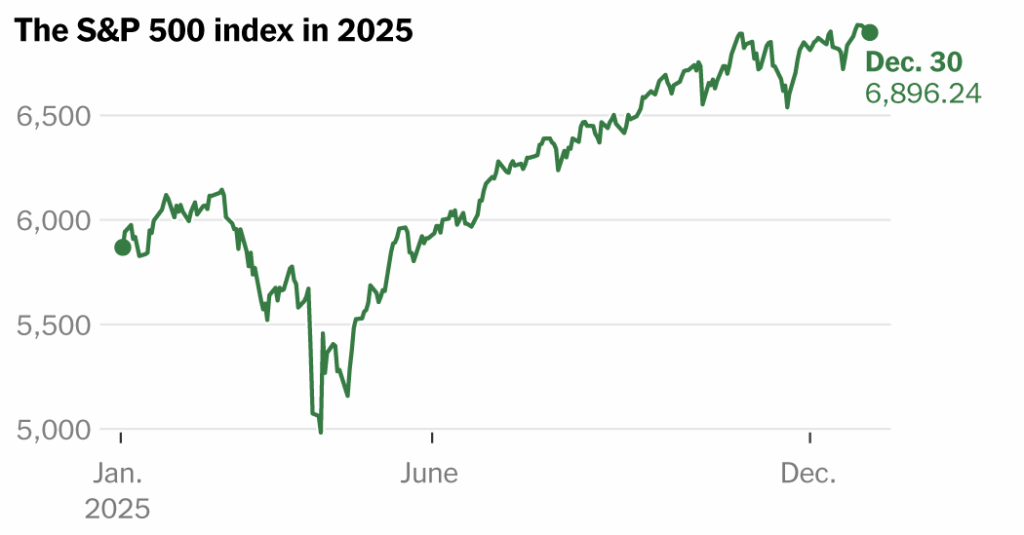

At a glance, stocks are set to end 2025 pretty much where analysts expected they would. But it’s been a bumpy ride getting there.

A year ago, analysts predicted that the market would rise steadily, economists forecast cuts to interest rates and, in the wake of President Trump’s re-election, market watchers broadly expected a business-friendly policy environment that would benefit the economy.

Twelve months on, the S&P 500 has climbed more than than 17 percent, the Federal Reserve has cut interest rates by three-quarters of a percentage point and, while there are emerging signs of weakness and intensifying concerns about the cost of living for the poorest in the country, the economy seems in OK shape.

But for investors and traders who lived and breathed the market over the past year, this was anything but a smooth and predictable journey.

In the end, the rally largely came down to one big idea: that artificial intelligence will be a generational force underpinning the stock market, because of the scale of investment needed to build the infrastructure that powers it and the technology’s expected productivity gains.

“If technology felt good, equities were on a tear,” said Cindy Beaulieu, chief investment officer for North America at the investment manager Conning. “If technology didn’t feel so good, well. …”

A Rough Start

The year started with inflation worries and the revelation that a Chinese company had developed competitive A.I. technology at far lower cost than American businesses were doing.

Then came Mr. Trump’s tariffs. Announced on April 2, an expansive suite of tariffs on dozens of countries sent stock markets plunging, with the S&P 500 sliding more than 12 percent within a week. The haphazard imposition of the tariffs and concerns that they would fuel inflation, damage corporate profits and hurt consumers left investors deeply unsettled.

The panicked reaction in the bond market pushed the administration to quickly backpedal.

The tariff delays, interest rate cuts by the Fed and the rally in technology stocks pushed the S&P 500 past previous record highs in every month from May through October.

The rally overlooked the slashing of the federal work force, threats by Mr. Trump to curtail the Fed’s independence, concerns about rising government debt, widespread deportations, and challenges to the judiciary and the balance of governmental power.

Those worries were masked by the unrelenting rise of companies at the forefront of A.I., obscuring a more modest year for other corners of the stock market. But the rally also raised concerns that investors had taken their bets too far.

