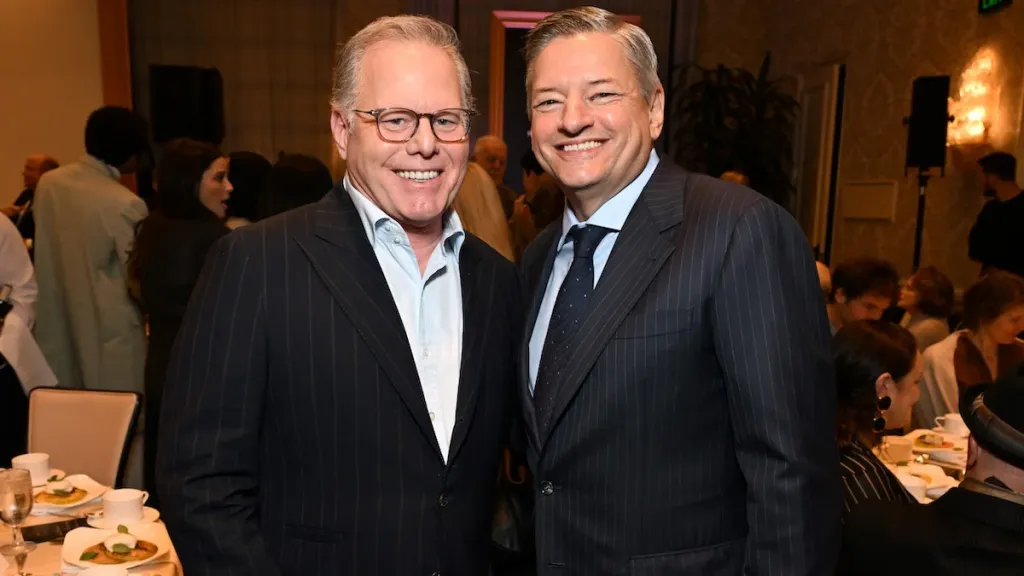

Even after eight rejections, Paramount CEO David Ellison remains undeterred in his mission to buy Warner Bros. Discovery. That obstinacy will lead to a lot of pain for all parties involved as the executive is taking his war with Netflix and WBD’s board to court.

Ellison filed a lawsuit in the Delaware Court of Chancery on Monday in an effort to extract more information about the Netflix deal’s terms and math behind its value, and is threatening to replace Warner’s board outright through a proxy battle. The plan? The Paramount Skydance CEO will try to sway shareholders to install a new slate of directors and make changes to the company’s corporate bylaws, arguing the current board is not acting in the company’s best interest by going with Netflix.

But similar to Paramount’s tender offer, which only garnered 400,000 shares as of Dec. 19 ahead of a Jan. 21 deadline, the nuclear option of a drawn-out legal challenge and proxy battle is a difficult one, experts told TheWrap.

“It’s a very hard case to prove the board has been shirking or falling short in their fiduciary duties to get the best possible value for the Warner Brothers Discovery shareholders. Dollars is their primary objective in this exercise,” Corey Martin, managing partner of Granderson Des Rochers LLP’s entertainment finance practice, said. “Without Paramount increasing their offer, there’s no incentive for the shareholders to vote for the Paramount slate. It all boils down to money and if they want this company, they’re gonna have to blow the Netflix bid out of the water.”

The move is just the latest wrinkle in the increasingly complicated saga of the Warner Bros. M&A race. While Paramount is hoping to find a weakness in the Netflix offer, experts say the lawsuit has a low chance of success and would only add further complications and delays to what is expected to be a protracted approval process. Shareholders are largely looking for a higher bid, which Paramount doesn’t seem willing to make as they’ve reiterated their “superior” $30-per-share offer in their flurry of press releases over the last few weeks.

Emarketer senior analyst Ross Benes told TheWrap that Ellison’s lawsuit comes off as “a desperate attempt by a company that didn’t get its way,” but warned that Paramount will “use all avenues available to press WBD into submitting to their will.”

“It’s unlikely the lawsuit alone will reverse the deal to be in Paramount’s favor,” Benes added. “But it is part of a broader strategy to keep pressing until something gives and then seizing on that opportunity.”

Family precedent

Ellison’s decision to take to the courtroom to get a deal done runs in the family. His father, Oracle shareholder and the second-wealthiest man on the planet Larry Ellison, didn’t hesitate to sue PeopleSoft back in 2003 in the midst of his hostile bid for the enterprise software maker, which had already struck a deal to merge with J.D. Edwards. Ellison was victorious after a lengthy legal battle, which included a lawsuit by the Justice Department, and ultimately acquired PeopleSoft.

On paper, the situations look similar. But Paramount is in a far weaker financial position than Netflix, which even after volatility in its stock price is still worth more than $400 billion vs. Paramount’s $13 billion.

“Netflix has superior cash flow and a superior balance sheet,” Stephen Henriques, a senior research fellow at Yale School of Management’s Chief Executive Leadership Institute, told TheWrap. “Paramount will be stuck with a debt burden that’s going to take years, if not a decade, to pay off.”

While acknowledging the difficult odds, Braden Perry, a regulatory and government investigations attorney, told TheWrap that the litigation could create leverage for Paramount by stripping away some board protections, such as confidentiality and deference, or even trigger additional negotiations. Martin said the lawsuit may be simply aimed at getting the additional information it needs to submit a high enough bid to beat Netflix, or it could just be adding another roadblock in the approval process of the $83 billion deal.

