In the world of high finance, the secondary market — selling off pre-owned investments — was once considered Wall Street’s version of a used-car lot. Few junior bankers clamored for the role, and bulge-bracket giants largely left the field to specialized boutiques.

But those days are over, and America’s biggest investment banks are aggressively piling in.

“I used to have to explain the first 10 minutes of an interview what we do,” Todd Miller, the global cohead of secondary advisory at longtime key player Jefferies, told Business Insider. “It’s a very hot industry. Everyone’s trying to get into this space.”

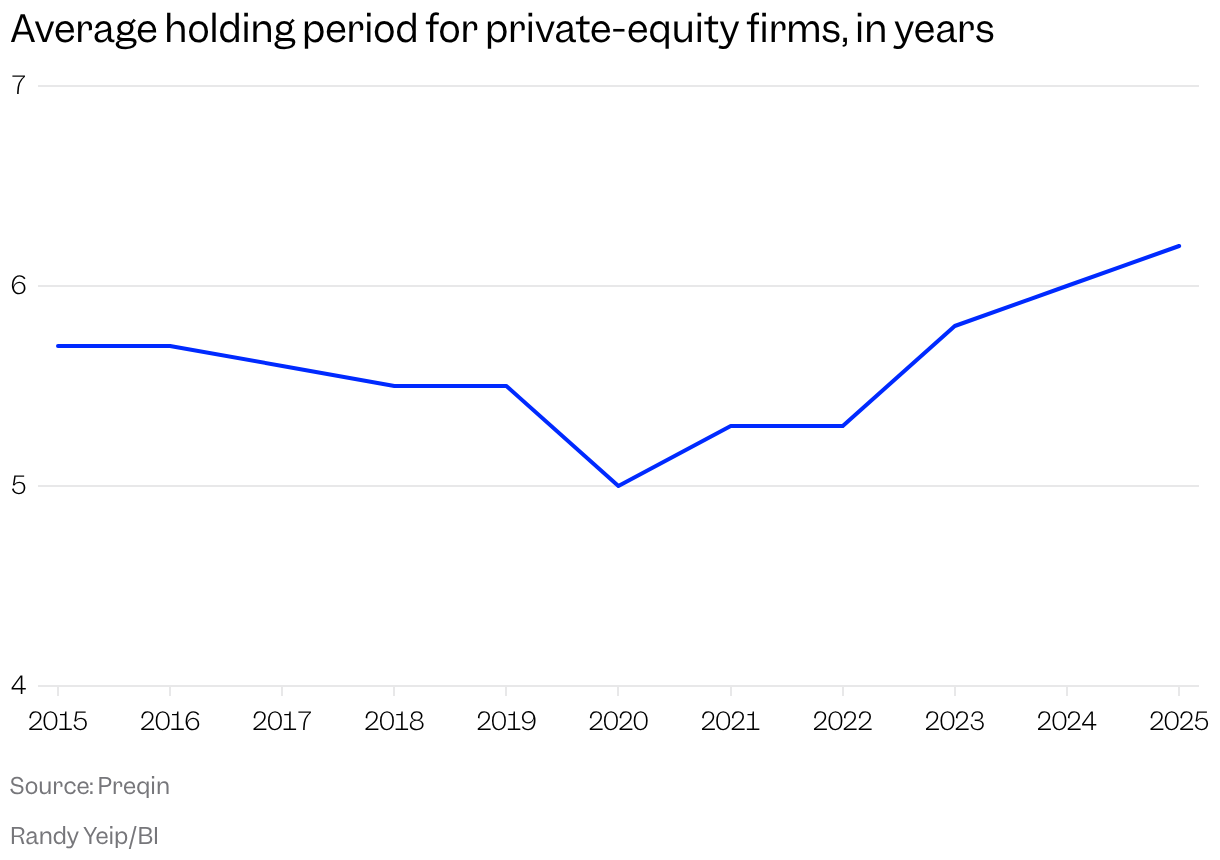

In the post-pandemic years of high interest rates and muted valuations, a capital bottleneck has pushed private equity exits well past the industry’s typical timeline. That delay has tested investors who backed PE funds and expected returns a long time ago. So-called “secondary” and “continuation vehicles” — structures that let PE firms shift ownership of a company from one fund to another, while giving existing investors the chance to cash out — have emerged as a key workaround.

