In 2014, Coinbase was a two-year-old start-up offering people the ability to buy and sell Bitcoin. It needed investment to grow and turned to an unlikely source: Jeffrey Epstein.

“Would be nice to meet him if convenient,” Fred Ehrsam, one of Coinbase’s founders, wrote to associates about Mr. Epstein in December 2014 as the financier prepared to make a $3 million investment.

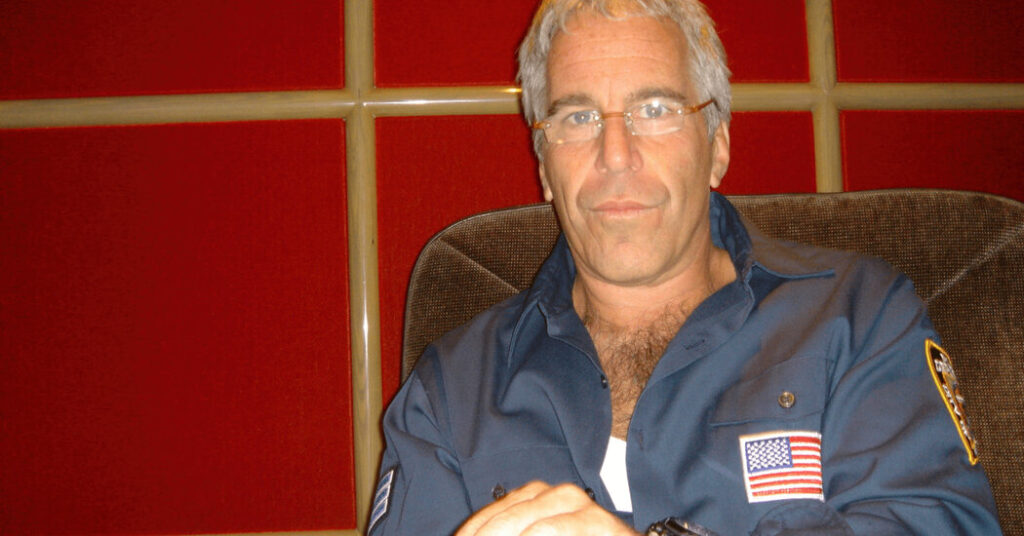

By then, Mr. Epstein was already a convicted sex offender, having pleaded guilty to charges of soliciting prostitution from a minor in 2008, but Coinbase took his money all the same. As the company developed over the years into one of the world’s dominant cryptocurrency exchanges, Mr. Epstein’s $3 million investment would net him multimillion-dollar returns, according to newly released documents from the Justice Department detailing the disgraced financier’s life before he was jailed in 2019 on federal sex-trafficking charges.

The documents illustrate not only Mr. Epstein’s deep relationships in Silicon Valley but also his ability to gain access to hot deals and buzzy start-ups, some of which would become pillars of today’s tech industry. Along the way, Mr. Epstein was aided by venture capitalists, entrepreneurs and communications professionals, despite growing scrutiny of his abuse of teenage girls and young women.

The billionaire Peter Thiel advised Mr. Epstein on potential investments in Palantir, Mr. Thiel’s data analysis company. Mr. Epstein put money into Jawbone, a popular wearable technology start-up, while his financial adviser was pitched on backing SpaceX. And Mr. Epstein tapped a Russian émigré who had become a public relations expert to help broker meetings with start-up founders and media outlets.

Mr. Epstein’s connections to high-profile tech leaders including Bill Gates, Sergey Brin, Reid Hoffman and Mr. Thiel have been well documented, and some have expressed regret for associating with the financier. The latest batch of files offer deeper insights into how Mr. Epstein made his money after his 2008 conviction and continued to fund a lavish lifestyle by amassing assets worth more than $600 million before his 2019 arrest, according to an audit of his finances within the files.

