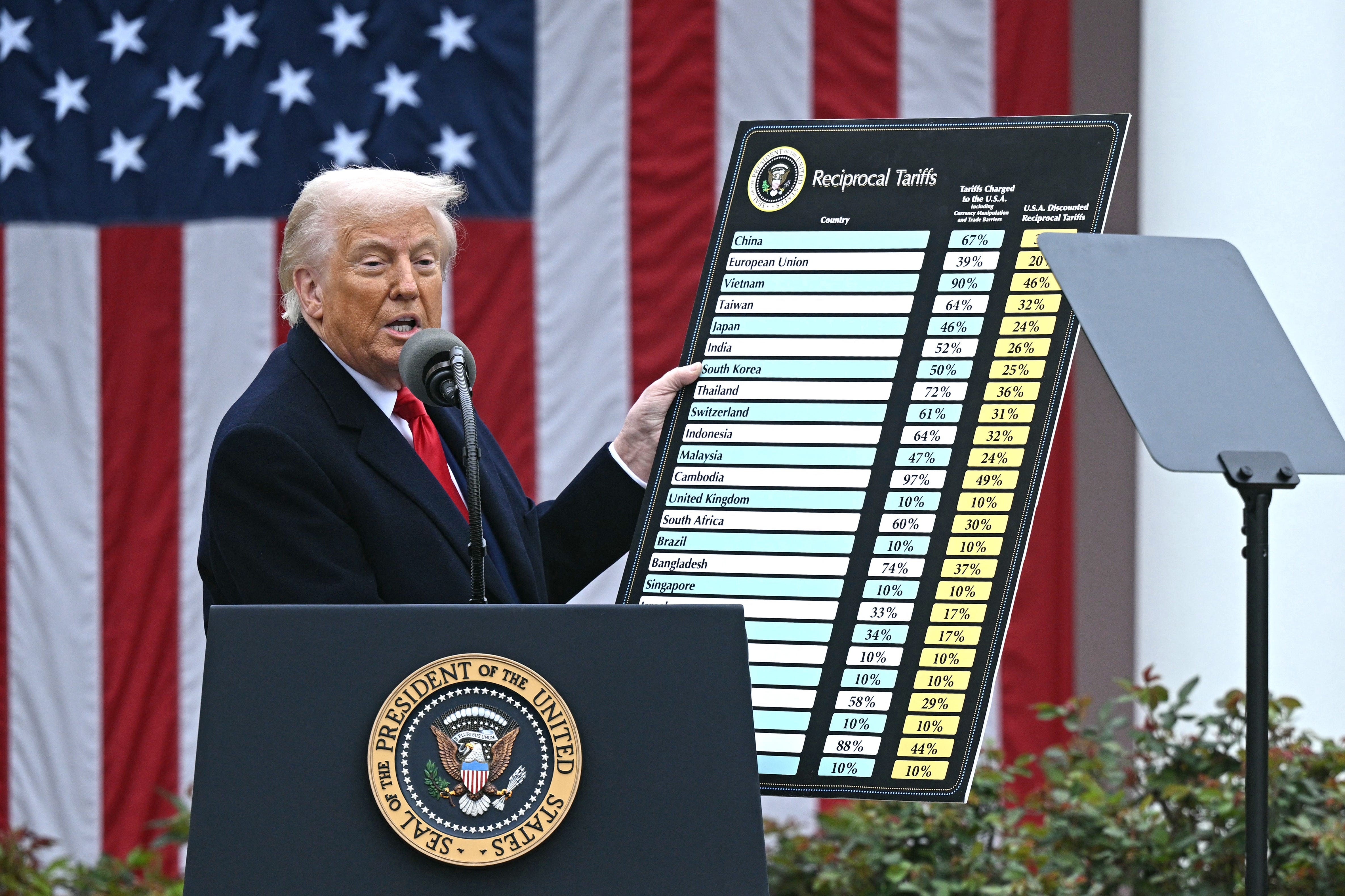

Indeed, on every bank’s first-quarter earnings calls in recent days, one person loomed over the proceedings, though not a single CEO mentioned him by name: President Donald Trump. Instead, they talked about uncertainty, worried clients, and a concerning economic outlook.

“While our corporate and consumer clients are resilient and in good financial health, the world is in a wait-and-see mode and is facing a more negative macro outlook than anyone had anticipated at the beginning of the year,” Jane Fraser, the CEO of Citigroup, said on a Tuesday morning phone call. “We know that prolonged uncertainty generally hurts confidence.”

Behind the scenes, bankers told Business Insider that they were feeling less diplomatic about the Trump administration and its tariff policies and pronouncements.

“I don’t know how you couldn’t be embarrassed” about the outcome, a managing director at a middle market-focused investment bank, who previously worked at one of the large-cap firms that reported earnings, told me by phone on Tuesday. “If you’re an executive in finance and you talk to clients frequently and you understand how the world works, there’s no way you can’t be upset.”

When I asked the MD what he’d been hearing from his friends throughout the industry who supported Trump’s economic agenda before he took office, he didn’t mince words: “They’re pretty quiet.”

Dashed expectations

Early clues from banks’ results are painting a picture of how the confusion unleashed by the White House’s policy shifts roiled investor sentiments.

Goldman said that the paralyzed merger market dragged advisory revenue of $792 million (collected from working on deals) down 22% as compared with the same period last year. “In investment banking, the volatile backdrop led to more muted activity relative to the levels we had expected coming into this year,” David Solomon, the firm’s CEO, said.

Bank of America said global investment banking fees of $800 million were down 20% from the most recent quarter. Watching the deals market sputter has surprised and deflated many insiders, particularly because of how recently they were convinced of the opposite outcome. One survey released in December found that 85% of respondents — corporate dealmakers — said they were eyeing more transactions six months earlier under the Biden administration.

Other firms like Citigroup said they were bolstering loan loss provisions, another bellwether of a weakening economy that marks the tightening of consumers’ wallets. Mark Mason, the firm’s CFO, said shoppers were “resilient,” according to data he’d reviewed, but pointed to a tilt in how some were spending their money.

“We’ve seen a shift toward essentials, and away from travel and entertainment,” he said.

The full impacts may be unclear for a few more months

Traders were among the only Wall Streeters to benefit from the volatility, earnings results showed. Firms like Goldman Sachs and Bank of America rode the wave to record revenues, with Morgan Stanley saying “strong client activity amid a more volatile trading environment” shot its trading revenues up by 45%.

The impact was so pronounced that compensation expert Alan Johnson predicted in an interview with me last week that traders will be the only people in finance to receive meaningful year-end bonuses. For bankers and underwriters, he said, the storm clouds were gathering.

A fuller picture of how Trump is impacting Wall Street may not emerge till the next earnings season later this summer. Many of the worst days of volatility, which left some with flashbacks of the opening salvos of the pandemic or the financial crisis, happened in April, which is in the second quarter.

Whether the White House will care, however, is another matter. Press Secretary Karoline Leavitt had a message for Wall Street from the briefing podium earlier this month: “Trust in President Trump.”

For the time being, Wall Street may have little choice in the matter.

Reed Alexander is a correspondent covering Wall Street and investment banks. He can be reached via email at [email protected], or SMS/the encrypted app Signal at (561) 247-5758.

The post ‘They’re pretty quiet’: Wall Street dealmakers thought Trump was the answer. Now, they’re not so sure. appeared first on Business Insider.