Crashing home prices, stalled rebuilds and nightmare insurance red tape have been laid bare by homeowners whose houses were destroyed in the Los Angeles wildfires — with some now staring down the barrel of multimillion-dollar losses.

The homeowners have detailed they how the lost millions of dollars in fires that left large swathes of the Palisades and Altadena looking like “post-war Hiroshima”.

Single mother of three Jacqueline Chernov lost both her home in Huntington Palisades and an investment property in nearby Alphabet Streets says she’s facing a financial loss of at least $2.4 million.

The real estate broker claims progress on rebuilding her homes has completely stalled on the back of permit delays, soaring construction construction costs, and insurance company red tape that’s frozen the $1 million payout she needs to pay builders.

Now, she said, she may have to sell one or both properties — at a huge price reduction — and is worried there’s no way she’ll finish rebuilding before her insurance payments covering her rent run out.

“Before the fire my house [in Alphabet Streets] was worth $4.2 million,” she told The California Post. “But if I have to sell up a half built house, I might get $1.8 million.”

Chernov’s rebuild nightmare follows The Post revealing Donald Trump plans to sidestep reconstruction delaysby signing an executive order aimed at fast-tracking the rebuilding of Los Angeles.

Trump’s order is designed to “preempt” the building permit process — and empower the federal government to maneuver around the needless obstacles imposed by Democratic leaders.

Trump’s order comes as an exclusive report by Realtor.com for The California Post details how delays in rebuilding have caused widespread economic chaos with:

- Homes damaged or destroyed by the wildfires plummeting in value by 50%

- Vacant lot listings in the Palisades and Altadena soaring as residents can’t afford a rebuild

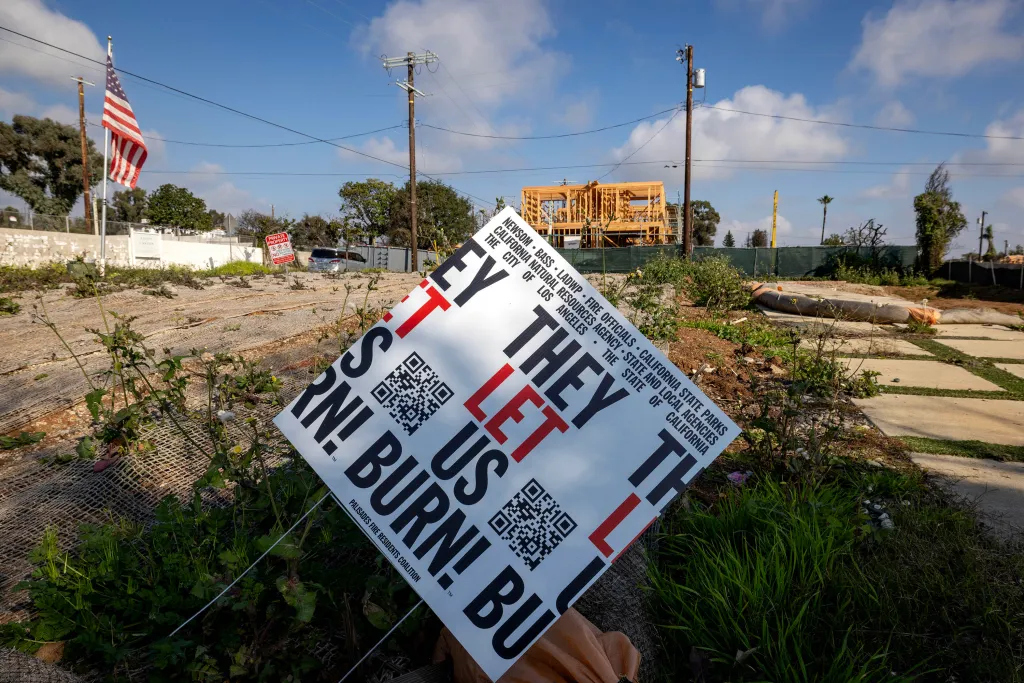

Jerry, a media publisher whose house was badly damaged, blasted officials for a lack of progress that has meant “Pacific Palisades resembles a devastated post-war Hiroshima.”

“The fabric of the culture has been destroyed, and nothing is the same,” he said. “My house is so toxic you can barely be in it.”

Fire safety experts are sounding the alarm over Los Angeles Mayor Karen Bass’s ill-thought-through order to “clear the way to rebuild homes as they were” — promoting “like for like” homes made from the same wood-frames that could portend further disasters. Ken Calligar, CEO of RSG 3D, a company that builds fire-resilient homes, said it’s not so much a matter of if the devastating wildfires could happen again,.

“It wasn’t an ember coming from the chaparral or the ridge,” he said. “It was a neighbor’s house. Wood is nothing more than fuel. These people are building themselves back into a giant pool of risk. Sometimes I get sick to my stomach walking down the street.”

Calligar also warned that Governor Gavin Newsom’s six-year freeze on most changes to building codes, intended to speed rebuilding, is actually preventing stricter safety standards.

“Building resilience takes more time and money, and saves on energy, maintenance and insurance,” he said. “I think there’s going to be a lot of regret.”

