The multi-billion-dollar war over the legendary media company Warner Bros. Discovery may, unexpectedly, come down to how much the old, dying cable business called Discovery Global is actually worth.

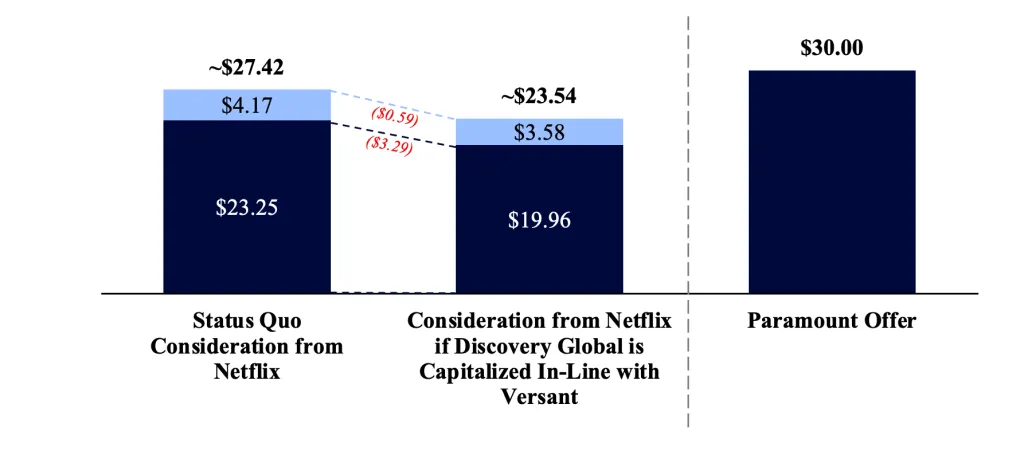

Paramount CEO David Ellison argues that Discovery Global — made up of cable networks like CNN, TBS, Food Network and HGTV — is worth somewhere between nothing and 50 cents per share. Warner Bros. Discovery’s board disagrees, pegging it closer to $3 to $5 per share, based on estimates from some Wall Street analysts.

Who is right? Financial analysts who spoke to TheWrap lean towards Warner’s calculation, arguing that Discovery Global holds more equity value than Paramount is letting on. That’s especially the case if the company is sold outright or in pieces following its separation in the third quarter.

“The upper level would possibly be a scenario where it is acquired that gives it credit for some cost synergies,” Seaport Research’s David Joyce, whose estimate mirrors the board’s range of $3 to $5 per share, told TheWrap. “The Paramount bid is ‘talking their book’ and not giving credit to the fact that between now and when Discovery Global might be spun off, that entity is generating cash to pay down debt. Even if it doesn’t get spun, it would be de-levering.”

The valuation and the total debt the spinoff carries play critical roles in calculating the difference between the two offers. Paramount is suing to obtain that information in an effort to help rally shareholder support for its tender offer, but believes it will ultimately trade at a discount to the Comcast cable network spinoff Versant.

Paramount’s $30 per share bid is backed by Oracle co-founder Larry Ellison’s irrevocable personal guarantee towards $40.4 billion of the equity financing, and $55 billion in debt financing from Bank of America, Citigroup and Apollo Global Management. Its other equity partners include RedBird Capital Partners and three Middle Eastern sovereign wealth funds.

Meanwhile, Netflix’s offer is $23.25 per share in cash and a target of $4.50 in stock, subject to a collar. As Netflix stock has fallen below the collar, the streamer is also considering shifting its offer to a simpler all-cash deal.

{ “symbols”: [[“NASDAQ:NFLX|3M”]], “width”: “100%”, “height”: “400”, “locale”: “en”, “colorTheme”: “light”, “isTransparent”: false, “showChart”: true, “scalePosition”: “right”, “scaleMode”: “Normal” }

The upside comes from what shareholders would get as an owner of shares in the Discovery Global spinoff, and none of the analysts agreed with Paramount’s math.

“You can get to a near-zero equity value for the cable business, but only under a fairly punitive set of assumptions. It’s not an objective fact. Calling it ‘zero’ is more a negotiating position than a settled valuation conclusion,” Qualia Legacy Advisors managing director Aaron Meyerson said. “Paramount’s approach is directionally understandable — they’re valuing the cable business as a shrinking, highly levered cash-flow stream rather than a growth asset. Where reasonable people differ is whether that implies de minimis equity or just a very low multiple with some residual value.”

Morningstar Research analyst Matthew Dolgin, who values Discovery Global at $2.50 to $3 per share, argued that Ellison’s estimate for its 2026 EBITDA (earnings before interest, taxes, depreciation and amortization) is too low and that any reliance on Versant’s multiple during its Nasdaq debut is “misguided.” But he still believes Paramount’s offer is stronger than Netflix as the two bids stand, partly because of the volatility of Netflix shares and the x-factor of Discovery Global.

Ellison’s Discovery Global math

Paramount pegs the value of the Netflix deal at $27.40 per share as of Monday’s lawsuit, down from a previous estimate of $27.42 per share.

Ellison put Discovery Global’s total enterprise value at $14.7 billion, with estimated debt of $15.1 billion and 2.6 billion outstanding shares. The company’s math factors an EBITDA multiple of 3.8x, based on Versant’s trading multiple on Jan. 7, and $3.9 billion in 2026 EBITDA, based on Wall Street consensus estimates.

He said that multiple gives Discovery Global a “fundamental value” of zero, though it leaves room for the “theoretical possibility that Discovery Global could trade with up to ~$0.50 per share of embedded M&A option value.”

