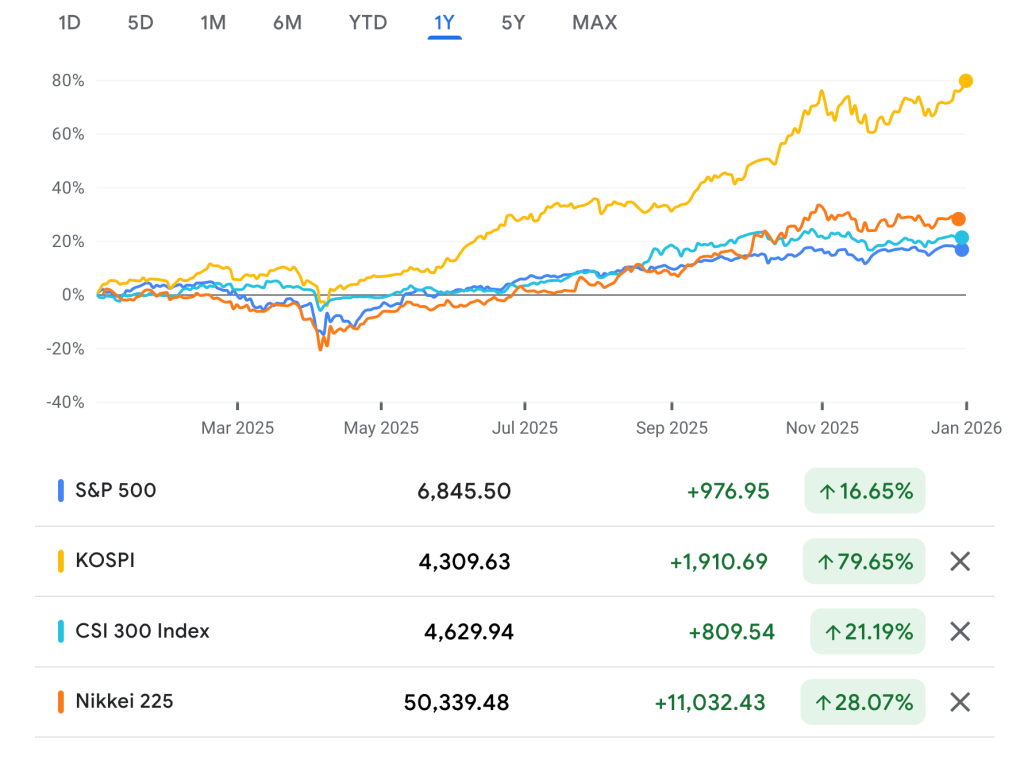

The S&P 500 rose 16.5% in 2025, and investors in U.S. equities are pretty happy about that. Futures are up 0.62% this morning as the index makes another attempt on its all-time high, 6,932, which it hit on Christmas Eve. But in comparison to other global stock indexes, the S&P didn’t do very well. This morning, British investors are celebrating the FTSE 100 surpassing 10,000 for the first time ever. The FTSE was up 21% in 2025. The S&P also performed poorly compared to Germany’s DAX (up 23%) and Spain’s IBEX 35 (up 48%)

But that’s nothing compared to South Korea. The KOSPI was up 75.6% in 2025. Elsewhere in Asia, China’s CSI 300 was up 21% and Japan’s Nikkei 225 was up 28%.

