The investment manager who helped scuttle one of the biggest data center acquisitions of 2025 believes that his bet against the multibillion-dollar buyout is about to pay off in the new year.

Trip Miller, the founder and managing partner of the Memphis-based investment firm Gullane Capital Partners, believes that Core Scientific, a data center developer and operator, is on the cusp of large new customer deals that will boost its value.

“I think over the next 90 days, you’ll see them announce greater than a hundred megawatts of deals,” Miller said. “It would show that there was a lot more value to be tapped there than we were getting paid for under the CoreWeave deal.”

In October, Miller, a major shareholder in Core Scientific, opposed an offer by the artificial intelligence cloud firm CoreWeave to acquire Core Scientific in a stock conversion deal that he felt undervalued the company. The purchase was originally valued at around $9 billion when it was announced in July, but fell to almost half of that when shares of CoreWeave dipped in the ensuing months. Shareholders in the firm rejected the deal in a vote on October 30 that reflected the concerns over the deal’s weakened economics.

Miller said that his expectation for the roughly 100 megawatts of near-term commitments was based on conversations he has had with knowledgeable parties outside of the company’s management. He projected that the company will find takers for a total of roughly 400 megawatts this year, citing strong demand for AI computing power.

Asked about the potential for upcoming leasing, a spokeswoman for Core Scientific said the company “does not comment on market rumors or speculation.”

The commitments, if they materialize, would show that data center developers with a runway for growth are increasingly valuable in an energy-constrained building boom.

Core Scientific has disclosed that it has about 1 gigawatt of data center capacity and another 1.5 gigawatts of power for expansion, according to an October investor presentation.

Evidence of an AI boom, not a bubble

It would also offer a competing view that the hundreds of billions of dollars being spent on data centers, computer chips, and power infrastructure are in support of a durable AI boom, not a bubble.

“We are in a situation where we’re likely to be systematically short compute —where the demand for compute will outstrip the supply,” Stephen Byrd, Morgan Stanley’s global head of thematic research and sustainability research, said.

