The stock market was starting to look overpriced for a while, and then the Great Correction of 2025 came along.

On the morning of April 9, the S&P 500 (SNPINDEX: ^GSPC) market index has dropped 18.5% below February’s all-time high. The popular index’s average price-to-earnings ratio (P/E) fell back from a lofty 30.0 to a more reasonable 24.7. It’s getting easier to find tempting buys in this cooler market.

I’m particularly interested in big-box retailer Target (NYSE: TGT) right now. Let me explain why the Minnesotan store chain looks so good in April 2025.

The innovative merchant’s stock has plunged 49% over the last year, including a 38% retreat from an attempted recovery that fizzled out on January 27. Long-term investors have taken an even harder hit, harking back to a record price of $266 per share in November 2021 — just before the inflation panic started.

I’ll admit that it’s not a perfect setup. Target’s revenue growth slowed down dramatically in the era of spiking inflation, while arch rivals Walmart (NYSE: WMT) and Costco (NASDAQ: COST) barely noticed the weaker economy,

But Target was defending its sector-leading profit margins. Whether you’re looking at operating margins, bottom-line net margins, or cash flow margins, Target still collects a few more pennies per revenue dollar than Costco or Walmart.

Target is making the most of its flattish revenues. Combining this money-making talent with Target’s swooning stock price results in two incredible charts.

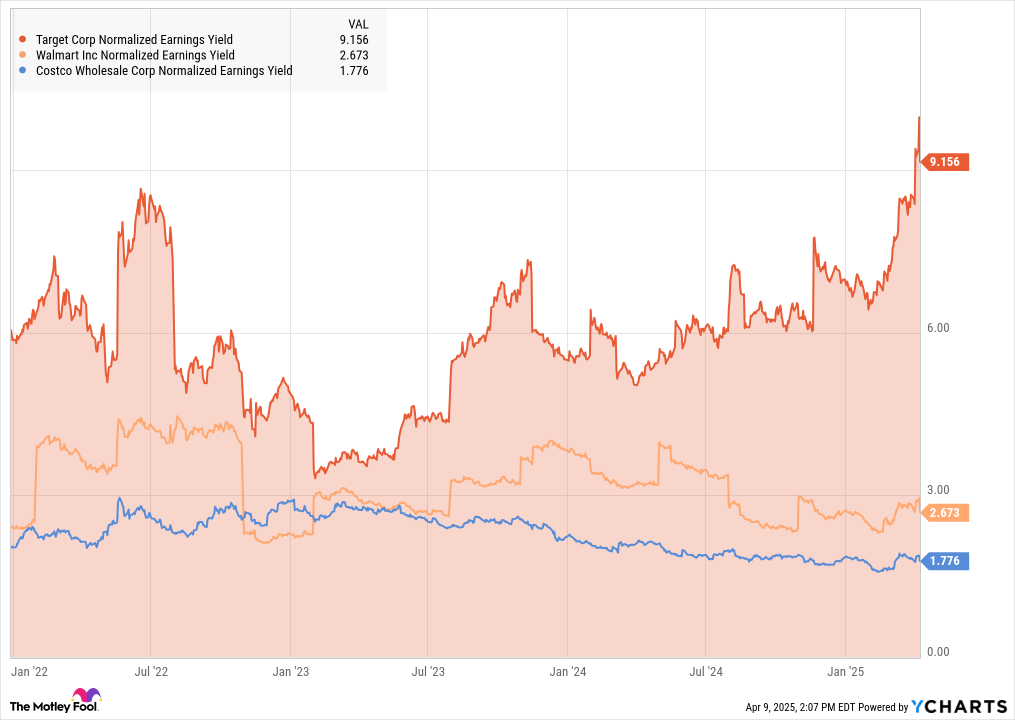

First, check out Target’s skyrocketing earnings yield:

This isn’t the most widely discussed valuation metric in the world, so it might not ring a bell. The earnings yield is essentially the P/E ratio backwards — divide a company’s earnings by the share price. A higher number indicates a more profitable company and lower-priced stock.

And Target looks like a bargain-bin find from this perspective. The stock is more than just modestly priced; it’s on fire sale.

Then there’s this little tidbit. Target has no reason to stop its annual dividend boosts, and the company has increased its payouts in each of the last 54 years. Through thick and thin, the dividend bumps keep coming. And when you pair that shareholder-friendly tendency with the same negative stock price action as before, you get a very generous dividend yield:

There’s just no contest if you’re looking for a strong income stock in the retail sector. Target is the no-brainer pick, leaving Walmart and Costco far behind.

So I don’t mind Target’s slow sales growth, as long as the company keeps making sector-leading profits and passing them on to investors in the form of great dividends.

Moreover, Target isn’t sitting on its cash-generating laurels. The company rolled out generative AI tools in 2024, aiming to support store workers and assist shoppers in one fell app. As recently as last month, management unveiled a multi-faceted plan to boost annual revenue by $15 billion over the next five years. This effort relies on the AI assistant, a more selective inventory management system, and more shop-in-shop experiences.

I’ve been watching Target’s turnaround plan from the sidelines for way too long. Don’t mind if I pick up a few shares at these rock-bottom prices, locking in a fantastic dividend yield at the same time. With five decades of uninterrupted dividend increases under its belt, I can imagine Target delivering solid income for the foreseeable future.

Before you buy stock in Target, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Target wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $509,884!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $700,739!*

Now, it’s worth noting Stock Advisor’s total average return is 820% — a market-crushing outperformance compared to 158% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of April 5, 2025

Anders Bylund has positions in Walmart. The Motley Fool has positions in and recommends Costco Wholesale, Target, and Walmart. The Motley Fool has a disclosure policy.

1 Magnificent S&P 500 Dividend Stock Down 49% to Buy and Hold Forever was originally published by The Motley Fool

The post 1 Magnificent S&P 500 Dividend Stock Down 49% to Buy and Hold Forever appeared first on Yahoo Finance.