Mr. Epstein was introduced to Coinbase by Brock Pierce, a crypto entrepreneur with a checkered financial past, who later sent him frequent updates on the state of the business that were signed by Mr. Ehrsam or Coinbase’s chief executive, Brian Armstrong. In 2018, an investment firm founded by Mr. Pierce sought to buy half of Mr. Epstein’s Coinbase holdings for $15 million. It is unclear if, or when, Mr. Epstein sold the other half.

A spokeswoman for Coinbase declined to comment. Mr. Ehrsam did not respond to emailed requests for comment.

Mr. Epstein’s connections with tech go back to the dot-com boom, before his criminal activities were made public. He was a frequent guest at tech conferences and at Edge Foundation dinners, which brought together a who’s who of industry luminaries.

The investor Jason Calacanis stayed in touch with Mr. Epstein after his 2008 conviction and three years later helped the financier contact a pair of Bitcoin developers, according to emails included in the documents.

“I barely knew him, but he was everywhere,” Mr. Calacanis wrote in a social media post after the release of the documents. He added that “his interest in me was probably because I was an angel investor in technology startups.”

Hosain Rahman, a co-founder of Jawbone, a start-up that made Bluetooth headsets before expanding into wearable fitness trackers, first met Mr. Epstein at a TED conference. In 2012, Ian Osborne, an adviser to executives and political figures, reconnected the pair and encouraged Mr. Epstein to invest in Jawbone. When Woody Allen was filming “Blue Jasmine” in San Francisco, Mr. Epstein invited Mr. Rahman to visit the set, where Mr. Epstein showed off a pair of high-tech eyeglasses.

“Have some BIG ideas,” Mr. Rahman emailed to Mr. Epstein in 2012. “Can we chat about it more?” That fall, Mr. Rahman went to the Zorro Ranch, Mr. Epstein’s sprawling New Mexico property.

Mr. Epstein invested $5 million in Jawbone in 2012 and increased his holdings to $11.25 million by 2017, according to documents.

Jawbone failed and liquidated itself in 2017. Mr. Epstein threatened legal action against Mr. Rahman over the failure and even hired a private investigator to try to dig up dirt on him, according to a report released by the Justice Department. In 2018, Mr. Rahman offered Mr. Epstein a role as a “senior adviser” in a newly formed company, Jawbone Health, in an attempt to stave off the legal threats.

“Epstein put together a special purpose vehicle to invest in Jawbone, and we wish he hadn’t,” Mr. Rahman said in an email. Mr. Osborne declined to comment.

With Mr. Epstein, Mr. Osborne also discussed potential investments in cybersecurity companies and Palantir, which Mr. Thiel co-founded. By 2014, Mr. Epstein took an interest in Palantir and, at one point, suggested to Ehud Barak, the former Israeli prime minister, that he speak with Mr. Thiel about an advisory role there, according to a recording released by the Justice Department.

Mr. Epstein was scheduled to meet with Mr. Thiel several times in 2014, and by that year had started emailing the venture capitalist for investment advice. That October, he asked Mr. Thiel if Palantir was doing a round of financing, before asking Mr. Thiel whether he should invest $100 million in Spotify, the music streaming service, at a $5 billion valuation.

In response, Mr. Thiel emailed Mr. Epstein to tell him to “hold off” on investing in Spotify. “Somewhat more bullish on Palantir, but I think there is no need to rush,” Mr. Thiel said of his own company.

In a statement, a Palantir spokeswoman said the company “was not aware of Epstein ever investing in or being a shareholder in Palantir.” She also said Palantir “has never had a business relationship with Ehud Barak.”

A spokeswoman for Spotify declined to comment. A spokesman for Mr. Thiel did not respond to a request for comment.

Mr. Epstein did invest $40 million in one of Mr. Thiel’s venture capital firms, Valar Ventures, across two separate transactions. Mr. Epstein’s estate still possesses these holdings, which were worth about $170 million as of last summer.

In a statement last year, Valar said it hoped the “eventual distribution of these investments can be put to positive use by helping victims move forward with their lives.”

