The stunning U.S. strike on Venezuela and the capture of President Nicolás Maduro earlier this month was a momentous event, and for one mysterious Polymarket trader, a very lucrative one.

Someone bet on Maduro’s ouster just hours before the military operation on Polymarket, the wildly popular bet-on-everything tool, taking home more than $400,000 and raising suspicions about their identity. “It’s more likely than not that this was an insider,” one expert told the Wall Street Journal.

Sen. Chris Murphy (D-Conn.) warned this week “about a dystopian world we are entering — where every moment, event and crisis just become commodities.”

Four days after Maduro’s capture, Dow Jones, the parent company of the Wall Street Journal, announced it was forming an exclusive partnership with Polymarket to bring its real-time data across Dow Jones consumer platforms, a sign of how prediction markets are increasingly becoming enmeshed in news coverage — both as a source and a subject. It came after CNN and CNBC struck deals last month with Polymarket rival Kalshi, whose up-to-the minute odds on potentially world-shaping events now pop up on air.

The succession of deals in such a short period underscores how quickly prediction markets have wormed their way into society. Their prime placement in news programs also give the wagers an added element of legitimacy. But with critics warning of the unanticipated dangers of near-unbridled wagering, how long before people start betting on future tragedies?

In interviews with TheWrap, representatives from Dow Jones and CNBC spoke of prediction markets as providing a wisdom-of-the-crowds perspective that can be valuable in covering the news. Such metrics offer another tool for journalists to provide insight and analysis to consumers.

With billions of dollars already flowing through Kalshi and Polymarket, the newsrooms are aiming to capture up-to-the-second public sentiment, even if its a self-selecting group of traders.

But in establishing formal partnerships, news organizations are aligning with platforms in which anonymous users not only profit off the news, but possibly manipulate it. While it’s suspected someone with advance notice of the Venezuela raid cashed in, even more mundane political events are being perceived through the lens of betting. When White House Press Secretary Karoline Leavitt abruptly ended a briefing last week just shy of the 65-minute mark, it sparked an outcry among traders given the 98% odds she’d go over. With just a 2% chance, someone betting she’d stop stood to make 50X their bet. (For example, a $1,000 bet nets $50,000.)

Politicians have a love-hate relationship with prediction markets — particularly when it comes to their campaigns. At a time in which the country is torn apart by Donald Trump’s immigration crackdown, with seemingly unaccountable masked agents roaming the streets of American cities, one can wager on Kalshi as to whether the president will invoke the Insurrection Act before March 2026.

Odds are at 40%.

With sportsbooks, the house sets the odds and users bet against it. On Polymarket and Kalshi, users buy yes-or-no contracts tied to outcomes of events — whether political, cultural or sports-related — and are essentially betting against one another, which means they fall under different kinds of rules. Both Kalshi and the crypto-based Polymarket are now federally regulated under the Commodity Futures Trading Commission.

Shayne Coplan, the 29-year-old college dropout who founded Polymarket, said in November the company is valued at $9 billion. Last month, Kalshi, founded by 29-year-old MIT grads Tarek Mansour and Luana Lopes Lara, announced a $1 billion funding round at valuation of $11 billion. The companies also share ties to Donald Trump Jr., who was an adviser to Kalshi before later joining Polymarket’s board.

On both platforms the odds of a candidate winning an election, or a country launching a military strike, fluctuate alongside the news. For instance, when Democratic California gubernatorial contender Katie Porter’s behind-the-scenes behavior was exposed in a couple viral videos last fall, her odds of winning the race plummeted on Kalshi from 40% to 18%; she’s now at 5%.

Not sure I’ve ever seen anyone potentially annihilate their gov chances as fast as Katie Porter did this week. With her snappings heard round the world, her chances to be the next gov of CA have tumbled from 40% to under 20% per Kalshi. Google searches for her are up 10,000%. pic.twitter.com/XYk5lO0jgu

— (((Harry Enten))) (@ForecasterEnten) October 10, 2025

And one major news event can influence how traders see the likelihood of another.

CNN chief data analyst Harry Enten cited Kalshi data last week when discussing shifting perceptions about whether the United States under Trump will buy Greenland by the end of his term, with the odds on Kalshi shooting up from 12% before the Venezuela raid to 36% after it.

