Donald Trump has a rainy day insurance policy just in case the global market downturn wrecks his dream of a golden age for America.

With stocks in turmoil over his stop-start tariffs, gold bullion is setting record highs as the one true safe haven for a world in trading turmoil.

And the president has at least $250,000 in gold bars tucked away just in case JPMorgan Chase CEO Jamie Dimon’s 50/50 bet on a recession proves to be overwhelmingly optimistic and the Trump administration sends the country hurtling into a full-scale depression.

Nobody is putting money on that right now, but any gambler likes to spread their bets. And the markets are no exception.

Gold skyrocketed past the $3,200 an ounce mark on Friday, as the realities of a trade war with China clicked and the dollar faltered. Investors ran for the gold in them thar hills, as Mark Twain would suggest, as one of the few remaining safe havens for their money.

Gold hit a record high of $3,237.56 and in a new world set upside down by Trump’s tariffs, bullion is up over 6% for the week.

Writing on Linkedin on Friday, Wei Li, Global Chief Investment Strategist at BlackRock, wrote: “This is not normal – #rates higher, currency down. Also not normal – risk off, #dollar and Treasuries down. I will keep saying it: #gold is a better diversifier than Treasuries in this environment of high debt.”

Unease in the bond market–another traditional financial harbor in a rocky economy– was widely believed to be the reason Trump relented on his sliding scale of tariffs and called a 90-day pause on Wednesday.

There’s a reason Trump loves gold so much. It never lets him down.

In his financial disclosures released last August as part of his presidential campaign, Trump said his assets included up to $250,000 of gold bars.

His Trump buildings, and the West Wing are also awash with the yellow metal. The Trump International Hotel & Tower in Chicago and the Trump International Hotel Las Vegas both use real 24-karat gold in their exteriors.

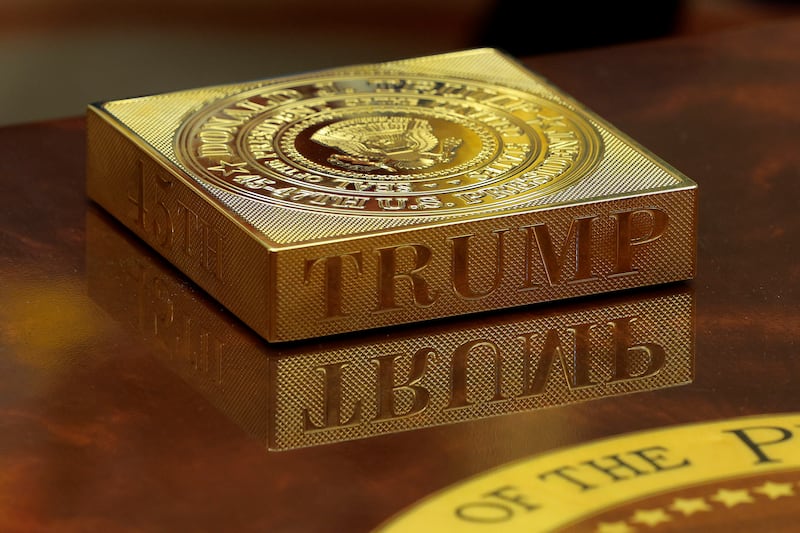

When he sits down with world leaders in the Oval Office, they are surrounded with ostentatious symbols of his power and wealth, all in gold.

Incidentally, he also sells giant chocolate gold bullion bars ($86) in the Trump store, as well as a gold bar paperweight ($35) and a gold bar coin bank ($24).

Richard Nixon abandoned the gold standard, deciding the U.S. would no longer convert dollars to gold at a fixed value, in 1971. It would be no great surprise if Trump revived it. His favorite president, William McKinley, in office from 1897 until being assassinated in 1901, ruled over America’s Gilded Age.

Trump’s gold bars will only stop growing in value if Wall Street settles back into a solid upward rhythm and investors stop worrying that his tariffs will implode world trade.

Otherwise, it’s probably time to make some more room in the Trump Tower vaults.

The post Trump’s Gold-Plated Insurance Policy Against Market Meltdown appeared first on The Daily Beast.