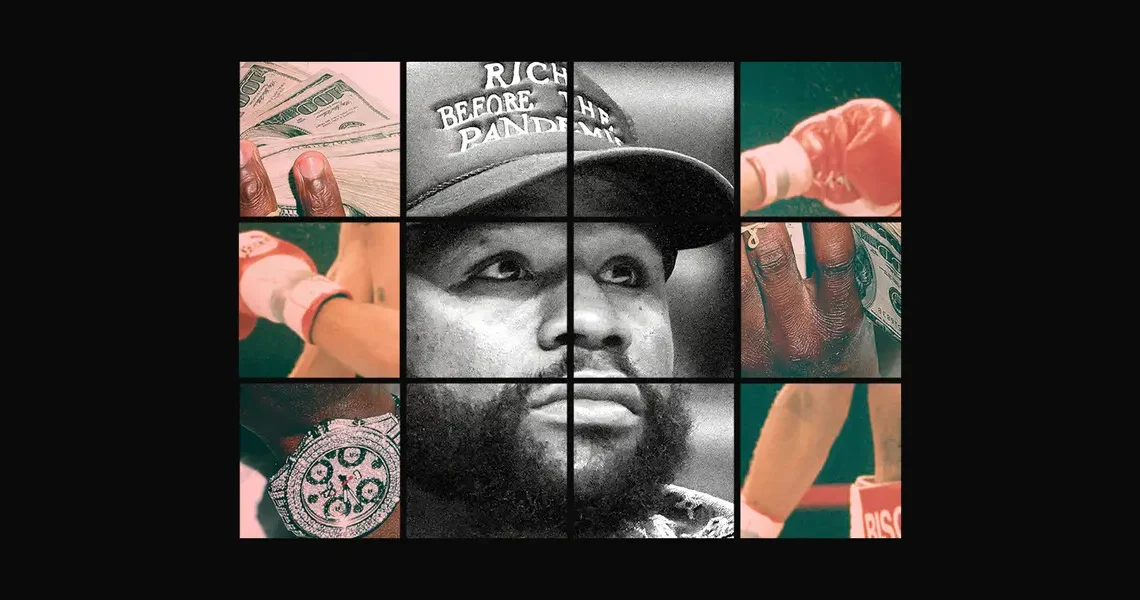

It was a typical scene for anyone familiar with the luxe life that Floyd Mayweather flaunts on social media: the 48-year-old former boxing champion sitting in the cabin of a private jet, counting a heap of $100 bills and talking about the envy that gets directed at him.

“Continue to hate,” Mayweather said in the September video as he piled the stacks of cash into a clear plastic bag. “You know, people only talk about winners. I’m a winner. So, continue to talk.”

“Money Mayweather,” as he calls himself, was indeed a winner in the ring, ending his pro career in 2017 with a 50-0 record. He scored more than a billion bucks in boxing paydays, making him the 10th highest-paid athlete of all time, according to the sports business outlet Sportico.

Since his retirement, he’s fashioned himself as a business mogul whose successes keep him in Bugatti sports cars, Richard Mille watches, Gucci clothing, and opulent mansions.

“I’m financially set, and I want to let everybody know this,” he said in 2021. “Every property that I have is paid for. My jet is paid for. All my cars is paid for. I own billion-dollar buildings.”

Everything is no longer paid for: Mayweather took out millions in mortgages on his homes last year, a Business Insider review shows. He has also faced a string of lawsuits and liens that say he owes money for a Mercedes Maybach G-Wagon, jet fuel, and garbage collection at his Las Vegas mansion.

At the same time, he has trumpeted a major entry into big league commercial real estate.

Starting in the fall of 2024, Mayweather talked up a spending blitz on commercial property in New York through his newly formed real estate firm — splashy moves that earned him a featured spot at a prominent real estate conference with a session titled “Real Estate Knockout: The Floyd Mayweather strategy.”

That big talk doesn’t always end in big deals, Business Insider found.

Mayweather’s social media last year promoted an article that reported he had made a deal to invest $100 million in a portfolio of Manhattan luxury high-rise apartment towers owned by Go Partners. People with knowledge of the investment said that Mayweather put in a “nominal” sum late last year but did not invest further and his initial equity in the deal was later absorbed by Go Partners, leaving him with no stake. The portfolio of buildings was eventually spun off into a publicly traded entity.

