Last week’s tariff-induced market sell-off ripped through 401(k) accounts, and over the weekend millions of savers and retirees took matters into their own hands.

People pulled vast sums of 401(k) money from large US equity funds and target date funds and shifted to more conservative stable value, bond, and money market funds, according to Alight Solutions’ 401(k) Index.

Trading activity on Monday was almost 10 times an average day’s volume, with investors fleeing stocks for the safety of fixed-income funds, Rob Austin, head of thought leadership at Alight Solutions, told Yahoo Finance. It was the highest daily trading level since March 2020 when the pandemic hit.

Why the Monday meltdown? Historically, when stock markets have large losses on Fridays, very high trading activity in 401(k) plans follows on Monday, Austin said. People react to the news by tweaking their portfolios over the weekend, but those changes don’t get executed until the market reopens.

“The high volume isn’t surprising as people tend to sell during market drops and buy back after rebounds, which leads to selling low and buying high,” he said. “Saving for retirement is a marathon, not a sprint and a long-term approach to investing is generally wiser, even if it means enduring occasional downturns.”

Tell that to stressed-out investors and savers. They were all over the map.

“Engagement with the markets was high among Schwab’s retail clients last week,” Alex Coffey, senior trading and derivatives strategist at Charles Schwab, told Yahoo Finance.

More clients bought equities than sold, Coffey said. But in terms of dollar amounts, clients were net sellers — meaning the amount of money behind selling transactions was bigger.

In terms of individual names, there weren’t many surprises. Nvidia (NVDA) was the most-bought stock, followed by Amazon (AMZN), Apple (AAPL), and Tesla (TSLA).

“We also saw a lot of buying in index-tracking ETFs, perhaps as a volatility-driven alternative to investing in individual stocks where risk can be higher,” Coffey said.

Lindsay Theodore, a certified financial planner at T. Rowe Price, said not all her clients reacted the same way.

“Some see the volatility as an opportunity to redeploy cash that had been sitting on the sideline,” she said. “Others are worried and seeking validation that they’re in the right investments and on the right track.”

Read more: How to protect your money during economic turmoil, stock market volatility

You can remind people again and again to sit on their hands instead of making big moves to jettison their stock holdings during economic turmoil and stock market volatility, but human nature often takes over.

At TIAA, retirement participant calls and online account logins jumped nearly 30% since April 3 as retirement savers sought answers.

“Stay anchored” was the advice from Niladri ‘Neel’ Mukherjee, chief investment officer at TIAA Wealth Management.

He advised investors to stay diversified across equities, bonds, and cash holdings according to their risk profile. Raise some cash if you need it for immediate purposes. However, he urged investors to balance the need to remain invested in equities for growth during retirement years. Maintaining a long-term perspective is critical even in retirement.

That’s the tried and true advice we always hear, and I am an advocate for that approach myself. Yet any time the markets flip out it seems inadequate, and this sudden downward shift feels different.

Fidelity was unable to share up-to-date figures on outflows and inflows from 401(k) and IRA accounts since Thursday, but I did get some calming predictions that could soothe rattled nerves.

“Market volatility may remain in the short term, but our outlook for US stocks remains positive,” said Mike Scarsciotti, a certified financial planner in Fidelity’s Capital Markets Strategy Group.

A safe haven in the meantime: intermediate-term bonds, which can “act as portfolio shock absorbers,” he said.

Read more: What are bonds, and how do you invest in them?

It’s tough not to get twitchy and want to do something to take control of your retirement account when things take a turn for the worse.

“A dramatic emotional action like panicking and going all to cash and all to bonds is not a strategy,” Rob Williams, managing director of financial planning at Charles Schwab, told Yahoo Finance. “We have seen increased calls with questions and concerns this week and increased angst,” he said. “The tendency as an investor is to say, yes, I want to take cover.”

A better response is to take “ownership of your financial life,” Williams said.

That doesn’t mean “set and forget it” or not paying attention. Have an investment plan based on how many years you have until you really need those funds in retirement. “It can be very simple, but having a plan is an active move,” Williams said.

Be aware of your emotions and concerns when there’s uncertainty, he added, and create a plan you can stick to.

That means if your time horizon is more than three or four years, you stick with the plan even through the turmoil, Williams said, “continuing to save, continuing to invest, and rebalancing your portfolio once a year.”

“All of our studies show that people who have a financial plan tend to feel more confident or are looking for opportunities in a down market like this more than they are panicking or making emotional decisions that may end up not helping them in the long term,” he said.

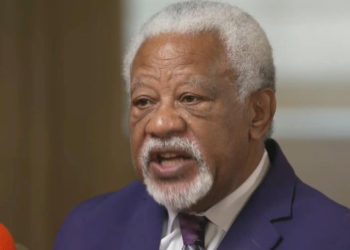

When you see in big red letters that your stocks are losing money, it’s hard to not react, Benedict Guttman-Kenney, an assistant professor of finance at Rice University, told me.

The common thinking: The stock market’s falling. I want to get out before it falls further, and I lose more money.

“But a fantastic way to lose money is to sell in a panic,” Guttman-Kenney said. “It is a bit cheesy, but when I think of this behavior, I remember the Beatles’ hit ‘Let it Be.’ That’s what most people need to do, and it’s very hard.”

A valuable nugget to consider: If you’re saving automatically in your employer-sponsored retirement plan, or you’re making automatic contributions to a Roth IRA or a traditional IRA and are years from retirement, you’re always investing in your retirement accounts regardless of whether markets are up or down. That evens out your returns over the long haul as you roll through the changing tides.

Moreover, many retirement savers these days have their funds set aside in target-date retirement funds which automatically shift when the markets go haywire.

“Target-date funds are a great solution for many retirees, especially 401(k) plan accounts,” Schwab’s Williams said. “If you want a default solution, that’s the right place to start. It will help you stay the course through dips and downturns like this because they rebalance your portfolio periodically.”

And heed this message from Guttman-Kenney: “The stock price movements over an hour, a day, a week, a month — those really shouldn’t be affecting those long-run decisions,” he said.

“Do whatever kind of self-control mechanism works for you. Take a walk if that helps.”

Kerry Hannon is a Senior Columnist at Yahoo Finance. She is a career and retirement strategist and the author of 14 books, including “In Control at 50+: How to Succeed in the New World of Work” and “Never Too Old to Get Rich.” Follow her on Bluesky.

Sign up for the Mind Your Money newsletter

Read the latest financial and business news from Yahoo Finance

The post The market pummeled 401(k) accounts last week. Panic selling ensued. appeared first on Yahoo Finance.