This report is a partnership between WrapPRO and PitchBook, the go-to financial data and software platform that provides detailed information on private and public capital markets.

What began as a year of stasis over uncertainty about a second Trump term, with dealmakers and their money sitting on the sidelines for several months, ended as those fears fell away with media and entertainment generating one of the most robust M&A waves in recent history.

Distressed properties like local TV stations drew the interest not only of strategic buyers but of private equity, and we saw more sovereign wealth funds dipping their toes into U.S. M&A, especially those from the cash-rich Middle East.

Of course, the pursuit of Warner Bros. Discovery was the big headline of the year, a saga that still continues as of this writing. The match between Netflix’s deep pockets and disruptive ways and the scrappy tenacity of the father-and-son tandem of Larry and David Ellison at Paramount is reminiscent of an earlier time of swashbuckling bidding wars.

But WBD wasn’t the only big deal that was announced coming out of early 2025’s deep freeze. Video gaming giant Electronic Arts was taken private in a spectacular $55 billion leveraged-buyout (talk about reminiscing — LBOs return) by Saudi Arabia’s Public Investment Fund, Silver Lake and Affinity Partners. Even the late Charles Schulz’s Peanuts media empire was on the block, sold in a deal announced by Sony in December for $467 million. And while it didn’t make it into the top 10, a newspaper, yes, somebody still wants newspapers, the Dallas Morning News, was purchased this past year by Hearst for $104.5 million.

Overall, the deals announced in the media space, according to PitchBook data, as of Dec. 22, topped $107 billion for the year and for the entertainment software, publishing and media information sector, deals announced hit nearly $87 billion, both with valuations higher than in 2024.

We’ve combined both of those sectors and highlighted the big announced deals using PitchBook’s numbers in the chart below.

By most estimates, the strong finish to the year should continue into 2026.

Kyle Walters, a research analyst for private equity at PitchBook, said about M&A overall that “dealmaking conditions continue to improve. The Federal Reserve (the Fed) has already cut rates twice this year, and we could potentially see a third cut … This, paired with better market clarity related to tariff implications and over $1 trillion in PE dry powder in the U.S. alone, is beginning to align the stars for sponsors to put capital to work at scale.

“When all is said and done, 2025 will be the second consecutive year that sees YoY growth in PE deal activity. Through October, the U.S. PE ecosystem saw 7,370 deals announced or completed, worth an aggregate value of $969.8 billion. Moreover, platform LBOs account for $525.3 billion of that nearly $1 trillion dollars in deal activity—the highest value figure since the 2021 peak. Deal count is on pace for another strong year of activity and will likely surpass 2024 when including fourth-quarter figures and any late-reporting deals captured after the fact.”

And the biggest deal ever could just come together in 2026, Jeffrey Goldfarb, a columnist for Reuters BreakingViews, surmised. “It’s go big or go home for dealmakers. As of November 2025, acquisitions valued at more than $10 billion apiece were on pace to reach a new high, even as the total number of transactions tumbled. The jumbo trend, powered by abundant capital and emboldened CEOs, sets the stage to break individual price-tag records achieved a quarter-century ago by British telecom titan Vodafone and erstwhile internet pioneer America Online.”

And when it comes to mega-mergers, media and telecom have had a history of dominating those as BreakingViews shows in this chart.

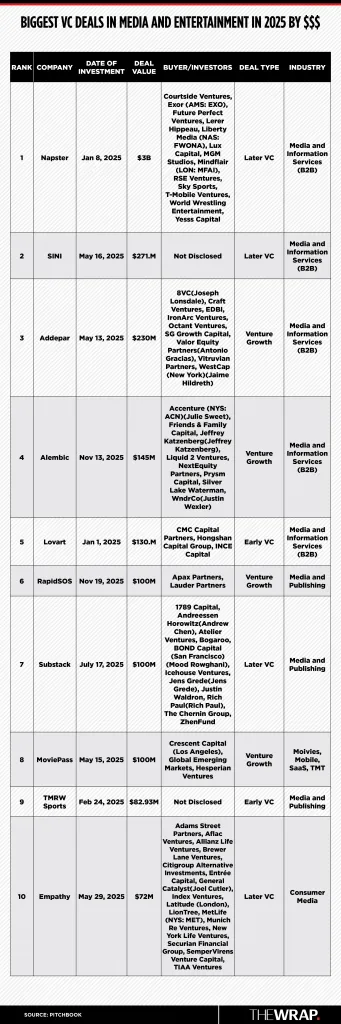

Venture capital deals

The year in media and entertainment investment raises was defined and dominated by AI, except for the anomaly January raise of a whopping almost $3 billion raise by Infinite Reality from investors that it did not disclose, according to PitchBook data. Infinite Reality, which has bought the brand name of the former Napster file sharing company, said it uses immersive technologies to offer a suite of services to brands and creators to increase audience engagement.

But as you can see by the chart below, firms like Alembic, Lovart and RapidSOS, all with artificial intelligence strategies, benefitted from sizable investment rounds in 2025.

Speaking more broadly about AI in venture capital, Kyle Stanford, director of research for venture at PitchBook, said “on the dealmaking side, AI continues to foster optimism. It was a key driver of the surge in billion-dollar funds, and the nature of the AI market has significant implications for venture. AI startups have captured 65% of the total VC deal value in the U.S. year to date, and more than half of new unicorns are AI companies. The market value of AI startups exceeds $1 trillion.”

