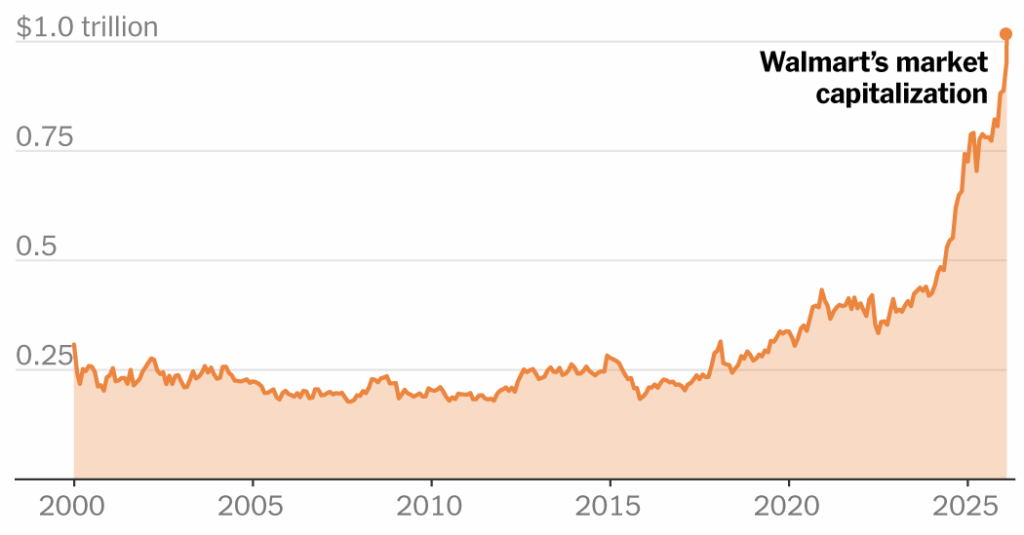

Walmart crossed above $1 trillion in market value on Tuesday, becoming the first traditional retailer to hit the milestone and joining a small club mostly made up of technology giants such as Apple and Microsoft.

The nation’s largest retailer is known for its supercenters and low prices that have lately pulled in even higher-income consumers. Investors have been drawn to the company’s rapid e-commerce growth in recent years and push into automation and artificial intelligence. Walmart’s stock has climbed about 28 percent over the past year, outpacing the S&P 500 index’s 15 percent gain during the same period.

“Walmart management was prescient in building out a business model optimized for this moment,” said Sarah Henry, managing director and portfolio manager at Logan Capital Management, an investment management company. “Their rebuilding recast their image as much as a technology company, as they are a retailer.”

Digital sales have been a major driver of growth lately. Walmart’s e-commerce business includes curbside pickup, same-day delivery and a growing third-party marketplace, while its advertising business has become increasingly important to its bottom line. In its last quarter, Walmart reported a 27 percent increase in e-commerce sales and a 53 percent jump in advertising revenue.

That growth is rooted in acquisitions the company made nearly a decade ago as it sought to compete with Amazon for online customers. In 2016, Walmart bought the online bulk retailer Jet.com for $3.3 billion, and in 2018 Walmart bought a controlling stake in Flipkart, an e-commerce company.

It’s also built a new 350-acre campus in Bentonville, Ark., that resembles the headquarters of companies in Silicon Valley — with a food hall, an amphitheater and sprawling fitness and child care centers — as it looks to compete for tech workers.

At the same time, the company has pitched itself to investors as a “technology-forward” company, moving its stock listing from the New York Stock Exchange to the Nasdaq, where many of the largest tech companies are listed.

But even Walmart’s reputation of offering low prices as a traditional retailer has worked in its favor lately, benefiting from consumers seeking big discounts to help offset the fast inflation and new tariffs that are straining their budgets. And wealthier shoppers have been attracted to Walmart’s expanding online offerings that include apparel and furniture.

Walmart’s $1 trillion valuation comes just days after John Furner assumed the role of chief executive, replacing the company’s longtime chief, Doug McMillon. Mr. Furner is expected to accelerate Walmart’s transformation into a high-tech retailer with plans like expanding the use of A.I. assistants for online shoppers.

“The company has successfully positioned itself not only as standing for strong pricing, but now also as a more convenient omnichannel retailer,” said Michael Baker, senior research analyst at D.A. Davidson, a financial services firm.

Kailyn Rhone is a Times business reporter and the 2025 David Carr fellow.

The post Walmart Joins Tech Giants With $1 Trillion Market Valuation appeared first on New York Times.