There’s a war on Black wealth.

It’s happened before and is being waged again, now under the Trump administration.

Under the leadership of Elon Musk, the U.S. DOGE Service slashed the federal workplace, cutting jobs that helped create a Black middle class in many communities, including the one where I live.

The Black unemployment rate increased by over a percentage point last year, reaching 7.5 percent in December. The increase is heavily linked to the reduction of the federal workforce.

Private corporations, colleges and nonprofits, fearful of President Donald Trump’s wrath, have scuttled diversity, equity and inclusion (DEI) programs and hiring practices meant to correct past discriminatory hiring practices.

Is history repeating itself, in which federal, state and local laws helped keep Black Americans economically disadvantaged?

Yes, it is, declares Rep. James E. Clyburn (D-South Carolina), dubbing this period Jim Crow 2.0.

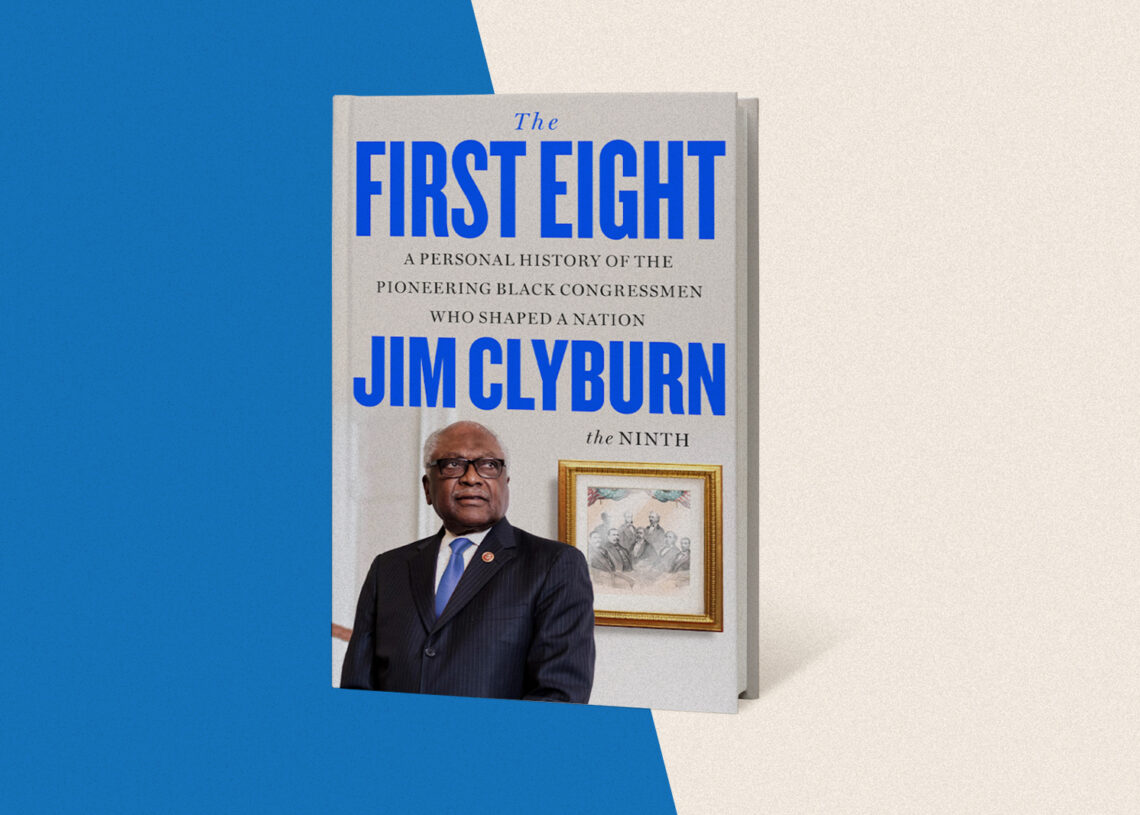

In honor of Black History Month, which as a friend says should be viewed as just American history, I’m recommending for the Color of Money Book Club Clyburn’s “The First Eight: A Personal History of the Pioneering Black Congressmen Who Shaped a Nation.”

