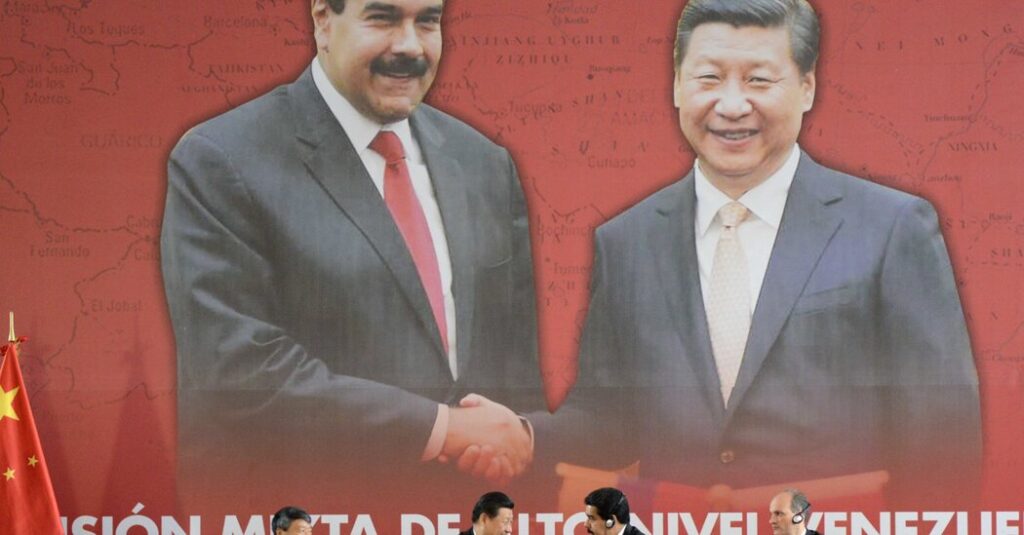

For China, President Trump’s power grab in Venezuela is a frontal attack on a longstanding source of oil, cultivated through billions of dollars in loans and years of political courtship. But Mr. Trump has also expressed a wider vision for power that involves breaking China’s economic dominance across Latin America.

His new focus — and willingness to put military force behind it — threatens to loosen China’s economic grip in a region where it has quietly used abundant trade, massive loans and financial tie-ups to build influence.

China has gone from doing nearly no business in the region two decades ago to bilateral trade worth more than $500 billion in 2024.

Chinese mining companies extract copper from Peru and lithium from Argentina. China’s agricultural conglomerates import lifeline commodities like soybeans from Brazil. Chinese utilities power entire cities. China controls much of the shipping infrastructure and the ports that transit goods across the Pacific.

Latin America’s 670 million consumers are also buying Chinese brands. In Mexico, dealerships sell gasoline-powered Chery cars and MG sedans. In Brazil, the fast-food chain Mixue sells ice cream, the e-commerce platform Meituan delivers food and the ride-hailing service Didi ferries people around. In Peru, Xiaomi smartphones are popular.

China has closely followed Mr. Trump’s comments singling out countries like Colombia, Cuba and Mexico, and it has expressed its opposition to the U.S. actions in Venezuela, saying that China’s economic relationship with the country is “protected by international law and relevant laws.”

A spokesman for China’s Commerce Ministry said this week that “China will continue to work with Latin American countries to address international vicissitudes.”

China is still owed, by one estimate, about $10 billion that Venezuela is paying off through oil shipments. In 2024, more than half of its crude exports — or 768,000 barrels — went to China, according to Kpler, a global oil monitoring service.

Washington’s new strategy “explicitly focuses on China’s influence in Latin America, which will pose certain challenges to Chinese investment,” said Tao Zhigang, a Chinese economist. This investment “faces a lot of uncertainty,” Mr. Tao told local Chinese media.

China’s pursuit of deeper ties in Latin America began two decades ago. At the time, Chinese companies were scouring the world to secure copper, oil and iron ore to power China’s breathtaking economic growth. Chinese banks extended ever-larger loans to countries across Latin America in exchange for oil and critical minerals, and along the way China began building railways and highways and selling its goods.

