California drivers and Republican legislators are furious over a Democrat-led proposal that could see motorists taxed for each mile they drive.

With the state staring down a budget deficit in the billions and more Californians switching to electric vehicles, Democratic lawmakers are searching for new ways to shore up declining gas tax revenue.

Californians pay the second-highest gas price in the nation behind only Hawaii. In January, the average price was $4.23 per gallon, according to the American Automobile Association.

On Thursday, state legislators advanced Democrat Lori Wilson’s bill, AB 1421, which would direct the California Transportation Commission and the state Transportation Agency to continue studying options for a mileage-based tax, rather than implementing one.

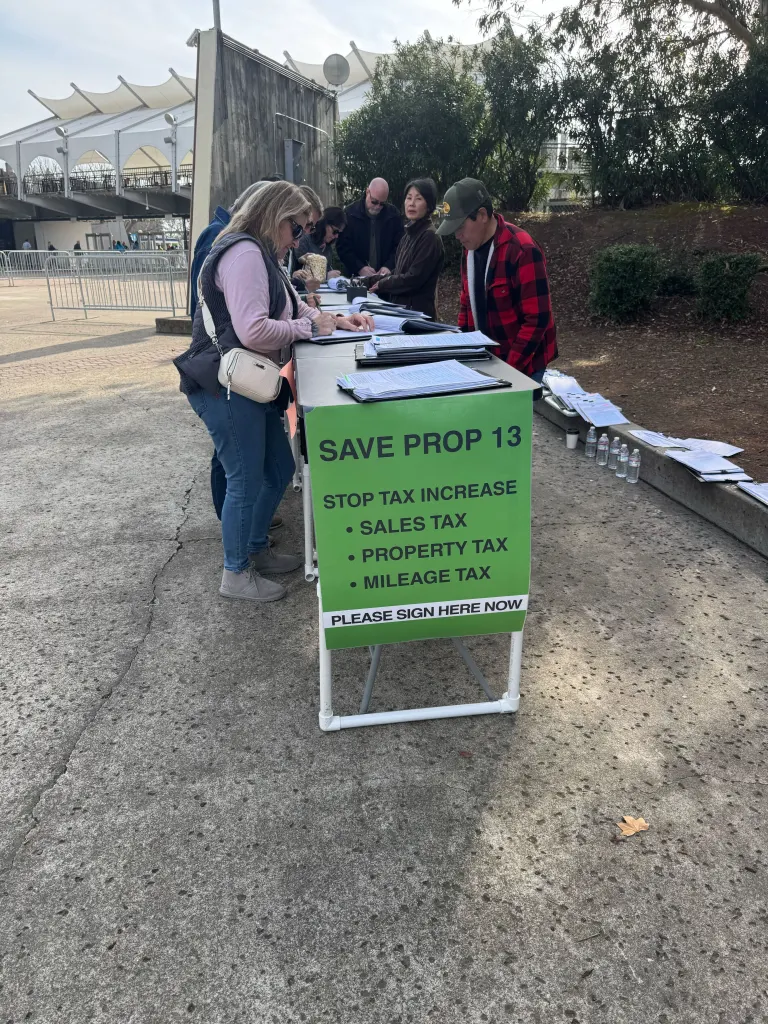

Opponents of the proposal were out in force Saturday, with activists gathering at Cal Expo in Sacramento to collect signatures opposing a raft of new Democratic tax measures, including a potential mileage charge.

“I just got very tense and insecure, because I drive a lot of miles,” said Sherrie Ann Lorenzo, a Chico resident. “I don’t want to be taxed for driving. It’s my freedom. I live in the home of the free, I thought.”

Under concepts outlined in the study, the tax could range from two to nine cents per mile. With California drivers logging roughly 11,400 miles a year on average, a mileage charge could cost motorists between $228 and $1,026 annually.

Beyond the price tag, critics warn that tracking drivers’ mileage could be both logistically complex and deeply invasive.

“This disproportionately hits rural residents and long-distance commuters,” Republican lawmaker Alexandra Macedo said. “This favors wealthy EV drivers over everyday Californians. We already pay the highest gas tax in the U.S. We shouldn’t be adding a mileage tax on top of it.”

Bruce Lou, a delegate for the San Francisco and state Republican Party, was among those blasting the proposal online.

“This per-mile tax would be on top of the highest gas taxes in the country,” Lou wrote on X. “Citizens shouldn’t be treated like ATMs.”

Assemblymember Carl DeMaio (R-San Diego) delivered a blistering critique of AB 1421 in comments on the Assembly floor Thursday.

“When you add up the car tax, the gas tax, and this new mileage tax, a working family with two cars and two parents driving could be forced to pay $4,200 a year to the state of California just for the privilege of driving on crappy roads,” DeMaio said. “What are we thinking here?”

Wilson has dismissed the backlash as partisan and defended the bill, arguing it “responds to a reality that we can no longer ignore.”

Download The California Post App, follow us on social, and subscribe to our newsletters

California Post News: Facebook, Instagram, TikTok, X, YouTube, WhatsApp, LinkedIn California Post Sports Facebook, Instagram, TikTok, YouTube, X California Post Opinion California Post Newsletters: Sign up here! California Post App: Download here! Home delivery: Sign up here!Page Six Hollywood: Sign up here!

“California’s transportation funding system is becoming less stable, less equitable, and less sustainable as more drivers switch to fuel-efficient and zero-emission vehicles,” she said.

Wilson said she is “committed” to amending AB 1421 to ensure motorists are not double-taxed through both mileage fees and the gas tax.

In its current form, the bill would commission a report examining equity concerns for low-income drivers who often travel longer distances in less fuel-efficient vehicles, analyze the potential impact of a weight-per-mile fee on commercial and electric vehicles, and outline regional and statewide options for implementing a road usage charge.

Mileage-based road usage charges have been proposed or implemented in several other states. Oregon and Utah have established operational, largely voluntary programs, while Hawaii is phasing in a mandatory road usage charge for electric vehicles. Washington and Colorado have conducted pilot studies and continue to explore mileage-based fees as potential long-term replacements for traditional fuel taxes.

Privacy concerns are also expected to loom large, alongside complications involving out-of-state drivers, rural residents, low-income households, and inevitable billing errors.

Rep. Darrell Issa (R-San Diego) warned that AB 1421 could pave the way for intrusive government monitoring, branding it “a tool for future control.”

“To collect the tax, the government will amass a database of everywhere a car goes,” Issa wrote. “Church? Political rallies? Gun ranges? Fast food?”

For now, those questions remain unanswered.

The post Drivers fume over Dem-led push that could see them taxed for every mile: ‘Citizens treated like ATMs’ appeared first on New York Post.