What does the world’s biggest asset manager that just raised the most capital in a single year in company history do as an encore? Raise more money, of course.

BlackRock now runs $14 trillion, thanks to nearly $700 billion in net cash that flowed into its investment products last year, according to financial results released Thursday. The manager’s iShares ETF franchise alone brought in $181 billion in net new money in the fourth quarter of 2025, a record for the division.

“It’s not the biggest are getting bigger — it’s the best are getting bigger,” boasted CFO Martin Small on the company’s earnings call Thursday.

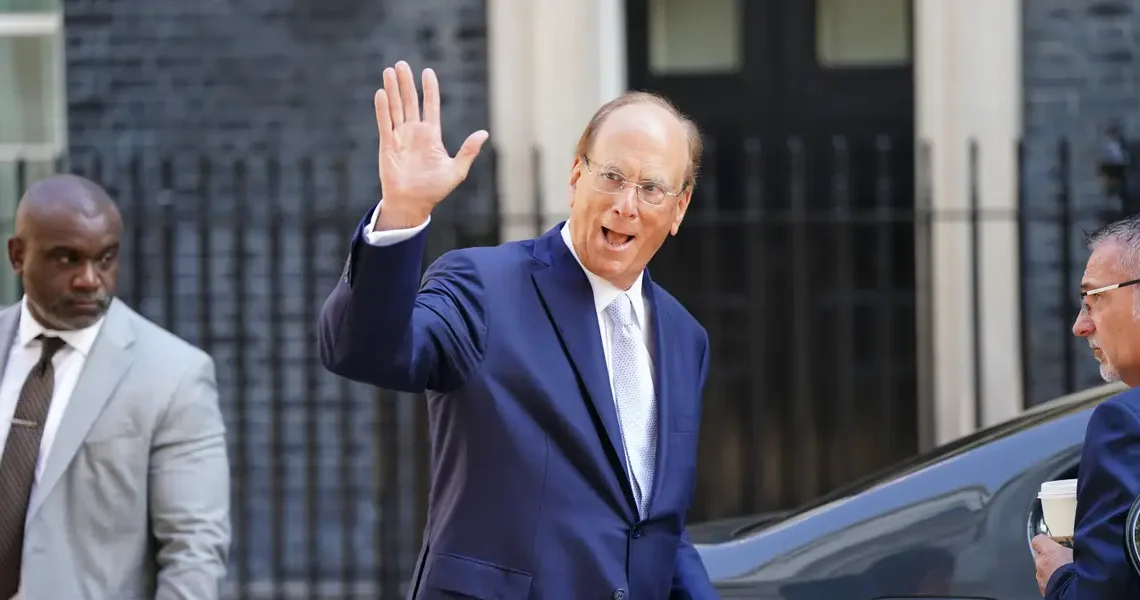

To maintain the pace, CEO Larry Fink and his team outlined the firm’s “ambitious 2026 fundraising plan,” which will focus on a range of products, including private markets, target-date funds, active ETFs, and international retirement savers.

Private investment vehicles have been a focus for Fink for years, and 2026 will be the first full year with private-credit player HPS, infrastructure investor GIP, and private-market-data provider Preqin all under the BlackRock umbrella after their acquisitions in recent years.

The firm’s goal for new private market assets is $400 billion by 2030, and one key client group for the firm is insurance companies, Fink said. The manager is currently in “late-stage conversations” with close to 20 insurers about a range of private market offerings.

But the firm’s private market strategy extends down to retail and retirement savers. The manager plans to launch the first target-date fund with private market exposure later this year, Fink said, and the industry is watching the Department of Labor to see if private assets will be allowed in 401(k) plans, as many asset managers have hoped for over the years.

Fink said the firm’s sales and distribution team, which he called the largest in the industry, is getting HPS products in front of financial advisors at wirehouses such as Morgan Stanley and Merrill Lynch.

“The opportunity ahead is inspiring,” Short said.

BlackRock also sees plenty of room to grow internationally.

Fink and his executive team mentioned Asia, the Middle East, and Latin America as places that were once “exporters of capital” but are now building their own capital markets and investing.

Fink highlighted the firm’s direct-to-consumer retirement offering in India and pension funds and insurers in Japan as examples of international opportunities from individual savers to institutions for BlackRock to scoop up assets.

“BlackRock is going to grow as long as the world’s capital markets grow,” Fink said.

And while the firm has certainly moved beyond its roots as a fixed-income specialist, Fink highlighted the growth of BlackRock’s bond investment products, including the active ETF managed by Rick Rieder, the firm’s chief investment officer of global fixed income, which trades under the ticker BINC.

For 2025, fixed-income ETFs attracted $159 billion in net new money, only $9 billion less than core equity offerings, despite stock funds managing significantly more capital.

“We’re positioned ahead for new, great opportunities,” Fink said.

Read the original article on Business Insider

The post BlackRock is now $14 trillion after a record-breaking year. The firm has an ambitious fundraising plan for 2026. appeared first on Business Insider.