JPMorgan Chase CEO Jamie Dimon urged President Donald Trump to allow the Treasury team to renegotiate some of his “Liberation Day” tariffs as the markets crater, adding that he fears a recession is on the way.

Dimon, one of the most influential figures on Wall Street, told Fox Business host Maria Bartiromo on Wednesday morning that the tariffs are “way beyond what people expected,” and will fuel inflation and slow growth.

“I hope what they really do is let [Treasure Secretary] Scott Bessent, who I think is a professional, negotiate” with other countries, Dimon said, urging the Trump administration to “get those things done quickly.”

Bartiromo also asked Dimon for his personal take on the possibility of a recession after JPMorgan raised its probability of a global recession from 40 percent to 60 percent. “I think probably that’s a likely outcome,” he said.

“I mean, when you see a 2,000-point decline [in the Dow Jones Industrial Average], it sort of feeds on itself, doesn’t it,” Bartiromo responded. “It makes you feel like you’re losing money in your 401(k), you’re losing money in your pension. You’ve got to cut back.”

“Markets aren’t always right, but sometimes they are right,” Dimon said. “I think this time they are right because they’re just pricing uncertainty at the macro level and uncertainty at the micro level, at the actual company level.”

Stock markets tumbled as the president’s tariffs came into effect Wednesday, sparking fears of an all-out trade war with China as Beijing imposed retaliatory tariffs of 84 percent on U.S. imports.

In an attempt to diffuse tensions, Trump posted a series of all-caps messages on Truth Social urging the public to “BE COOL” and assuring them, “Everything is going to work out well. The USA will be bigger and better than ever before!”

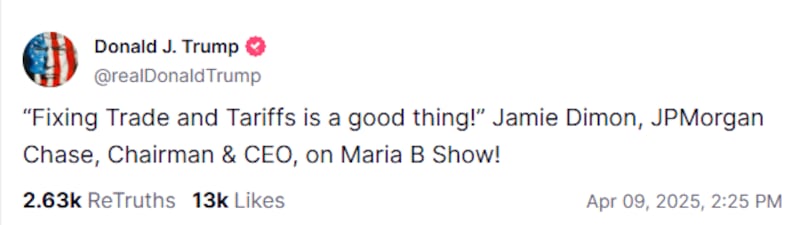

He also misquoted Dimon’s interview from earlier in the day, claiming the JPMorgan CEO had told Bartiromo that “Fixing Trade and Tariffs is a good thing!”

Bessent also chimed in and said he was “optimistic” the U.S. could strike a deal with China, telling a bankers’ convention in Washington that the economy was in “pretty good shape,” The Wall Street Journal reported.

Hedge fund billionaire Bill Ackman, a vocal critic of Trump’s recent economic policy, wrote on X: “Our stock market is down. Bond yields are up and the dollar is declining. These are not the markers of successful policy.”

On the other end of the scale, Shark Tank star and MAGA fanatic Kevin O’Leary claimed Trump’s tariffs didn’t go far enough, saying on CNN that the U.S. should impose a 400 percent tariff on Chinese imports.

“They take product technology, they steal it, they manufacture it, [and] sell it back here,” O’Leary told a panel this morning. “I want Xi on an airplane to Washington to level the playing field. This is not about tariffs anymore. Nobody has taken on China yet. Not the Europeans, no administration for decades. As someone who actually does business there, I’ve had enough.”

“America is the No. 1 economy on earth with all the cards,” he added. “We will not have that forever. It’s time to squeeze Chinese heads into the wall.”

The post America’s Top Banker Pleads With Trump to End Tariff Chaos appeared first on The Daily Beast.