2026 has so far resembled the worst parts of 2025 at many quant hedge fund managers.

The beginning of the year had the worst stretch of losses since early October, according to a Goldman Sachs report, and several big-name managers did not avoid the pain.

HSBC’s Hedge Weekly report states that Renaissance Technologies’ two largest funds lost roughly 4% each through January 9. A person familiar with Schonfeld said the manager’s quant-only strategy was down 3.9% through January 16.

Engineers Gate was down around 6% midway through the month, a person familiar with the matter said.

Renaissance, Schonfeld, and Engineers Gate declined to comment.

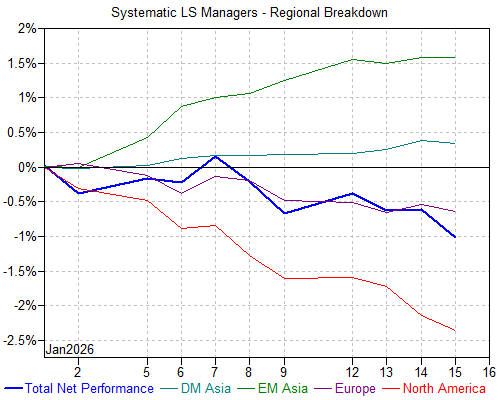

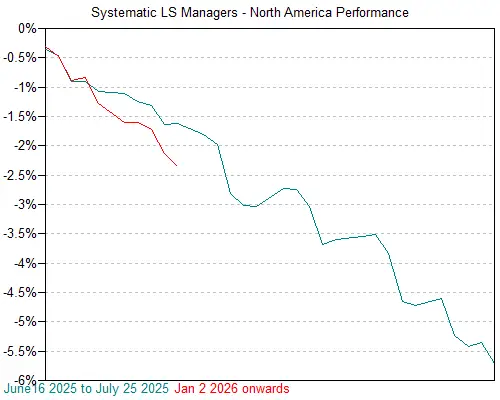

The average computer-run equity fund was down 1% through January 15, according to Goldman’s note. The losses were mainly driven by US stocks, which have been choppy to start the year thanks to trade proposals floated by President Donald Trump’s administration. Funds crowding into similar trades have also hurt returns, Goldman notes.

Performance on January 16 — not captured in the Goldman note — was especially bad for many quant funds, industry insiders said.

Last year, systematic funds had several extended periods of losses, including a stint in June and July that one consultant described to Business Insider as “a long, slow bleed.” Funds gradually recouped summer losses, but ran into trouble again in early October when crowded trades, a momentum sell-off, and inflated junk stocks led to drawdowns.

While funds again rebounded from those losses, the average quant returned 7.7% last year, according to hedge fund research firm PivotalPath, less than the average fund and the S&P 500’s 2025 gain.

PivotalPath flagged equity quant crowding as an investor concern in a January report, noting that spikes in crowding measures have preceded previous drawdowns in systematic trading strategies.

Read the original article on Business Insider

The post Renaissance, Schonfeld, and Engineers Gate stung in a shaky start for quants in 2026 appeared first on Business Insider.