In a recent report, Jefferies said secondaries drove $240 billion in global transaction volumes last year, a 48% increase from the year prior.

In late January, JPMorgan Chase announced a new “center of excellence” in its investment bank: the Private Capital Advisory and Solutions group. Led by veteran banker Keith Canton, the former head of equity capital markets in the Americas, the team will advise companies on a spectrum of liquidity solutions. The symbolism was notable: a banker once focused on taking companies public is now helping them stay private longer. His newly formed group will draw on members of the bank’s existing teams focused on private capital markets and advisory, he told Business Insider, with more hires expected over the coming year.

Miller told Business Insider that the pace of the activity has become breathless. The banker estimated he spends as much as 20% of his time on recruiting, and his team — which counts some 130 heads — has grown by 50% over the past two years.

“I get a massive amount of inbounds on LinkedIn,” Miller said. “I’ve had kids writing to me on LinkedIn out of college, sophomores at elite schools. They want to do this job.”

Why banks are piling in

For banks like JPMorgan, establishing Canton’s group helps position the firm to compete for the wave of PE spending expected to begin in the coming months. Buyside firms are sitting on trillions in unspent capital, and banks want to be on speed dial when they decide to deploy it, whether through an M&A transaction, an eventual IPO, or a chance to help clients generate the liquidity they need in between.

“If you’re just waiting for the IPO market,” Canton said, “you have potentially missed out on some significant gains.”

In recent decades, the capital markets have experienced a sea change. Underwhelming IPO debuts and the red tape of being publicly traded dissuaded more corporate boards from taking the plunge.

Matters got more complicated after stubbornly high interest rates spiked around 2022, pumping the brakes on corporate dealmaking. In 2020, PE firms were flipping companies they’d owned for an average of five years. In 2025, the timeframe had stretched by more than a year, according to data from the data provider Preqin, a subsidiary of BlackRock.

Other banks have also been busy hiring. Last month, London-based banker Andrei Brougham joined Goldman Sachs from Rothschild to steer its EMEA secondaries advisory business. In 2025, Moelis poached Matt Wesley, then Jefferies’ global head of private capital, to run its advisory team.

If they play their cards right, the potential upside for these desks is significant. A February report from JPMorgan found that 76% of family offices still have no secondary private equity exposure, illustrating how much runway remains.

“It’s a big business opportunity,” Canton concluded. “It’s one that is very clearly strategic to the firm. It’s where we think the markets are broadly going.”

The hiring boom

Brianne Sterling, a headhunter who leads the investment banking practice at recruiting firm Selby Jennings, has seen an uptick in clients looking to bolster their private fund advisory capabilities. “I think it’s a really big hiring story,” she told Business Insider.

Private credit secondaries professionals are in demand, she said, reflecting the anticipated $17 billion in credit secondaries for 2025 that Jefferies projected last summer. And she added that some banks are poaching juniors from valuation groups and Big Four accounting firms. Their skills come in handy with pricing, which is long the most fraught part of these transactions, as limited partners scrutinize whether pricing practices are inherently fair.

The next wave will be cultivating sector-specific talent. Miller said that Jefferies is building eight- to 10-person verticals focused on niche areas like venture capital and growth funds, infrastructure, energy, and private credit — an indication that demand for these jobs isn’t going anywhere.

Read the original article on Business Insider

The post How this job went from the Wall Street equivalent of a used car dealer to the hottest gig for 2026 appeared first on Business Insider.