S&P 500 futures are flat this morning prior to the opening of markets in New York after the index fell 1.57% yesterday as traders fled from stocks exposed to AI. The market is now in negative territory for the year. Tech stocks led the decline yesterday, with the Nasdaq Composite down 2%. The S&P 500’s software sector is down 27% since October, according to the Financial Times, which gives you an idea of how worried investors are that AI will simply replace software makers. Gold—which is supposed to be a safe haven—took a sharp dip yesterday, an indicator that traders just want their cash out of assets generally. It’s back under $5,000 per troy ounce. Asia had a tough day—Japan’s Nikkei 225 was down 1.21% and China’s CSI 300 was down 1.25% at the close this morning. But markets in the U.K. and Europe were flat-to-up, suggesting sellers may be taking a breather today.

A karoake machine maker wipes billions off trucking stocks

It’s not just tech stocks that are in the crosshairs. Losses were imposed on non-tech companies too, as investors became paranoid about how much damage AI might inflict upon sectors like trucking, real estate, and finance.

Perhaps the wildest example of the rout was Algorhythm Holdings, a small trucking logistics company that also sells karaoke machines. The company said its SemiCab AI platform “helped customers scale freight volumes by 300% to 400% without a corresponding increase in headcount,” according to Jim Reid and his team at Deutsche Bank. “The Russell 3000 trucking index fell -6.64% as companies of all size reacted to the news.”

“It’s perhaps indicative of the state of markets at the moment that a $6 million market cap company that until recently specialized in karaoke helped wipe tens of billions off logistics stocks to add to the weakness. I’ve seen some shocking karaoke performances in my time but this perhaps tops them all,” Reid told clients.

In commercial real estate, CBRE lost 8.84% yesterday after its CEO said on an earnings call that AI might reduce demand for offices. “If there are less office workers in the long run as a result of AI, there will be less demand for office space. That would be a long-term trend to unfold,” Bob Sulentic said.

Wall Street thinks the selling is speculative and overdone

In theory, AI should allow companies to do more with fewer workers, thus boosting their earnings per share—so it is puzzling that traders are dumping stocks that might be boosted by AI. Deutsche Bank’s Reid noted that much of the selling driven by these anecdotes was purely speculative. “The market continues to price in further AI disruption across industries, sometimes in the most abstract way.”

For that reason, analysts on Wall Street this morning are suggesting that the selloff may be overdone.

“We think that the AI Immunity Trade is getting overdone, especially in the Financials sector. Many of the trade’s stock market casualties will survive and boost their productivity and profits using AI,” Ed Yardeni of Yardeni Research argued.

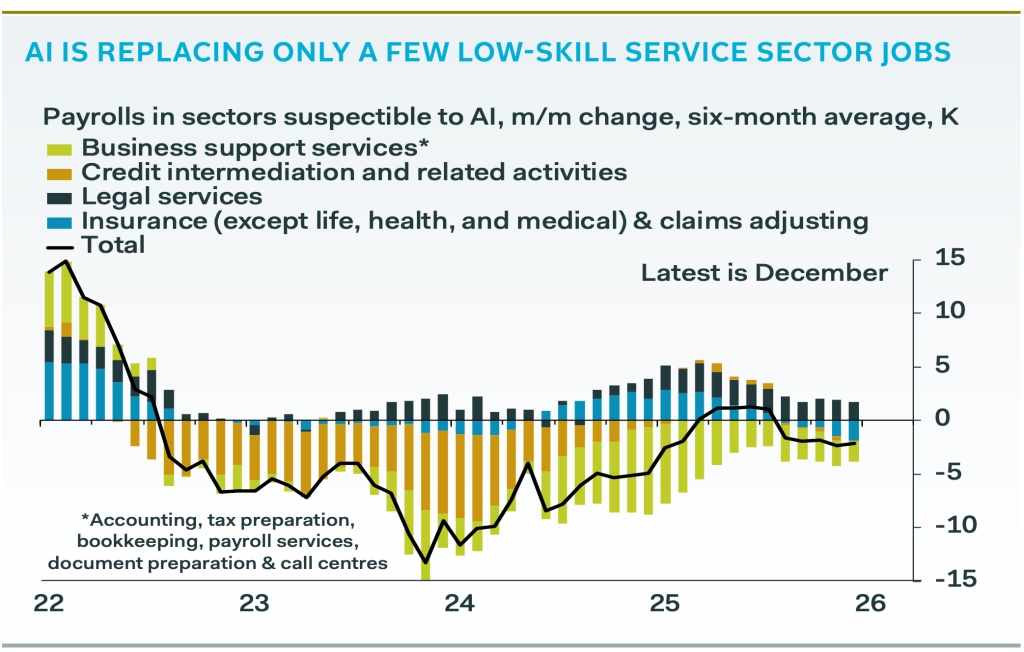

Thus far, there is little evidence that AI adoption is reducing employment outside the tech sector. Pantheon Macroeconomics’ Samuel Tombs and Oliver Allen looked at employment in the industries most likely to be affected by AI and found little effect on jobs. “Payrolls across these sectors … fell merely by 2,000 on average in the six months to December [and] the trend in employment in these sectors collectively improved in 2025 compared to 2024.”

“AI’s biggest impact for now probably is the extra uncertainty it is creating for businesses, at a time when unpredictable federal government policies already cloud the outlook. But AI is not reliable or advanced enough yet to replace many existing jobs,” they said.

Here’s a snapshot of the markets ahead of the opening bell in New York this morning:

- S&P 500 futures were flat this morning. The last session closed down 1.57%.

- STOXX Europe 600 was flat in early trading.

- The U.K.’s FTSE 100 was up 0.11% in early trading.

- Japan’s Nikkei 225 was down 1.21%.

- China’s CSI 300 was down 1.25%.

- The South Korea KOSPI was down 0.28%.

- India’s NIFTY 50 was down 1.53%.

- Bitcoin fell to $66.8K.

The post Friday the 13th brings global selloff in stocks and gold as AI fear grips markets appeared first on Fortune.