For years, Amazon was cast as Walmart‘s great disruptor. Now, it’s borrowing from the retail giant it once sought to upend.

The company is rolling out Walmart-inspired ideas, including “Supercenter” warehouses, a new distribution layer known internally as the “1DC” network, and microfulfillment centers within Whole Foods stores, according to internal documents obtained by Business Insider.

The shift reflects a hard lesson: mastery of e-commerce does not translate into dominance in groceries, particularly perishable items that drive frequent shopping. Walmart’s dense network of stores and distribution centers, designed to move everyday goods quickly and cheaply, has proved difficult to replicate.

Nearly a decade after paying $13.7 billion for Whole Foods, Amazon still trails Walmart in everyday grocery shopping, and is now reshaping its retail infrastructure to compete head-on with Walmart’s Supercenter model.

Earlier this month, plans emerged for a roughly 225,000-square-foot Amazon megastore near Chicago. Bigger than a typical Walmart Supercenter, the new concept is designed to let customers buy “fresh groceries, household essentials, and general merchandise — all in one trip,” according to Amazon.

Michael Levin and Josh Lowitz, cofounders of Consumer Intelligence Research Partners, called the move “mind-blowing” and said “it reveals a degree of Walmart jealousy that we didn’t expect.”

Powerful store network

There’s a lot to be jealous about. With roughly 90% of the US population estimated to live within 10 miles of a Walmart store, the company’s 5,000-plus locations give it a powerful edge in selling fresh food and other perishables, along with many other everyday staples.

According to research firm Numerator, Walmart accounted for about 21% of the US grocery market, both online and in-store, as of September. Amazon and Whole Foods, meanwhile, each held roughly 1.6% of the market.

Meanwhile, Walmart is leveraging its Supercenters to deliver online orders faster, challenging Amazon at its own game.

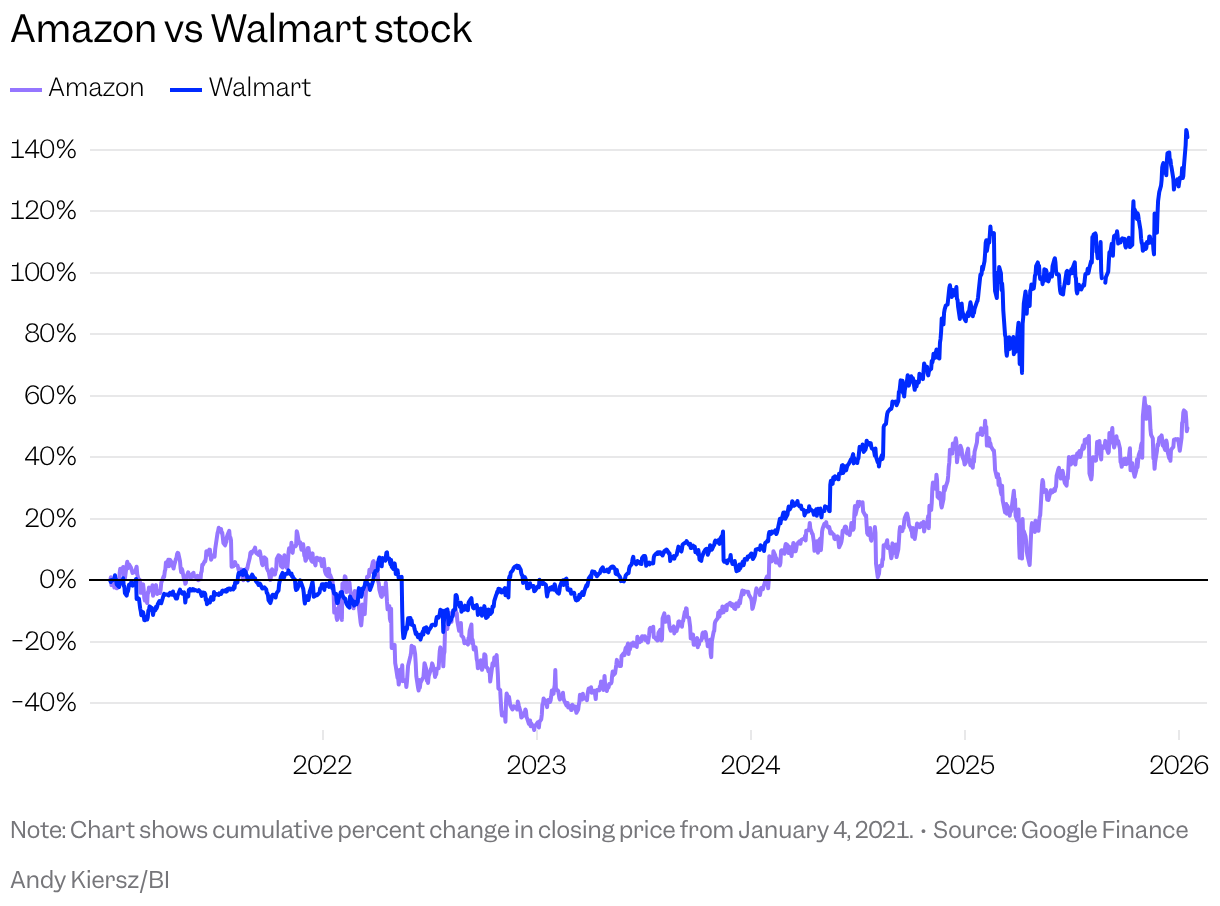

That’s fueled a surge in Walmart shares, valuing the company close to $1 trillion. The stock is up almost 150% over 5 years, far outpacing Amazon’s roughly 53% gain (although Amazon is still worth more).