Paramount expects Discovery Global to ultimately trade at a discount to Versant, arguing it will likely be “significantly more leveraged” and have a “less attractive portfolio.”

Versant stock has fallen over 20% since its Nasdaq debut, closing at $33 per share on Wednesday, though much of the initial volatility has been attributed to forced selling from index funds rebalancing their portfolios.

{ “symbols”: [[“NASDAQ:VSNT|3M”]], “width”: “100%”, “height”: “400”, “locale”: “en”, “colorTheme”: “light”, “isTransparent”: false, “showChart”: true, “scalePosition”: “right”, “scaleMode”: “Normal” }

Ellison vs. WBD

Ellison’s lawsuit accuses WBD of failing to disclose the valuation and debt of Discovery Global as well as the mechanism for a “purchase price reduction” in the Netflix deal tied to Discovery Global’s debt – deficiencies that it says “deprive stockholders of the ability to evaluate the real risk of a decrease in financial consideration or meaningfully compare Netflix’s offer to Paramount’s all-cash offer.”

Ellison argued that it is “implausible” that investment banks Allen & Co., Evercore and J.P. Morgan did not provide the board with a valuation and accused WBD of withholding it, “presumably because the stub has minimal positive value, if not a net negative value on the total company.” Additionally, it said that the board’s “effort to deflect by referencing analyst valuations is a breach of its duty of disclosure to stockholders.”

In addition to the lawsuit, Ellison is threatening a proxy battle aimed at replacing WBD’s board of directors with its own slate of candidates to engage further with its offer. Paramount would also propose an amendment to Warner’s bylaws that would require shareholder approval of the Discovery Global spinoff.

Warner Bros. Discovery said Paramount is “seeking to distract with a meritless lawsuit and attacks on a board that has delivered an unprecedented amount of shareholder value.”

“Despite six weeks and just as many press releases from Paramount Skydance, it has yet to raise the price or address the numerous and obvious deficiencies of its offer,” a spokesperson previously told TheWrap. “In spite of its multiple opportunities, Paramount Skydance continues to propose a transaction that our board unanimously concluded is not superior to the merger agreement with Netflix.”

In its latest SEC filing, WBD pushed back against Paramount’s claim about a purchase price reduction, calling it “misleading.”

“The debt allocation mechanism in the Netflix Merger is advantageous to WBD and provides it with flexibility to optimize the capital structure of Discovery Global,” the company said. “PSKY’s assertion ignores the fact that any such reduction in the debt allocated to Discovery Global is entirely at WBD’s discretion and also increases the value of the Discovery Global business, which would benefit WBD stockholders.“

While the board has not disclosed its own internal valuation for Discovery Global or how much debt is being placed on the company, it said the capital structure includes debt that has a long maturity period and low interest rate without “restrictive operating covenants” that position it to “further enhance” the equity value for shareholders. Additionally, the board argued that Discovery Global has greater scale and profits than Versant, touting a global reach across 200 countries and territories.

In a new court filing on Wednesday, Warner said it would provide “additional disclosure about the value offered by the transaction and full summaries of the work of WBD’s financial advisors, along with their fairness opinions.” WBD called Paramount’s motion for an expedited proceeding “premature” and an “exercise in urgency theatre — ringing a fire alarm in the absence of any flames or even smoke,” arguing it should be deferred pending the filing of the Netflix merger’s proxy statement.

Shareholders are expected to vote on the deal in late spring or early summer. Paramount’s tender offer is set to expire on Jan. 21 at 5 p.m. ET, barring no further extension.

Discovery Global’s M&A prospects

Ultimately, Discovery Global’s value won’t be set by its business fundamentals, but by what it fetches in the open market. And there are interested parties.

Per WBD’s prior filing, “Company C,” which TheWrap previously reported was Starz, submitted a $25 billion cash bid for Discovery Global and its 20% stake in Warner Bros. Additionally, “Company B,” which is described as a private holding company and global investment firm, also signed a non-disclosure agreement and expressed interest in a deal involving Discovery Global. At the time of the auction, both potential deals were determined to be “not actionable.”

Lightshed Partners analyst Rich Greenfield believes that Discovery Global will be sold or broken up after it’s spun out, which would unlock “significant value that far exceeds where the stock would trade as a standalone public company.”

He speculated that Nexstar, which has a minority stake in Food Network, could be a potential buyer. He also said there could be an auction with multiple buyers divvying up assets such as CNN, TNT Sports and Discovery Global’s international free-to-air and sports cable networks at multiples “far above 4-5x EBITDA.”

The Financial Times also reported in December that a WBD shareholder approached private equity firm Standard General about acquiring or investing in the company’s cable networks.

Greenfield believes that the Versant comparison to Discovery Global is a “false equivalence” and pointed to one clear route for Paramount to take if it ultimately wants to thwart Netflix.

“For Paramount to win, it not only needs to raise its bid substantially above $30/share, it also needs to change the composition of its bid to absorb the billions of costs associated with abandoning the Netflix bid and shift the financing from mostly debt to mostly cash,” Greenfield said. “Not to mention, the far larger amount of cash needed would have to come from sources that do not create potential regulatory risks.”

For now, Ellison is holding firm at $30 per share. But with its tender offer and a proxy battle facing difficult odds and the prospect of a revised all-cash bid from Netflix, it remains to be seen whether they can rally enough shareholder support or if they’ll have to sweeten the deal to bring WBD back to the negotiating table.

The post Paramount and Netflix Bidding War: How Much Is Warner’s Cable Business Really Worth? appeared first on TheWrap.