Enten said Kalshi traders — “the people who are putting their money where their mouth is” — are taking the president’s pronouncements about Greenland seriously. The CNN analyst’s reference to people with skin in the game is one of its main selling points for prediction-market odds being treated as a useful measure of public opinion.

And as Enten spoke, Kalshi odds ran along the bottom of the screen. The odds at the time were 19% chance that Attorney General Pam Bondi would be the first Trump cabinet official to leave; Defense Secretary Pete Hegseth was at 13%.

As for the chances Vice President JD Vance will be the next U.S. presidential election winner? 28%.

“Wisdom from the crowds”

Even prior to formally partnering with Polymarket last week, reporters at Dow Jones were already citing the platform’s odds in news stories, according to Nolly Evans, the general manager of WSJ Digital and head of business development and partnerships at Dow Jones.

But as part the deal, journalists at Dow Jones publications — the Wall Street Journal, Barron’s, MarketWatch and Investor’s Business Daily — can more easily access data to analyze where money is moving and use real-time information to build charts and graphics. There are also plans to launch modules for consumers where Polymarket odds on company earnings, for example, would appear alongside more traditional Wall Street analyst estimates.

“We liked the data that [Polymarket] had and also the strategic direction of the company being more focused on finance and geopolitics than, say, just sports betting,” Evans told TheWrap.

CNBC Editor-in-Chief David Cho similarly framed prediction-market data as another tool in a journalist’s toolbox. “From my perspective, you’re pulling out wisdom from the crowds,” he told TheWrap after the deal was announced last month. “It is not the definitive word, but it’s another great data point for us to check, especially on some things that don’t have that kind of data point.”

For instance, there are odds on Kalshi and Polymarket around who might be the next Fed chair, but it’s not a question you’re likely to see showing up in polls given there’s a subset of people closely following it (that small pool, conversely, is why it could also be ripe for manipulation). In addition, rigorous polling on an event might not be available for a day or several later. But one could see how the expectations of Joe Biden winning the 2024 election dropped in real-time on Polymarket even before his disastrous debate with Trump was over.

“I think you’ve got to take it for what it is,” Cho said. “It’s not absolutely correct, it’s what the crowds think. But that’s interesting, that kind of data point.”

Journalists can also spot “unusual betting patterns,” he said, and consider if a single investor, or whale, is buying up contracts to try and shape the odds. “The data’s useful, but with all things new, I trust this newsroom to figure things out as we go on,” he said.

BREAKING: Zohran Mamdani references his Kalshi odds on stage Kalshi is mainstream. pic.twitter.com/hLCzqLL7G2

— Kalshi (@Kalshi) October 27, 2025

Dow Jones and Polymarket have not disclosed the precise terms of their partnership, and neither commented on them for this article. A source familiar with the matter said Kalshi pays CNN and CNBC a part of their agreements, though the terms are not public.

A Kalshi spokesperson declined to comment. A CNBC spokesperson said the company has a multi-year commercial relationship with Kalshi around advertising and customer acquisition.

A CNN spokesperson declined to comment on terms, though said in a statement to TheWrap: “The data featured through our partnership with Kalshi is just one of many sources used to provide context around the stories or topics we are covering and has no impact on editorial judgment.”

When asked if there were concerns about bets from someone with advance knowledge of an event, Evans noted that “insider trading happens in stocks,” but “that doesn’t mean we don’t report on equities and we are [not] involved in any direct trading.”

“In our view, if the billions being traded already shows a genuine consumer interest from our audience, we [see] the potential that this will become a new asset class for managing risk on the professional side,” Evans said.

“I think what we look at is the actual data behind it, the efficacy of it, and how predictive is it vis-a-vis other methods?” Evans added. I don’t think it replaces polling. I don’t think it replaces Wall Street estimates. We see it as just another data point to inform you.”