Mr. Epstein gained access to other deals through his relationships at Deutsche Bank, which took him on as a client in 2013 and later paid a $150 million fine for its role in extending his influence. It was through a connection at Deutsche Bank that Paul Barrett, a financial adviser for Mr. Epstein, received an opportunity to invest in SpaceX with a venture capital firm, according to emails released by the Justice Department.

In October 2017, Mr. Barrett took a meeting with Vy Capital, an Emirati-based venture firm that offered the chance to invest in a subsidiary company with access to $50 million in SpaceX shares, according to emails released by the Justice Department. At the time, Elon Musk’s rocket manufacturer was worth $22 billion.

Mr. Epstein developed a personal relationship with Mr. Musk, who invited the financier for lunch and a tour of SpaceX’s headquarters in 2013. Mr. Epstein also had at least one prior opportunity in 2016 to invest in the company through a different financial adviser, according to his emails, but it is unclear if he ever did.

In a statement, a spokeswoman for Vy said the firm had only “a single 30-minute introductory call arranged by Deutsche Bank” with Mr. Barrett and never engaged in business with or interacted with Mr. Epstein.

“We regard his conduct as abhorrent and have never — and would never — associate with him in any form,” the spokeswoman said, adding that the firm learned of Mr. Barrett’s connections with Mr. Epstein only after The New York Times contacted it.

A spokesman for Deutsche Bank declined to comment. Mr. Barrett did not respond to a request for comment. On social media, Mr. Musk has said he “had very little correspondence with Epstein,” but did not address his meetings with him or the SpaceX tour.

In 2017, Mr. Epstein met Masha Drokova, a public relations professional now known as Masha Bucher. Ms. Bucher, who runs a venture capital fund called Day One Ventures, set up a series of meetings for Mr. Epstein with reporters at Forbes, Nature, The Times and other outlets. She also facilitated connections between Mr. Epstein and entrepreneurs, including Bryan Johnson, the longevity influencer and entrepreneur.

Mr. Johnson said in a statement that he had held one video meeting with Mr. Epstein and “left the call feeling as though Epstein was the most dark and evil person I had ever encountered.” A representative for Ms. Bucher did not respond to a request for comment.

Mr. Epstein maintained several connections with smaller tech figures and investors throughout the years, including a Bitcoin developer, Jeremy Rubin, and a cybersecurity entrepreneur, Vincenzo Iozzo, who both brought him investment opportunities. In June 2018, Mr. Epstein moved to create a dedicated investment vehicle called Deploy Capital for Mr. Rubin. Emails suggest the plan was to fund it with $5 million.

Mr. Rubin and Mr. Iozzo declined to comment.

Mr. Rubin expressed concern about how founders might react to taking money from a sex offender. “Potential investments googling your name might get spooked,” he wrote in an email to Mr. Epstein with the subject line “Fund Optics.” Mr. Rubin suggested not naming Mr. Epstein and simply telling people, “I raised a fund.”

Mr. Epstein agreed, but still wanted to meet the founders of Mr. Rubin’s first potential investment, a cryptocurrency company called Layer1. Mr. Rubin suggested that Mr. Epstein obscure his identity by using a pseudonym or just “Jeff” on a call with the founders.

When Layer1’s founders insisted on knowing whose money Deploy Capital was investing, Mr. Epstein replied in an email to Mr. Rubin that his powerful friend Mr. Thiel would vouch for him.

Alex Liegl, a co-founder of Layer1, said the company had not taken money from Mr. Epstein or Deploy Capital and had not discussed them with Mr. Thiel.

Still, later that day after getting Mr. Epstein’s email, Mr. Rubin wrote back with good news.

“They’re not bothered,” he said. “They’ll chat with Thiel.”

Ryan Mac covers corporate accountability across the global technology industry.

The post Jeffrey Epstein’s Money Mingled With Silicon Valley Start-Ups appeared first on New York Times.