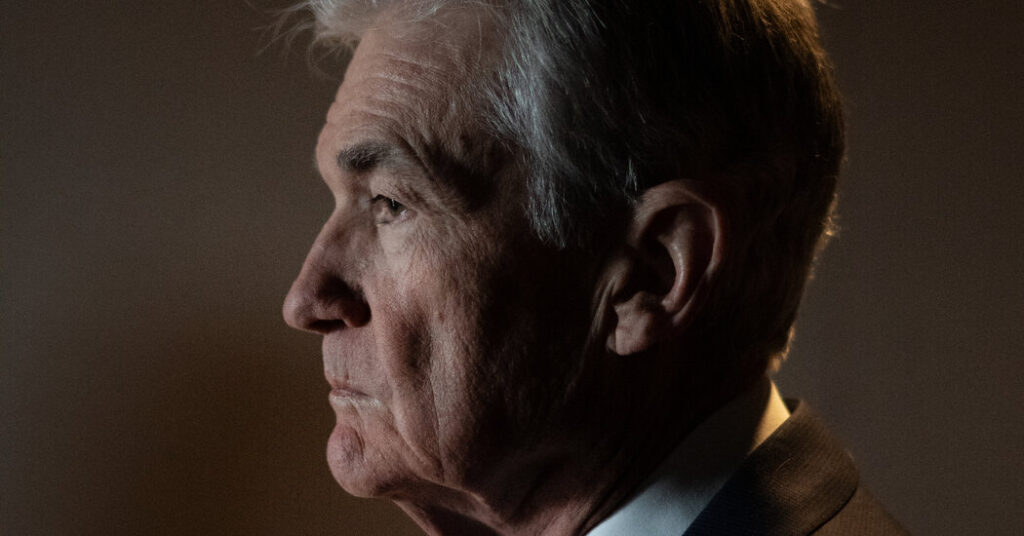

Jerome H. Powell had a list. It included the names of members of Congress who the Federal Reserve chair expected to have his back after finally taking on President Trump following the unthinkable — a criminal investigation by the Justice Department.

Mr. Powell’s belief that he would find a groundswell of support was not an idle thought. It was the product of years of deliberate relationship-building on Capitol Hill since Mr. Trump first elevated Mr. Powell to lead the central bank in his first term.

Mr. Powell was in touch with numerous lawmakers after the central bank received grand jury subpoenas on Jan. 9, including Senator Susan M. Collins of Maine and Senator Lisa Murkowski of Alaska. He also spoke with one the Fed chair’s harshest Republican critics, Senator Kevin Cramer of North Dakota, who sits on the powerful Senate Banking Committee.

Mr. Cramer said in an interview that he had spoken to Mr. Powell on Sunday before the Fed chair confronted the Trump administration in an extraordinary video message. They discussed the stakes of the criminal investigation and the potential connection to the president’s pressure campaign to force the central bank to lower borrowing costs.

“Prioritizing the relationship piece of it can save you lots of other times, so I give Jay Powell all the credit in the world for that,” Mr. Cramer said. “One of the things that gets many people in trouble in an administration is when they don’t have regular contact with their overseers.”

By Monday, the investigation into Mr. Powell had turned into a political mess for the president. Republican lawmakers, who had stayed silent through all the president’s previous attacks on the Fed chair, blasted the investigation as an egregious overstep.

Shortly after the Fed released the video on Sunday, Senator Thom Tillis of North Carolina, a pivotal member of the Banking Committee, said he would block any attempt by Mr. Trump to nominate a new Fed chair, throwing a wrench into the president’s plans for a replacement. Mr. Powell also got the backing of Senator John Thune of South Dakota, the majority leader. Every living former Fed chair and Treasury secretaries from both political parties denounced the move. Wall Street’s top banker, Jamie Dimon, also came to Mr. Powell’s defense.

The overwhelming response reflected in part the acute nature of the threat to the central bank’s independence, which gives officials the latitude to set interest rates according to what is best for the economy rather than what will please the president.

But it was also the product of something Mr. Trump may have underestimated — Mr. Powell’s popularity both in and out of Washington.

The outpouring of support, according to a person familiar with the matter, went well beyond Mr. Powell’s initial list. As he navigates his final months at the helm of the central bank, it is exactly this popularity that the Fed chair will need to leverage, especially if Mr. Trump further escalates his pressure campaign.

“It’s of paramount importance that the Fed chair has strong political support,” said Sarah Binder, a political science professor at George Washington University. “The backlash is going to protect Powell.”

Wearing Out the Carpets

Just months into his first term as Fed chair, Mr. Powell laid out his strategy for ensuring strong ties with Congress, which oversees the central bank.

“As far as meeting with Congress is concerned, I’m going to wear the carpets of Capitol Hill out by walking those halls and meeting with members,” he said in a radio interview with Marketplace in 2018.

“I feel like that’s a really important thing that the chair can do,” Mr. Powell said, later adding that, “I want them to think that we’re responsive to their concerns and their thoughts and that we’re here to be as clear as we possibly can.”

That approach quickly won him backers across the political spectrum, bipartisan support that had already proved pivotal to his reaching the pinnacle of the central bank.

“Jay Powell is very respected and very well liked on Capitol Hill, including by people like me who strongly disagreed with a lot of his monetary policy,” said Patrick Toomey, a former Republican senator from Pennsylvania who served as a ranking member on the Banking Committee.

Mr. Powell, a political centrist, was nominated in late 2011 to be a governor of the Fed by President Barack Obama, even though he is a registered Republican. Mr. Trump elevated him to chair in 2018 and in 2021, he was renominated to that role by President Joseph R. Biden Jr. for a four-year term that ends in May.