“It feels quite frothy,” said Kristina Hooper, chief market strategist at Man Group. “And I do believe we are heading into a downturn. My base case is a modest recession in 2026.”

A.I.-Powered Rally

By one measure, more than 90 percent of economic growth in the first half of 2025 came from investments in computer equipment and software, which economists chalk up to projects linked to the rush to build data centers and remain in the A.I. race.

Seven of the top 10 stocks in the S&P 500 this year were lifted by the bet on artificial intelligence.

SanDisk, the digital storage company spun off from Western Digital in February, led the gains and was up over 500 percent. Its former parent company was second, rising almost 300 percent.

The top 10 also included two other digital storage companies; the large government contractor Palantir Technologies; Lam Research, which produces equipment used by semiconductor makers; and Comfort Systems, which provides the mechanical, electrical, plumbing and ventilation installation for data centers.

The other three highfliers in 2025 followed other trends: a gold miner, reflecting the sharp rally in the precious metal; the trading platform Robinhood, tracking the rise of stock trading; and Warner Bros. Discovery, the subject of a takeover battle between Netflix and Paramount.

The ‘Magnificent Seven’ Lift the Market

But those companies, despite their meteoric rise, didn’t have the biggest impact on the index. That honor went to Nvidia, Microsoft and Alphabet, part of a group of technology companies, known as the Magnificent Seven, that has driven the market higher in recent years. The seven — Microsoft, Nvidia, Alphabet, Amazon, Meta, Tesla and Apple — each with its own A.I. ambitions, together rose 25 percent for the year. Nvidia, whose semiconductors have underpinned the A.I boom, rose 36 percent. Because of their sheer size, the Mag 7’s performance can dictate the direction of the S&P 500: Consider that SanDisk’s 500 percent gain increased its market valuation to roughly $35 billion from around $6 billion. Nvidia, with a much smaller percentage gain, increased its market valuation by more than $1 trillion to around $4.5 trillion. Nvidia alone was responsible for 15 percent of the S&P 500’s total return this year, according to data from Howard Silverblatt, a senior index analyst at S&P Dow Jones Indices.

“I don’t think people fully understand what it means to have Nvidia at $4 trillion and how powerful that is,” said Thorne Perkin, president of Papamarkou Wellner Perkin, an investment manager. “For most people, including me, it’s hard to get your head around these valuations.”

What Is the Rally Hiding?

Over the past three years, the Mag 7 has been responsible for more than half of the rise in the S&P 500. Without them, the stunning 88 percent gain over that period would fall to 40 percent, according to Mr. Silverblatt.

That has helped mask weaker showings in other areas of the market, and raised concerns that investment portfolios are again dependent on the performance of just a few companies — and highly tied to sentiment on the promise of A.I.

In recent months, a tumble in some of the more speculative A.I. companies has also knocked down some of the market’s leaders. Nvidia, for example, has fallen almost 10 percent since the end of October, and as it has, the market’s rally has stalled.

Bullish investors see an opportunity as underperforming parts of the market pick up while the A.I. rally slows down. In the past month, for example, the best performing sectors in the S&P 500 have been the economically sensitive financial and industrial companies, which have underperformed the broader index over the full year.

But analysts see risks, too. These kinds of cyclical companies are much more dependent on the ebb and flow of the broader economy, which sits at a precarious junction.

Add to that the Supreme Court’s coming ruling on the legality of the administration’s tariffs, the potential for another government shutdown, the appointment of a new Fed chair, a weakening labor market and the potential for the A.I. trade to fade, and there are “some real vulnerabilities” heading into 2026, said Ms. Hooper at Man Group.

The expectation among analysts broadly remains positive. But not for Ms. Hooper. “There is a lot that can go wrong,” she said.

Joe Rennison writes about financial markets, a beat that ranges from chronicling the vagaries of the stock market to explaining the often-inscrutable trading decisions of Wall Street insiders.

The post A.I. Held Up Wall Street in 2025. Will That Continue? appeared first on New York Times.