Since then, China has economically displaced the United States in 10 of 12 countries in South America alone, according to research by Francisco Urdinez, an associate professor of political science at the Pontifical Catholic University of Chile. China now engages in more trade, investment and development financing than the United States in most of the region, including Central America.

China is Latin America’s largest official source of aid and credit, offering an estimated $303 billion in financing across the region between 2000 and 2023, according to AidData, a research institute at the College of William and Mary in Williamsburg, Va. Between 2014 and 2023, for every $1 lent or given in aid by the United States in Latin America and the Caribbean, China provided $3, said Brad Parks, the executive director of AidData.

These investments in many cases have left the countries saddled with debt and obligations to fulfill contracts for commodities like oil.

China’s lending binge also gave its companies an advantage when they bid for government contracts to build roads, power lines and major projects like a multibillion dollar dam in the Ecuadorean jungle (which turned out to be ill-fated). Over time, China’s economic activities translated into a handful of free trade agreements and better access for Chinese companies.

Latin America swelled with a range of goods from Chinese factories, from car parts, electronic devices and appliances to equipment for satellites and space infrastructure — another area where China has invested heavily.

The region, in turn, became China’s most important source of critical minerals, including rare earths, an industry that China has near-total global control over.

“Hundreds of Chinese enterprises, and five to 10 banks from China, are on the ground in Latin America that were not active 20 years ago,” said Mr. Urdinez, the professor in Chile.

“China hasn’t replaced the U.S. hegemony, but it has eroded the leverage that Washington once had in the 1980s and 1990s,” Mr. Urdinez said.

By countless measures, China has outpaced competitors. Chinese companies are selling more cars to Mexico than any other country. Chile is the second-largest overseas destination for Chinese electric buses. Some of the trade also travels in the other direction: Nearly half of Chile’s exports now go to China.

But President Trump has signaled that he wants to curb China’s advances in the region.

Before his military raid that removed Venezuela’s president, Nicolás Maduro, and took control of the country’s oil, Mr. Trump had threatened to “take back” the Panama Canal. He accused the canal’s main port operator, the Hong Kong conglomerate CK Hutchison Holdings, of being an extension of China’s Communist Party. He called out Mexico for being a “backdoor” to the United States for Chinese goods. He has tried to use a 50 percent tariff on Brazil to secure a trade deal that limits Chinese investment in the country.

And Mr. Trump released a national security strategy last month that asserted that he would deny “competitors” from outside the Western Hemisphere the ability “to own or control strategically vital assets, in our hemisphere.”

China’s business world is on alert. A consortium of Chinese companies that is developing a major copper mine in Ecuador said this week that it would put the project on hold, citing a “volatile” political situation in the country. China and Ecuador signed a free-trade agreement in 2023. At the time, Ecuadorean officials indicated that they would have preferred to sign with the United States.

“It is normal and understandable that some Chinese companies might halt their investments after such a sudden geopolitical event,” said Cui Shoujun, director of the Research Center for Latin American Studies at Renmin University in Beijing, referring to Mr. Maduro’s capture.

Analysts said that many governments would likely turn to the United States if they were given an option to engage more deeply.

But they need funding for developmental needs that the United States, under Mr. Trump, might not be ready to address.

“Is the U.S. just worried about the defensive element of competition with China or is the U.S. going to deliver a credible offensive play?” asked Henrietta Levin, senior fellow for the Freeman Chair in China Studies at the Center for Strategic and International Studies in Washington.

“China has established such a powerful position within the economic status quo that it will be challenging for the administration to counter all of it in an effective way,” said Ms. Levin. She said the United States would need to offer a large and comprehensive aid program, like the Marshall Plan that helped to rebuild Europe after World War II.

Several big Latin American countries, including Brazil, Mexico, Chile and Colombia, have denounced Mr. Trump’s actions in Venezuela, something that Mr. Cui, the Chinese professor, said could strengthen China’s ties with these countries.

Besides, Mr. Cui added, it was impossible for China and Latin America to walk away from one another. “Who will Latin America sell its soybeans and corn to?”

Pei-Lin Wu contributed reporting.

Alexandra Stevenson is the Shanghai bureau chief for The Times, reporting on China’s economy and society.

The post Trump Is Making a Power Play in Latin America. China Is Already There. appeared first on New York Times.