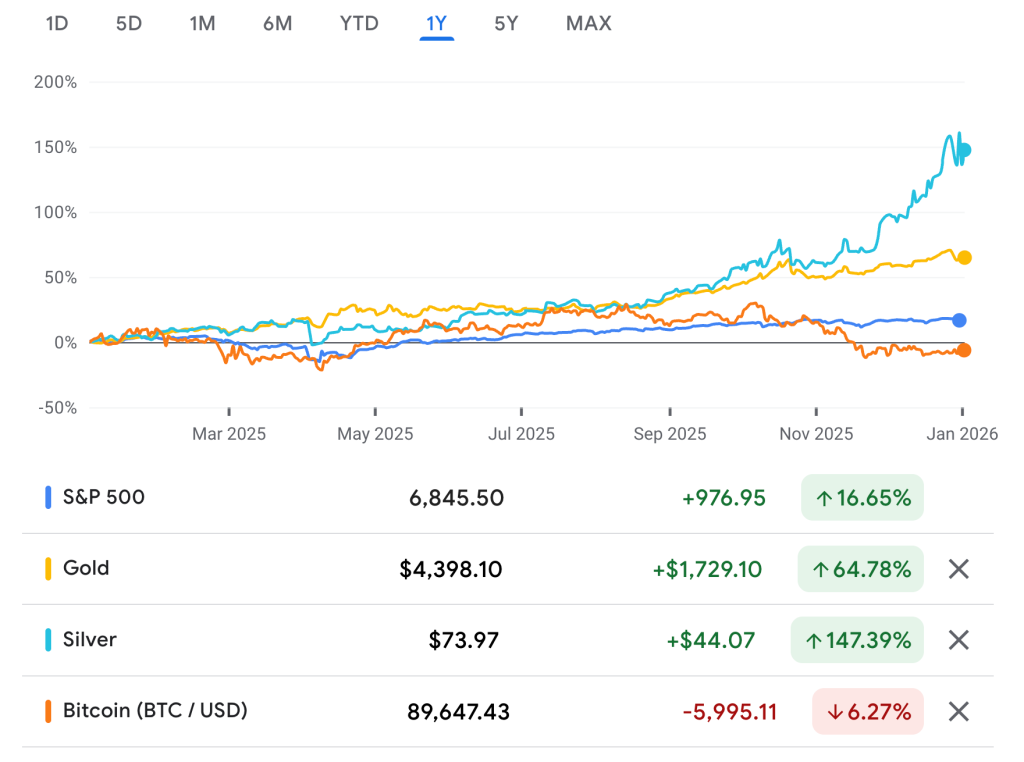

And let’s not talk about gold, which rose 65%, or silver which was up 147%. Bitcoin lost 7% over the period.

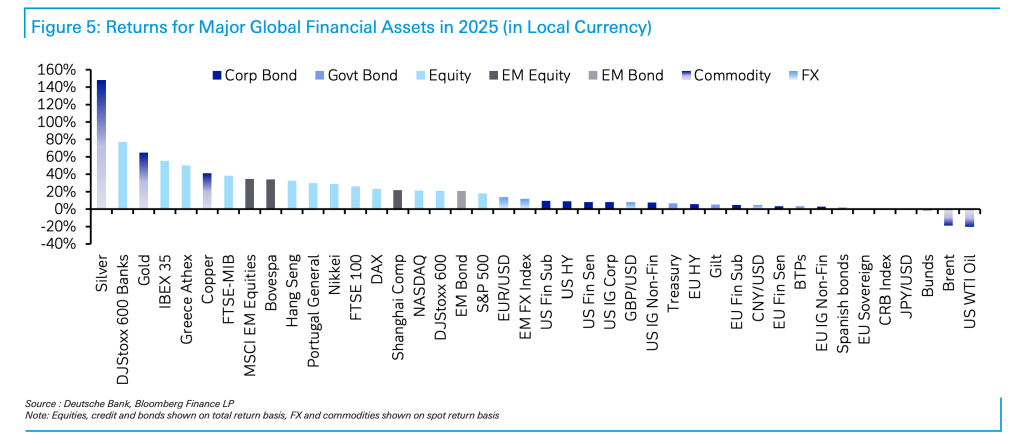

In fact, if your bets last year were “America and Bitcoin” then you came out far behind investors in foreign stocks and precious metals. Deutsche Bank published this chart showing just how mediocre, relatively speaking, the S&P was compared to other asset classes:

You could have bet on Greece last year and come our ahead of anyone in an S&P 500 index fund. The Athex Composite was up 45%.

Part of what is happening here is that investors are using non-U.S. stock markets as a hedge against the dominance of AI-related stocks in the S&P 500. The “Magnificent Seven” tech stocks have provided more than half the gains in the S&P 500 over the last three years, according to Howard Silverblatt, a senior index analyst at S&P Dow Jones Indices.

A bet on U.S. stocks is mostly a bet on a small number of tech stocks, and investors who want to balance that out thus need to go abroad. The U.K.’s FTSE for example is heavy on banks and mining companies—about as un-tech as you can get. Those hedges are likely boosting foreign markets, which are smaller and more easily moved upward by influxes of new money.

So where will the S&P go from here?

It’s anyone’s guess, of course. But here are two takes:

Ed Yardeni of Yardeni Research thinks the rally has a way to go: He is predicting the S&P will hit 7,700 by the end of this year. That would be a rise of 11%.

Adam Turnquist, chief technical strategist at LPL Financial, notes that the S&P just turned in its third straight year of 15%-plus gains. “When the index has posted at least a 15% annual price gain, next-year returns have averaged about 8%. The average max drawdown during these years has been around 14%, serving as an important reminder that even strong bull markets are not linear,” he said in an email to Fortune.

Here’s a snapshot of the markets ahead of the opening bell in New York this morning:

- S&P 500 futures were up 0.62% this morning. The last session closed down 0.74%.

- STOXX Europe 600 was up 0.63% in early trading.

- The U.K.’s FTSE 100 was up 0.61% in early trading.

- Japan’s Nikkei 225 was down 0.37%.

- China’s CSI 300 was down 0.46%.

- The South Korea KOSPI was up 2.27%.

- India’s NIFTY 50 was up 0.71%.

- Bitcoin was at $89K.

The post U.S. stocks had a terrible year (relatively speaking)—you could have bet on Greece in 2025 and come out ahead appeared first on Fortune.