“There is an endless stream of new AI tools being developed and adopted by corporations worldwide,” Stanford continued. “It has been challenging for large companies to develop their own AI tools, so many have turned to tools created by startups. Through the first three quarters of 2025, first-time financings were nearing the all-time high set in 2021. While this has led to a rally in the early stages of venture, it has also led to crowded vertical segments that will bifurcate into a few winners and many losers.”

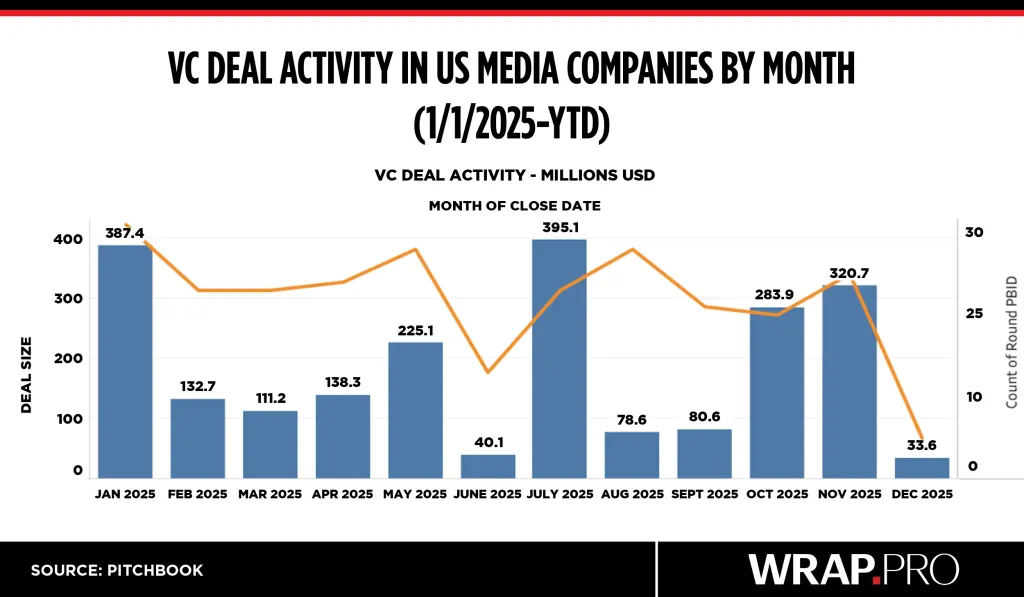

Month by month for media companies

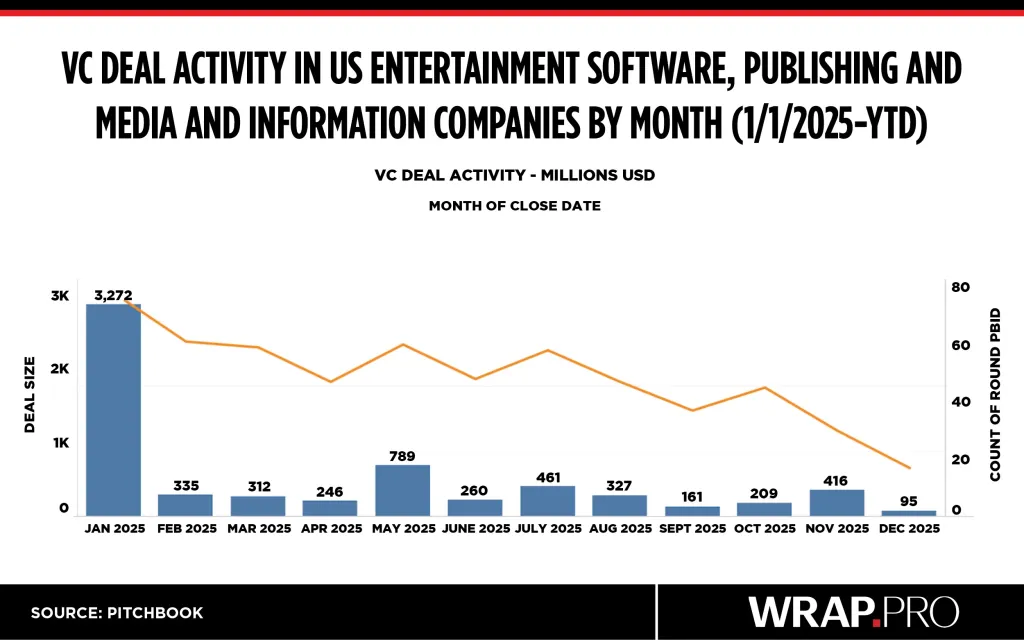

And in entertainment software, publishing, media & information companies …

The pace of investment in AI continues to increase despite the venture market’s slow liquidity and low fundraising levels, according to PitchBook, with AI dominating deal values across all designated series rounds through the third quarter (See chart below). And if liquidity should loosen up and fundraising see a pickup, PitchBook predicts deal counts in 2026 could reach levels last seen in 2020 and 2021.

The post The Funding File: The Biggest M&A and VC Deals in Media and Entertainment in 2025 appeared first on TheWrap.