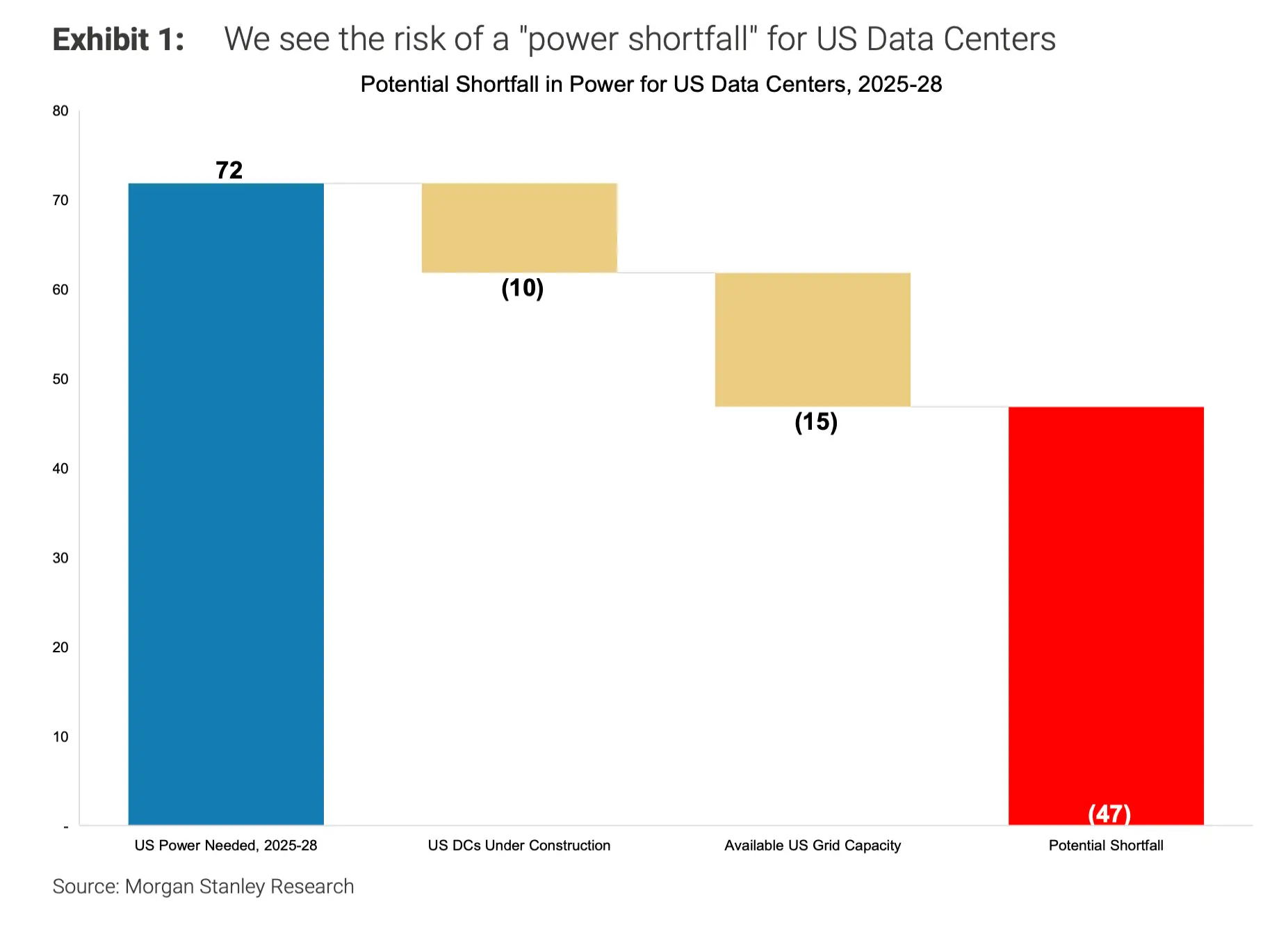

In a report published in December, Morgan Stanley suggested that one of the most significant hurdles for the AI industry will be the gargantuan loads of power required to drive its computing.

Morgan Stanley projects that data centers, the vast facilities that handle the training for large language AI models and the inference computations that put them to work in everyday applications, face a 47 gigawatt shortfall of electricity from the grid nationally by 2028 — a gap almost 10 times the size of New York City’s energy footprint on an average day.

Among the chief beneficiaries are crypto mining firms that have access to in-place power and utility contracts to light up new facilities quickly.

From Bitcoins to AI riches

Both Core Scientific and CoreWeave were former crypto mining companies before repurposing their businesses to focus on AI in recent years.

Amid the mounting shortage of power — along with headwinds in the crypto mining business — more of the industry is turning to data center computing.

Byrd said Morgan Stanley anticipates that about 12 gigawatts of mining facilities, about 60% the mining industry’s current gigawattage, will convert over to AI and high-performance computing in the next three years.

In September, Cipher Mining announced it would build a data center in Colorado City, Texas, with 168 megawatts of computing capacity that will be leased to the AI cloud company, Fluidstack. Cipher’s stock, which had been trading in August for around $5 a share, jumped as high as roughly $25 in November after the announcement.

Iren, another mining firm, announced a recent $9.7 billion AI cloud computing deal with Microsoft. Last month, Hut 8, said it had signed a deal to lease a 245-megawatt data center it is developing in Louisiana to Fluidstack.

“Our view is that crypto miners, by and large, are likely to pivot for the most part to delivering high-performance compute infrastructure solutions and services,” Paul Golding, an analyst at Macquarie who covers the crypto mining industry, said.

In July 2025, CoreWeave said it had reached an agreement to acquire Core Scientific in a stock conversion. But in the months after the announcement, CoreWeave’s shares declined and Core Scientific’s rose, effectively reducing the value of CoreWeave’s offer.

Since the deal’s collapse, shares of Core Scientific have traded as low as below $14 a share — less than the $17 per share price that the CoreWeave deal would have amounted to.

Golding covers Core Scientific and has set a $34 target for the company’s stock in October, more than double its current market price — upside that he sees stemming from its ability to tap power in a constrained utility market. That estimate is “based on a sum of the parts that evaluated potential value for the uncontracted megawatts in the portfolio, the megawatt pipeline in load study phase, and the existing co-location deal with CoreWeave,” Golding said.

CoreWeave is Core Scientific’s only data center customer, outside of legacy crypto mining facilities it operates. Core Scientific leases 590 megawatts to CoreWeave, worth roughly $10 billion in revenue over the next 12 years, according to a spokeswoman for the company. It plans to repurpose 400 megawatts of its crypto mining operations over to high-performance computing in the next three years, the spokeswoman said.

Miller said that the upcoming leases he expects Core Scientific to announce will be with new customers.

“I expect them to announce deals for AI with third parties other than CoreWeave,” Miller said.

Read the original article on Business Insider

The post The investor who blocked a $9 billion AI deal expects that bet to soon pay off appeared first on Business Insider.