“It’s a high bar, but they don’t need an outright win. They just need to slow the process and extract information and leverage to cause a reevaluation,” Perry explained. “But generally, courts are hesitant to interfere with arms-length deals, unless there are clear fiduciary breaches. Most likely, this will delay and potentially revise the transaction, and perhaps, through discovery, identify some leverage.”

Meanwhile, a vote to replace the board would typically be held at Warner’s 2026 annual meeting, which has not set a date, though a threshold of just 20% of shareholders who have held the stock for at least a year are needed in order to call a special meeting before then.

CELI CEO Jeffrey Sonnenfeld argued that Ellison’s odds of winning a proxy battle are “unlikely” and that their efforts are “not going to make a difference” without raising its bid above $30 per share. Despite its regulatory hurdles, Sonnenfeld and Henriques told TheWrap the Netflix deal as it stands is ultimately a better long-term opportunity for shareholders than Paramount.

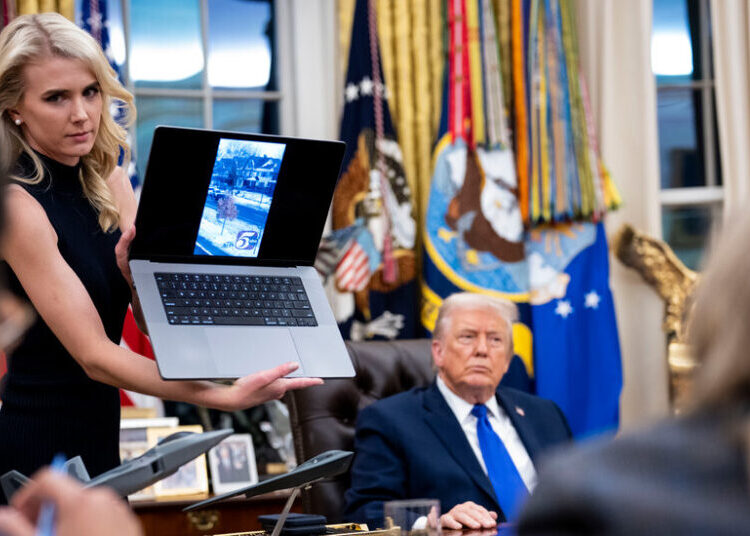

“There’s no evidence that [shareholders] have confidence that the Paramount deal would be a smooth transaction as Ellison is arguing it would be. Basically, [the Ellisons are] overplaying their hand as Trump allies,” Sonnenfeld told TheWrap. “This debt load is problematic, it’s already classified as junk. So this is going to be pretty hard.”

Down to the shareholders

Warner Bros. Discovery blasted Paramount’s move on Monday, arguing it is “seeking to distract with a meritless lawsuit and attacks on a board that has delivered an unprecedented amount of shareholder value.”

“Despite six weeks and just as many press releases from Paramount Skydance, it has yet to raise the price or address the numerous and obvious deficiencies of its offer,” a spokesperson told TheWrap. “In spite of its multiple opportunities, Paramount Skydance continues to propose a transaction that our board unanimously concluded is not superior to the merger agreement with Netflix.”

Even with an irrevocable personal guarantee from Larry Ellison, WBD has pointed to the fact that abandoning its deal with Netflix in favor of Paramount could result in $4.7 billion, or $1.79 per share, in total costs. It also warned that Paramount’s $55 billion in debt financing heightens the risk that the deal could fail to close and cited other operating and debt refinancing restrictions that could damage WBD’s business.

Ultimately, without the board’s approval, Ellison’s last hope is in the hands of the shareholders, which offer a mixed bag of sentiment.

GAMCO Investors chairman Mario Gabelli told TheWrap on Monday that he still intends to tender the majority of his clients’ more than 5 million shares to Paramount and called on Netflix to simplify the structure of its bid. He also said Paramount should hold off on raising its bid until it sees how its litigation with WBD plays out.

Warner’s fifth largest shareholder Harris Associates believes that Paramount’s revised $108.4 billion bid is “not sufficient” and has called for the media company to raise the offer, while the media giant’s seventh largest shareholder Pentwater Capital Management has accused the Warner Bros. board of failing to appropriately engage with Paramount and breaching its fiduciary duty.

“We have the ability to vote for who represents us on the board of directors. We have the ability to vote for if we want the Netflix transaction or not,” Pentwater’s CEO Matt Halbower told CNBC last week. “We are a small voice, but I think it’s important for the board to at least hear our voice as the seventh largest shareholder, because I think what they’re doing is wrong. If Paramount goes away, then it is a lost opportunity.”

Warner Bros. Discovery shareholders are expected to vote on the Netflix deal in late spring or early summer. Netflix, which is engaging with regulators including the DOJ and European Commission, has said its deal would close in 12 to 18 months, while Paramount has argued that its bid would close within a year.

The Department of Justice asked for additional information in its review of Paramount’s tender offer and lawmakers on Capitol Hill have already gotten the ball rolling with a hearing evaluating the impact of a potential WBD merger on consumers and competition. A favorable ruling by the Justice Department could benefit Paramount’s regulatory approval argument.

Paul Nary, a Wharton School of Management assistant professor who specializes in M&A strategy, told TheWrap how the situation will play out is “anyone’s guess” and pegged the odds in the Paramount-Netflix case at a 50-50 toss up.

“Paramount is clearly still serious about staying in the game and pushing whatever advantage they can,” Nary said. “Most of the time, if the winner is the challenger and not the incumbent bidder, they typically have to come up with a higher price or something to make their bid more appealing. It’s rare to win without coming up and offering better terms.”

The post Paramount Goes Nuclear on Warner Bros. Discovery — and Everyone Will Feel the Pain | Analysis appeared first on TheWrap.