Scrutiny on Capitol Hill

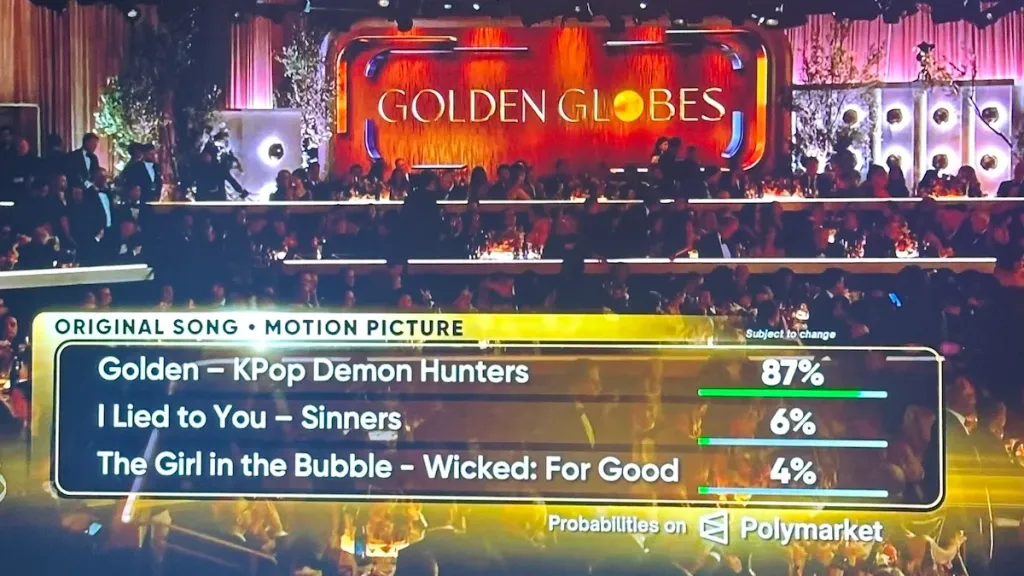

The Golden Globes faced criticism this week for on-air tie-ins with Polymarket, but news organizations arguably have more to lose in tying their journalistic reputations to companies drawing controversy over opaque bets and facing heightened Congressional scrutiny.

Rep. Ritchie Torres (D-New York) wrote Thursday in the Washington Post that the Maduro “transaction bore the hallmarks of insider trading,” and as for Leavitt’s exit, “whether coincidental or not, the episode underscored just how potentially vulnerable official government proceedings are to being parlayed into opportunities for profit.”

Torres introduced legislation last week, he said, that “would prohibit employees and elected officials in both Congress and the executive branch from buying or selling prediction market contracts tied to government action.”

For the average Joe, Polymarket and Kalshi are compelling platforms, and especially for news junkies who may simply want to watch shifting sentiment through the day or, perhaps, wager on who might be the the Democratic Senate nominee in Texas, if Russian and Ukraine agree to a ceasefire or — already! — who’ll win the 2028 election.

Politicians are keeping tabs, too: “Predictive markets are with us! Holding strong on @Kalshi,” Rep. Eric Swalwell (D-Calif.) wrote last month on X about his odds of being California’s next governor.

Predictive markets are with us! Holding strong on @Kalshi pic.twitter.com/w8NsbhnARL

— Eric Swalwell (@ericswalwell) December 19, 2025

Mansour responded, “Campaigns are increasingly using prediction markets to inform strategy. We saw it with Trump and Mamdani. Expect to see more of this in 2026.”

Kalshi and Polymarket declined to make Mansour and Coplan, respectively, available for interviews.

A “60 Minutes” profile on Coplan in November provided a good sense of where he’s coming from. He described Polymarket as “the most accurate thing we have as mankind right now, until someone else creates some sort of a super crystal ball.”

Correspondent Anderson Cooper mentioned at the time of their interview, in October, that more than $3.6 million had already been wagered on whether Maduro would be out of power by the end of 2025 — that, of course, would be a losing bet as Maduro was out on Jan. 3.

“If something is being discussed in the news, if something is of importance, whether it’s geopolitically, you know, macroeconomically, culturally, we want to have a Polymarket for it,” Coplan said.

In December, Mansour spoke about his long-term vision “to financialize everything and create a tradable asset out of any difference of opinion.” Such pronouncements have set off alarms in the media — “The Most Terrible Sentence Ever Uttered” was Noah Rothman’s take at National Review.

Sen. Murphy also noted Mansour’s December remarks in his Wednesday thread on X, along with how sports betting odds have become ubiquitous in coverage of sports and his concerns for news.

“CNN has a lucrative partnership with Kalshi, but it’s wildly corrupt,” Murphy wrote, as “news coverage starts to be influenced by betting markets and vice versa. Facts be damned.”

The post Inside Media’s Risky Bet on Explosive Prediction Markets | Analysis appeared first on TheWrap.