A lawyer by training who spent years on Wall Street, Mr. Powell was the first chair in decades to not hold an economics doctorate. The lack of that pedigree was initially criticized by some, who questioned whether Mr. Powell would be an effective chair without having deep economic expertise.

But his legal and banking background helped to hone his communications style and broaden his appeal outside Washington. Often he has opted to speak directly to the American people, eschewing economic jargon and instead matter-of-factly explaining how their lives will be affected by the actions the central bank has undertaken.

Mr. Powell’s reputation took a hit in the wake of the worst inflation shock in decades after the pandemic. The Fed, which had initially misdiagnosed the extent of the problem, was slow to shift policy to address it. Mark Spindel, chief investment officer at Potomac River Capital, described the inflation surge as the “mortal sin of central banking.”

In May 2022, Mr. Powell began speaking directly to the American people at the start of some news conferences, in a bid to assure the public that the central bank was working hard to fix the problem and that it understood “the hardship” it was causing.

While he is still admonished for missing the extent of the inflation problem initially, Mr. Powell is often lauded for having wrestled it back under control without plunging the economy into a recession.

Mr. Powell’s track record has been marred by other crises, including a trading scandal that led to the resignation of several policymakers and a regional banking crisis that forced multiple institutions to shutter. But the Fed chair managed to retain his credibility despite those errors, a testament to the good will many cite him as having built up over the years.

That support has grown, even from the Fed chair’s biggest detractors, as Mr. Trump has ratcheted up his attacks on Mr. Powell.

Roughly five years ago, Senator Elizabeth Warren, a Democrat from Massachusetts, told Mr. Powell at a congressional hearing that she thought he was a “dangerous man” and would not support his renomination as chair.

Now, she has rallied behind Mr. Powell, keeping in close touch with him over the past several months, according to a person familiar with the matter. While she remains at odds with him over how the central bank is handling its oversight of Wall Street, Ms. Warren has expressed concern about Mr. Trump’s attempts to politicize the Fed’s decision-making.

“The Fed works best when its decisions are grounded in data and the interests of the American economy, not political loyalty,” Ms. Warren said this week. “This takeover would devastate American workers, families and small businesses, and the Senate Banking Committee must not pave the way for it.”

Stay or Go?

Even before the grand jury subpoenas landed on Jan. 9, Mr. Powell was facing a difficult decision. While his term as chair ends in May, his role as a governor stretches on for two more years.

Mr. Powell had previously dodged questions on his future at the Fed. In the wake of the criminal investigation, discussions around whether he will stay or go have taken on new significance.

Mr. Cramer stood by his assertion earlier this week that it would be an “elegant” solution for Fed chair to step down in exchange for dodging a potential indictment — a deal that many say confirms that the investigation was nothing more than than a coercive move. It is also a deal that Mr. Powell appears nowhere close to even considering.

“Public service sometimes requires standing firm in the face of threats,” he said in his Sunday statement.

Those who know Mr. Powell often describe him as an institutionalist, saying he is someone who strives to put the central bank before all else. But they now sense that what it means to be an institutionalist for Mr. Powell has changed in the face of Mr. Trump’s broadside.

“If he thinks that his resignation as governor will endanger the institution and its independence, he’d be tempted to stay on,” said Donald Kohn, a former vice chair of the Fed.

“Jay is going to do what he believes is right, irrespective of pressure from the president,” added Michael Boskin, who served as chair of the Council of Economic Advisers under George H.W. Bush and has known Mr. Powell for over three decades. Mr. Boskin said that included how Mr. Powell would approach setting rates in his remaining months as chair, “even though the natural human reaction might be to just oppose what Trump wants.”

The stakes are high for all involved.

If he stays on, Mr. Powell could be a major impediment to the president’s desire for lower borrowing costs. The Fed chair has just one vote on the 12-person policy-setting committee, meaning whoever Mr. Trump chooses will have to persuade the other members to get on board with what they support. Neel T. Kashkari, president of the Federal Reserve Bank of Minneapolis, said in an interview this week that the next chair will need to “bring forward the best arguments that he or she can, and then win the votes.”

Mr. Powell’s presence would no doubt make it difficult for the next Fed chair to lead the central bank with authority. Mr. Trump had narrowed in on his pick, with Kevin A. Hassett, a top economic adviser, emerging as a front-runner. But the blowback from the investigation appeared to change the president’s thinking, perhaps in recognition that someone perceived as too close to the White House would struggle to assert independence.

On Friday, Mr. Trump said to Mr. Hassett at a health care event, “I actually want to keep you where you are, if you want to know the truth,” as he pointed out how effective his economic adviser is on TV in promoting the administration’s agenda.

“I would lose you,” he added. “It’s a serious concern to me.”

Uncertainty over who will lead the Fed, especially if that is complicated by Mr. Powell sticking around, risks making it harder for the central bank to communicate its policy views effectively. But if the Fed’s independence is indeed in jeopardy, Mr. Powell is likely to see that as a necessary cost.

“He’s not just fighting for himself,” Anil Kashyap, an economist at the University of Chicago’s Booth School of Business, said of Mr. Powell. “He’s fighting for others who might be in this position. He’s fighting for the legacy of the people who came before him. Dying on the hill of monetary policy independence is probably the right place to go out on.”

Colby Smith covers the Federal Reserve and the U.S. economy for The Times.

The post Powell, an Unlikely Foil, Takes on Trump appeared first on New York Times.