“The mayor, she hasn’t done anything. And that’s the worst thing ever.”

More than a year after flames tore through Pacific Palisades, real estate broker Jacqueline Chernov says the rebuilding process has become almost as punishing as the disaster itself.

Neither of her houses are close to being rebuilt. One stalled due to surging construction costs. Another remains half-finished, with construction frozen, after insurance delays collided with mortgage requirements.

More than $1 million in insurance proceeds, she said, are still being withheld, leaving her bank unwilling to release additional construction funds.

What she expected would be a relatively straightforward claims process has turned into a bureaucratic maze. Insurance payouts are broken into rigid categories, each requiring documentation, receipts and repeated explanations. Even debris removal became a sticking point.

“They told me I needed to divide the debris between the house, the garage and other structures,” she told The California Post. “But it’s all ash. How do you divide ash?”

She’s also living in fear of even more spiraling costs when the insurance payments covering her rent end.

“I have insurance money to rent a home now, but then that’s going to run out. And that’s my concern. And I think it’s a concern for lots of people,” she said.

“A lot of people had in their policies one to two years of loss of use, which means they’re paying the rent. The insurance company is paying my rent right now. But once that’s up, if my house isn’t built or they decide they’re not going to pay me the money, then I’m selling a half-built house.”

Chernov is one of the few actually contemplating a return to her fire ravaged homes. According to an extensive report from the Pacific Palisades Community Council released in January, only one in four residents whose homes were badly damaged have returned. And just over half expecting to be living in Pacific Palisades in 10 years time.

Per the same report, few have confidence in the government to effectively manage rebuilding efforts.

Chernov herself is deeply critical of Mayor Bass’s lack of efforts to help residents, calling out much delayed action to attempt to freeze the mansion tax still currently applied to fire-damanged homes.

“The mayor, she hasn’t done anything,” she said. “And that’s the worst thing ever. Because it’s not a tax on the rich. It’s a tax on the people coming to buy the houses, and it just adds that to the purchase price.

“So it’s the homeowner that’s paying, which isn’t fair, and it’s hurting the community from being built back up again because people don’t want to come in.”

Crashing prices

The delays in rebuilding have destroyed property prices in the area too.

The shocking Realtor.com reporton the state of California’s real estate, exclusively for The California Post, also reveals that homes damaged by the wildfires have on average plummeted 50% in value — comparing pre-fire purchase price to final sales price.

And this trend is one that Chernov has observed herself, as a realtor as well as a homeowner.

She just listed a smoke-damaged house at 737 El Medio Ave., at an ambitious $4.9 million. “You have to get the price at a certain point or all the values in the area will be lost,” she said.

“Some people would rather get into a smoke-damaged house and remediate it themselves than rebuild,” she said.

“Rebuilding is daunting and time-consuming. People don’t know how hard it is.”

She estimated that, even with ambitious pricing, listing values are down by 30 to 35% on pre-fire times. For example, she said that the 3,800-square-foot dwelling for $4.9 million would list for closer to $6 million undamaged.

Those who plan to sell tend to be retirees or young couples with children — who are generally not interested in dealing with the headache of construction, said Chernov.

A market for a “bargain” that will change the area forever

Despite the widespread destruction, some buyers do want the fire damaged lots, with exclusive Realtor.com data showing that Pacific Palisades homes classified as destroyed averaged 73 days on the market — not far above the 66 days for all single-family residences.

But industry experts warn that those buying in will fundamentally change the region’s demographics. When the dust settles, an area of staggering wealth — one with perfect weather and spectacular views — will end up even wealthier, pushing more and more of Los Angeles’ middle class out.

Download The California Post App, follow us on social, and subscribe to our newsletters

California Post News: Facebook, Instagram, TikTok, X, YouTube, WhatsApp, LinkedIn California Post Sports Facebook, Instagram, TikTok, YouTube, X California Post Opinion California Post Newsletters: Sign up here! California Post App: Download here!Page Six Hollywood: Sign up here!

Not every home in the area was as lavish as an 18-bedroom mansion that appeared on “Succession,” which sold for $83 million in 2021 and burned down. There were dwellings in the $2 to $3 million range — but now with many owners listing their vacant lots, the new builds stand to be far more luxurious — and out of reach for most.

“Places like Malibu and the Palisades remain uniquely compelling,” said Carl Gambino of the Gambino Group at Compass. “Scarcity ultimately drives demand.”

As for the many vacant lots for sale, some of which are unlisted, a typical “dirt value” is around $2 million.

One $2 million lot just north of Sunset Boulevard is advertised as presenting “a remarkable chance to build your dream home. . . with debris removal finished and the site ready for development, you can create anything from a forever residence to a tranquil coastal retreat.”

But, buyers be warned, because the listing also notes that they “should verify all rebuild feasibility, permits, utilities and lot lines with the City of Los Angeles and the appropriate agencies.”

An increasingly tall order, it seems, in the slightly-less-golden state.

The post Our rebuild hell: LA fire victims reveal nightmare scenario of red tape and financial ruin – one year on appeared first on New York Post.