I’m a member of a book club, and we recently read Clyburn’s historical look at the first eight Black congressmen from his home state and why it took so long to elect him — the ninth — nearly 100 years later.

After joining us on Zoom to discuss his book, Clyburn sat down with me for a follow-up interview.

What I got from Clyburn’s book was not just an incredibly rich history lesson but a warning that a lot of what’s happening today ties back to the first Black representatives who fought for economic equity for freed Black people. “The First Eight” is a money story.

“This book is the money book because it’s about capitalism,” Clyburn said during our book club meeting. “These people were trying to become a part of what makes this country operate.”

The first representative was Joseph Rainey, a formerly enslaved individual. Rainey’s father, a barber, earned enough money to purchase his family’s freedom. By far my favorite story in the book was about Robert Smalls. At the age of 12, Smalls went to Charleston to work on a waterfront, but all the money he earned except for $1 a week went back to his enslaver. He was a Civil War hero, who in a brilliant strategy impersonated a boat captain and commandeered a Confederate ship, and as a result gained freedom for himself and others.

These men’s stories are important to know to put current events in perspective because the racial wealth gap for Black people during Reconstruction was a calculated result of policy.

Rainey and Smalls and the other men pushed to end voting restrictions and unfair labor laws. They fought against efforts to enslave Black people through sharecropping agreements and championed access to public education. The First Eight wanted to see more Blacks own land. They knew that freedom without economic advancement would still keep Blacks enslaved in poverty.

But when Reconstruction ended in 1877, many of their accomplishments were deliberately reversed. The subsequent era of sharecropping and Jim Crow laws trapped families in a cycle of debt that made property ownership nearly impossible for a century.

The similarities between then and now are striking. We are in another period of attacking the ability of minorities to gain financial traction, Clyburn says.

Black homeownership is as low as it was when housing discrimination was legal. There is a significant homeownership gap, with Black homeownership at 45 percent, nearly 30 percentage points lower than the White homeownership rate of 72 percent.

Trump’s policies are disproportionately affecting Black Americans and represent a “direct assault on their ability to maintain economic stability,” according to an analysisfrom the Center for American Progress, a prominent left-leaning think tank.

The Joint Center for Political and Economic Studies released a report last month — “State of the Dream 2026: From Regression to Signs of a Black Recession” — that highlights a severe economic downturn for Black Americans.

Trump’s executive orders in his second term “have shifted federal support away from disadvantaged businesses, threatening an estimated $10 billion to $15 billion in lost federal support for Black-owned firms,” the report said.

The dismantling of the Consumer Financial Protection Bureau has left Black communities disproportionately vulnerable to predatory fees, discriminatory lending and financial fraud, the report concluded.

“The systematic withdrawal of protections, investments, and accountability mechanisms that have historically assisted Black communities from economic shocks combined with a substantive increase in Black unemployment all point to 2025 as a regression and recession for African Americans,” according to the report.

Clyburn’s main point is that we’re living through a rerun of history. He notes a grim irony: Right after the Civil War, “Black Codes” literally made it a crime for Black people to be unemployed, even though they were barred from almost every job.

“Wealth is at the bottom of all of this,” Clyburn said. “You’re not going to function effectively in a capitalist system without capital. It’s just that simple. Nobody’s asking anybody to give them a living, just the equipment that’s necessary to earn a living.”

Today, he sees the same strategies playing out in the predatory policies stripping away Black wealth. For him, the fight for the right to vote has always been about the fight by Black people to build their bank accounts.

His history lesson is a haunting reminder that financial gains can be easily lost.

With “the tumultuous and challenging times in which we now live, this book has become much more than an introduction to heroic figures who have been lost to history,” Clyburn writes. “It is now a cautionary tale.”

As for the book club, we don’t meet in person. But I would love to know what you think of my selection. Email your comments to [email protected]. In the subject line put “Color of Money Book Club.” I’ll feature feedback in my weekly newsletter. It’s free, and you can subscribe at washingtonpost.com/newsletters/personal-finance/.

The post Rep. James Clyburn’s ‘First Eight’ warns about today’s war on Black wealth appeared first on Washington Post.