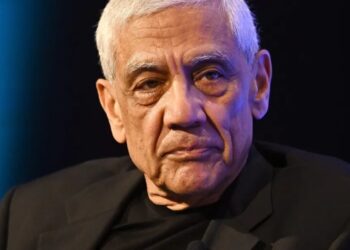

Dean Baker has earned a reputation for predicting economic catastrophe, and he tries to follow his own advice.

After the economist warned of a stock bubble in the late 1990s, he rebalanced his investments to reduce exposure to the market. Several years later, he became concerned that soaring home values would fall to earth, so he and his wife sold their condo in Washington.

He was right both times: The dot-com bubble burst in March 2000, and D.C.-area home prices crested in 2006 before slumping toward the depths of the Great Recession in 2009.

Now Baker, who’s a distinguished senior fellow at the Center for Economic and Policy Research, has that foreboding feeling again.

Investment in artificial intelligence has propelled the stock market to record highs, but he’s shifting his investments to be less exposed to what he considers to be an AI bubble edging closer to popping. “I don’t make a point of coming up with a negative forecast,” he said. “I just try to have open eyes on the economy, and sometimes I see something that other people don’t.”

Baker is among a select group of people with track records of foreseeing major economic train wrecks. These proven prophets of doom are winning attention in online posts and media interviews, as more people begin to wonder if the AI boom is too good to be true. That’s giving economic groundhogs like Baker a chance to spread their market wisdom more widely or actively cultivate big new audiences.

Michael Burry, whose mid-2000s bet against the housing market inspired Michael Lewis’s 2010 book, “The Big Short,” triggered headlines across financial news outlets in November when his hedge fund Scion Asset Management disclosed it was betting that the stock prices of AI darlings Nvidiaand Palantir will fall significantly over the next few years.

The same month, Burry, who didn’t respond to a request for an interview, started a Substack newsletter that often predicts an AI-catalyzed market implosion. It has more than 195,000 subscribers and is called Cassandra Unchained, after the princess of Greek myth cursed to foresee the future but to always be ignored.

“OpenAI is the next Netscape, doomed and hemorrhaging cash,” Burry wrote in a post on X last month that was viewed more than 2 million times, likening the maker of ChatGPT to a casualty of the dot-com bubble. (The Washington Post has a content partnership with OpenAI.)

Although voices of caution are having a moment, that doesn’t mean they’re winning the argument. James Chanos, the founder and managing partner of Kynikos Associates, who bet on the fall of energy giant Enron, said in an interview that market contrarians are often disregarded.

Short-sellers like himself are often viewed “as the village idiots or Dr. Evil,” he said, either wrongheaded or trying to manipulate the market. “There’s kind of no in-between,” said Chanos, who prefers to see himself and others as “financial detectives” hunting for bad actors, fraud or froth that should be cleared away.

A 2025 Harvard and Copenhagen Business School study of the beliefs of market experts during periods of boom and bust suggests that questioning market optimism is a good idea. “Optimism portends crashes: the most bullish forecasts predict the highest crash risk,” the authors found. In most cases, the authors said, “optimism remained unchecked until well after the crash.”

Other economists have identified key factors that indicate a crisis could be around the corner. A 2020 study of postwar financial crashes around the world by economists at Harvard, the National Bureau of Economic Research and the Copenhagen Business School found that “crises are substantially predictable.” When credit and asset prices grow rapidly in the same sector — conditions the researchers term a “red zone” — there was a probability of about 40 percent of a financial crisis starting in the next three years, they concluded.

A tech-fueled surge in share prices over recent years has driven the total value of the stock market to far outweigh U.S. economic input, an imbalance that has come before previous downturns. But a report issued Jan. 9 by Goldman Sachs Research said many features of past bubbles are absent.

Corporate debt is relatively low in historical terms, and most of the S&P 500’s 18 percent returns last year came from increased profits, not investors marking up valuations, the report said. Double-digit earnings growth is “providing the fundamental base for a continued bull market,” wrote Ben Snider, chief U.S. equity strategist. The report forecast that U.S. stocks would continue to grow in value this year.

When Andrew Odlyzko — an emeritus professor of mathematics at the University of Minnesota who has studied economic bubbles and has a history of recognizing warning signs before a crash — started getting calls from journalists asking about a potential AI bubble in 2024, he dismissed the idea. At the time he reasoned it wouldn’t be systemically devastating if a big company like Google, Microsoft or Meta made an expensive technological bet that flopped.

But things have changed in the past year and a half, Odlyzko said. “Now the investments are exceeding the capacity of these platform companies to finance them out of their cash flow, and they are drawing in other sectors of the economy,” he said.

He pointed to Meta’s recent deal to develop a $30 billion data center project in Louisiana, in which the project’s debt is held in a separate entity off Meta’s books. Such deals remind Odlyzko of the creative financing that led to the Great Recession in 2007.

“If — or more precisely, I’m pretty confident when — things collapse, the spillover effects will be much more substantial, much more deadly,” he said.

Today’s rush to build AI data centers also reminds Odlyzko of the 19th-century railway mania in Britain, a bubble of speculation on new railroad infrastructure. Both frenzies are creating “big infrastructure … that’s actually drawing on other parts of the economy,” he said.

Chanos makes comparisons between today’s AI fever and the 1990s tech boom, as both bull markets have centered on big ideas: AI today and the internet’s beginnings decades ago. In the short term, many early internet businesses cratered, even though the technology worked out in the longer term.

Artificial intelligence technology “is real and probably will be very important, but lots and lots of companies that claim they’re a great business … are probably not going to be great businesses,” Chanos said.

What’s different is that it’s now much easier for retail investors to jump into the stock market with the rise of stock-trading apps like Robinhood. Chanos said he’s “seeing more and more speculation in terms of retail investors who only know markets that generally go up, and if they go down, they go down for just a short period of time.”

Baker is one of those retail investors who’s preparing for the worst, as he has before — although he hasn’t always had perfect timing. He pulled back his portfolio a couple of years before the dot-com bubble burst in March 2000 and sold his D.C. condo in 2004, about two years before home prices started falling in the region.

Although discussion about predicting market slumps often frames the events as bad, Baker thinks an AI crash could do the U.S. some good.

A slump could lead to a reallocation of resources in the economy, perhaps toward other sectors like manufacturingor health care, he said. “There’s all sorts of things you could better use those resources for if the AI really doesn’t make sense,” Baker said.

The post These prophets of economic doom are worried about another collapse appeared first on Washington Post.