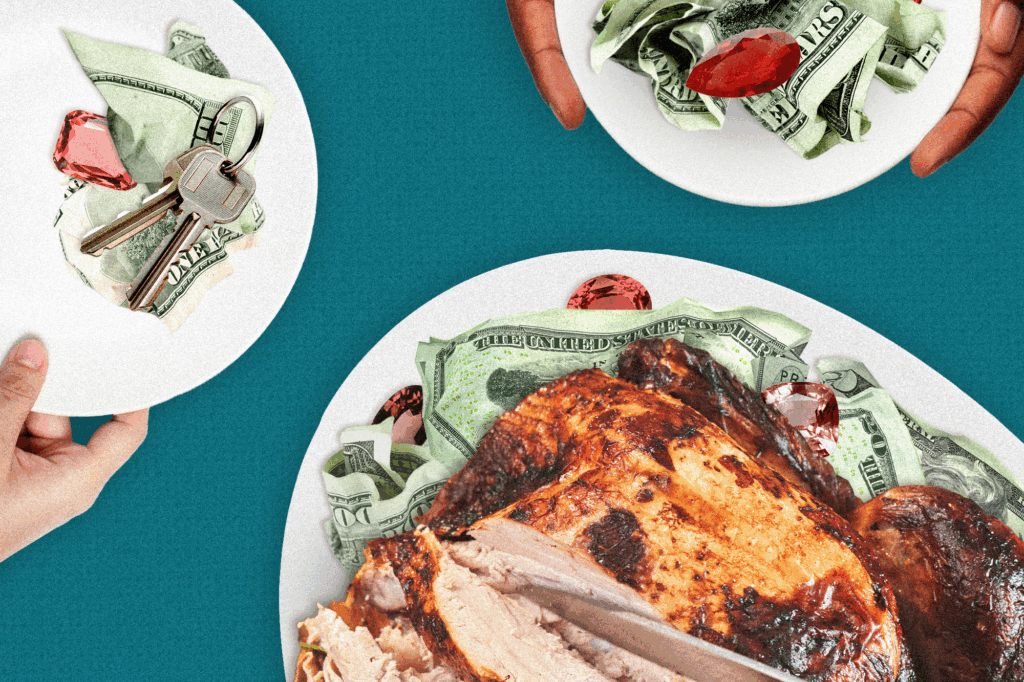

When your family gathers for Thanksgiving and everyone is settling in for post-turkey conversation, consider bringing up the “Great Wealth Transfer.”

How great? Baby boomers and older generations are projected to transfer $105 trillion to their heirs by 2048, according to a 2024 report by Cerulli Associates.

Before your eyes roll back, hear me out.

When your family gathers for Thanksgiving and everyone is settling in for post-turkey conversation, consider bringing up the “Great Wealth Transfer.”

How great? Baby boomers and older generations are projected to transfer $105 trillion to their heirs by 2048, according to a 2024 report by Cerulli Associates.

Before your eyes roll back, hear me out.

All too often, families don’t want to engage on estate planning because it raises the specter of someone you love not being there. It can be overwhelming, and some may view it as ghoulish.

But I’m all too familiar with the consequences of inaction: Some of the nastiest battles I’ve faced — both personally and within other families — come from a lack of a well-thought-out estate plan when passing on wealth.

I’ve written about the long, drawn-out court disputes after Aretha Franklin and Prince died. However, you don’t need to be famous or wealthy to plan how your assets will be distributed. The most loving thing you can do for your family is to take care of your affairs.

Still, I understand the hesitancy. To break the ice, check out one of my favorite comedy routines by the late Joe Recca. It’s from a performance he did on BET’s comedy competition “Coming to the Stage” and can be found on YouTube.

Recca starts by talking about the high cost of funerals and then shares his story of the first Thanksgiving after a cousin’s mother died. She was cremated, and his cousin placed her urn on the dinner table. No one wanted to say anything, and he marveled how she had “her mama sitting there right by the salt and pepper shaker like she’s a condiment.”

The video is a reminder that we often need a good sense of humor to deal with loss. But you know what’s not funny? Avoiding the conversation.

That’s why I was so moved by an email I received from a reader asking for advice on how to fairly divide assets among children. Both parents are in their 80s.

“We have three adult children, and one has needed far more financial assistance over the years,” he wrote. “I view that help as an advance on his inheritance. Am I correct in [calculating] … what the estate would be worth if we had not advanced money to that son? We would divide by three and subtract the present value of those advances.”

“The result, of course, is that the two adult children who were never advanced funds get much larger shares of the estate,” he concluded. “Am I being fair to all three children?”

Before I responded, I asked a few questions of my own.

To protect the family’s privacy, I’ve omitted some details and summarized the answers:

The son in question is in his 50s, earns a modest income and has struggled with some mental health issues, the father said. He and his wife purchased a second home and are renting it to their son, where he lives with his family. The rent covers the mortgage payment. Between the down payment and repairs, they’ve spent about $92,000. They’ve discussed having the son assume responsibility for the mortgage when they die. The couple used loans to pay for college for one daughter, who attended an elite university, and provided a $20,000 down payment to their other son to buy a house.

“The siblings now have a good relationship,” the father added. As for outside help, the couple has consulted an attorney, but they haven’t yet finalized an estate plan.

Here’s the advice I offered based on my experience working with individuals and couples involved in estate disputes.

First, I don’t think they need to treat their assistance to the older son as an advance on the inheritance. As parents, we often care for each child based on their specific needs, which can lead to an unequal distribution of resources to support them. In this case, the parents shouldn’t exclude the financial assistance to their other two children.

This suggestion reflects an insight I gained over years of hearing from disappointed heirs. I used to think you should do whatever you want with your money. But now I realize that many people left with less aren’t just grieving the loss of money; they’re mourning what it symbolizes — whether a tangible sign of love or a critique of their relationship with the departed.

You might be trying to decide whether to leave more money to the adult child caregiver who has done significantly more for you than your other children. Or perhaps one adult child has been very successful, and may not need the money. However, leaving less to the more financially secure children can make them feel like you didn’t appreciate their hard work. Additionally, a well-off adult child’s financial situation may change because of a job loss, divorce or serious health crisis.

Consider a parable from the Bible (Matthew 20:1-16) about a vineyard owner who hired workers at different times throughout the day; at the end, he paid them all the same full daily wage.

The workers who had been laboring since the start of the day complained. They were upset that others who arrived later, and hadn’t worked as long, were paid the same.

The parable addresses the concept of fairness and serves as a lesson against envy.

I have a son on the autism spectrum. He requires more of our attention and resources. His needs are greater than those of his sisters. However, when creating our estate plan, my husband and I haven’t adjusted for the extra financial support he has received. Our three children will inherit equal shares, with instructions to our eldest, who will manage our estate, that if her brother needs more, she should give it to him. She and her sister agree.

Distributing an inheritance equally can demonstrate to your adult children that they are equally loved and valued, regardless of their financial situation, career achievements or personal choices. If you’re concerned about an heir who is careless with money, you can establish a trust.

Ultimately, it’s your money, and you have the right to decide how to distribute your assets based on your judgment, conscience and love for your children.

However, as I told the reader, I’m not a fan of keeping a pre-death ledger. This couple has done what caring parents do: give according to each child’s needs. If one has received more, it’s not an injustice; it’s grace.

The post With estate planning, should all kids get an equal share?

appeared first on Washington Post.