Amazon does well with non-perishable goods and everyday essentials such as toothpaste and paper towels. Overall, it offers millions of products for same-day delivery.

But when it comes to more delicate food items, such as pears, meat, and cheese, the company knows it has more work to do.

A company spokesperson said Amazon serves more than 150 million US grocery customers, offers nearly 3 million grocery and household items, and provides same-day delivery in more than 9,000 cities and towns.

Grocery is an “ever-growing” part of its fast-delivery business, the spokesperson added, while noting that in 2025, Amazon added perishable groceries to its Same-Day Delivery service, now available in 2,300 locations, allowing customers to shop without trade-offs between speed, selection, and savings.

Amazon’s Supercenter ambition

One element of this fresh Amazon effort is a new type of same-day delivery warehouse internally called an “SSD Supercenter.” SSD refers to sub-same-day deliveries, typically within four hours. Unlike traditional SSD warehouses that tend to be smaller, these facilities are designed to be larger to close the selection gap, specifically with “Walmart” in groceries, the document said.

Internal planning documents show Amazon intended to launch at least five such sites last year. Amazon wanted to test whether customers would “step-change their shopping habituation and engagement” once the Supercenter warehouses went live, one of the documents stated. Amazon planned to add products not currently sold on its site to the new warehouse and take a more hands-on approach to inventory sourcing, with in-stock targets above 95%, according to the document.

Sub-same-day grocery delivery is still a tiny part of Amazon’s business. At the end of September, it had 30 million eligible customers for this service, according to one of the internal documents obtained by Business Insider. Only 1.6 million of them, or roughly 5%, shopped through the service.

Speed, at scale

Amazon’s Supercenter warehouses are part of a broader push to expand same-day grocery delivery. Internal forecasts called for at least 34 US same-day grocery sites in 2025. Amazon already operates over 80 same-day facilities nationwide, though not all handle groceries, according to Marc Wulfraat, president of logistics consultancy MWPVL.

Amazon is also planning to take the model overseas. Under an initiative known as Project Taylor, the company plans to expand sub-same-day grocery delivery across Europe. It also plans to pilot sub-two-hour “ultrafast” deliveries in London in 2026, one of the documents showed.

A new “1DC” layer in the network

Less visible, but just as important, is a new upstream distribution layer called “1DC.”

These facilities store the most frequently purchased products and replenish fulfillment centers as demand emerges. That can shift weeks’ worth of inventory out of space-constrained fulfillment centers and into distribution sites optimized for palletized storage and rapid transfer.

One internal document described the change as a move from a “push” system, in which inventory is positioned based on forecasts, to a “pull” system that allows fulfillment centers to draw inventory from distribution centers as needed.

Amazon began rolling out the 1DC concept last year through new buildings and retrofits. By the end of 2025, the company planned to operate a dozen of these centers, capable of moving at least 20 million units a week, according to one of the documents. As of October 2025, the facilities only handled non-perishables, including shelf-stable food items, but not frozen or chilled products, the document stated.

“Untenable”

The 1DC idea emerged after Amazon introduced one-day delivery in 2018, one of the documents stated. Longer delivery windows once allowed the company to rely on a single layer of warehouses that could ship inventory from any fulfillment center to any customer. But faster delivery promises made that model “untenable,” forcing Amazon toward a structure long used by traditional retailers, the document added.

MWPVL’s Wulfraat said Walmart pioneered the distribution-center model that stores inventory for replenishing retail locations, while Amazon built its business around fulfillment centers that ship directly to consumers. Amazon also operates a cross-dock network to resupply its fulfillment centers, he said, and the 1DC sites represent a newer, more targeted layer of that system focused on high-velocity items.

Amazon’s spokesperson told Business Insider that 1DC is part of a broader initiative the company previously announced to regionalize its delivery operations and reduce shipping costs.

Whole Foods as infrastructure

Perhaps the clearest signal of Amazon’s shift is its rethinking of Whole Foods. Once positioned mainly as a premium grocer, the chain is increasingly treated as logistics infrastructure.

Amazon has begun installing micro-fulfillment centers in the back of select stores, effectively turning them into local hubs for online orders.

One upgraded Whole Foods site in suburban Philadelphia, announced last year, now fulfills Amazon orders from the back of the store. The model lets shoppers buy Whole Foods-specific items while also ordering products available only on Amazon, reducing the need to shop at other retailers.

Amazon expects this store to serve roughly 100,000 e-commerce units a week by consolidating deliveries from nearby stores, and forecasts online order adoption to grow to 10% by the end of 2026, according to one of the documents.

This approach also mirrors Walmart’s strategy of using its stores to fulfill online orders. Walmart said last year that it can offer same-day delivery to 93% of US households through its store-fulfilled network, with about 35% of those orders arriving within three hours.

The perishables problem

The success of Amazon’s new approach depends on one of the hardest problems in logistics: perishables.

Internal plans show Amazon aiming to expand its perishables distribution capacity from 2.6 billion units in 2025 to 3.3 billion units by the end of 2026. The increase would come from new distribution centers and tighter operational standards across the existing network.

The push is central to Amazon’s same-day delivery strategy and its broader grocery ambitions. Company documents stress that delivering high-quality perishables quickly and reliably is essential to scaling the business.

The goal is expansive. One document calls for making perishables available to “100% of Prime customers” as quickly as possible.

Have a tip? Contact this reporter via email at [email protected] or Signal, Telegram, or WhatsApp at 650-942-3061. Use a personal email address, a nonwork WiFi network, and a nonwork device; here’s our guide to sharing information securely.

Read the original article on Business Insider

The post Inside Amazon’s ‘mind-blowing’ plan to fix groceries and beat Walmart appeared first on Business Insider.