In February, Mayweather also said he bought a portfolio of rent-regulated apartment buildings in Upper Manhattan for $402 million, declaring that “all the buildings belong to me, I don’t have no partners.” Business Insider previously reported there were no property records showing an outright or majority sale.

Meanwhile, in the last 18 months, two of Mayweather’s commercial properties have been foreclosed, and he is at risk of losing a Las Vegas building that houses his strip club Girl Collection over $52,000 in back property taxes and penalties. Mayweather has been accused in lawsuits of failing to pay for millions of dollars of luxury items, including watches and high-end jewelry, allegations he has disputed.

Mayweather has been pursued by creditors over Air Mayweather, the Gulfstream jet that’s been one of the symbols of his megawealth. In December, FAA records showed he had sold the plane — and he’s sold his mansions in Beverly Hills and Miami to two of his real-estate partners.

Business Insider reviewed hundreds of pages of public records and interviewed dozens of current and former friends and business associates about Mayweather’s finances and his team, which includes a convicted felon who has been named in several lawsuits against the boxer.

“He doesn’t seem to have the guardrails that were in place,” Mark Tratos, a Las Vegas attorney who represented Mayweather during his professional fighting career in various business and legal matters, told Business Insider.

“When you’ve got professionals that are doing the thing for you, you’re a little better protected. When you’re out there on your own, your protection is dropped.”

Mayweather’s lawyer, Bobby Samini, said Mayweather is not “experiencing financial strain,” and “works with a team of seasoned professionals.”

“Floyd Mayweather rose from poverty and hardship to become one of the greatest champions in boxing history, transforming his talent and discipline into an undefeated legacy and a highly successful business empire,” Samini said in a statement. “Creating unfounded narratives misrepresents the truth and minimizes the achievements of an individual who has risen from adversity to become one of the most successful athletes and entrepreneurs of his generation.”

Mayweather has said that he embarked on the road to mega-wealth in 2007, a decade into his professional fighting career, when he bought himself out of his contract with a promoter and founded his own company, Mayweather Promotions.

The arrangement allowed him to cut out middlemen and negotiate larger shares of the proceeds from pay-per-view, ticket, and food-and-beverage sales. He ditched his original nickname, “Pretty Boy Floyd,” and christened himself “Money Mayweather.”

In the ring, his defensive technique and lightning counterpunching made him a winner, even if it deprived fans of the drama of a ferocious knockout. He embraced the role of a villain audiences wanted to see bloodied, which enhanced his bankability.

“There can’t be two good guys,” he said in the lead-up to his 2007 fight against Oscar De La Hoya. “I chose to be the bad guy.”

Showing off his enormous payouts and playboy lifestyle were part of the provocation.

“He understood the dynamics of entertaining,” said Derrick Poindexter, a boxing promoter. “People tuned in just to see him get his ass whooped.”

As the earnings flowed in, Mayweather kept his fortune where he could see it — bricks of cash, high-end cars, and real estate in Los Angeles, Miami, and his home base of Las Vegas that he owned debt-free.

“He liked the tangible element of having cash in his hand and watching it come and go,” said David Levi, who worked closely with Mayweather from 2010 until his last professional fight.

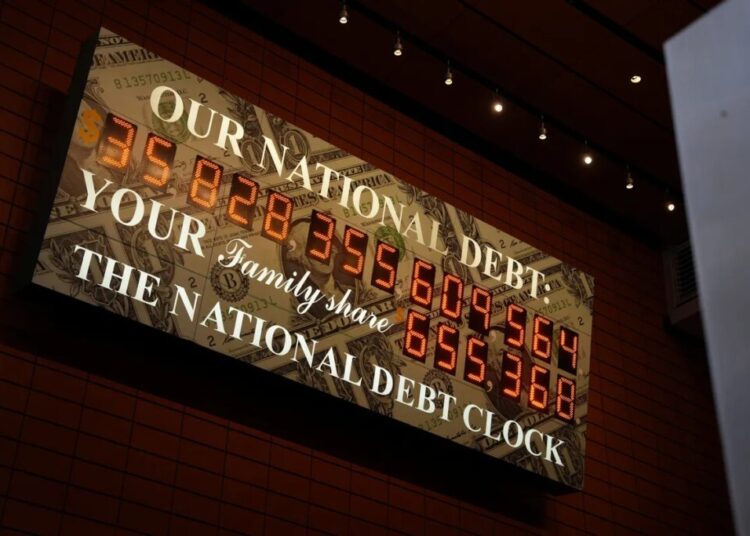

Dave Hall, Mayweather’s accountant in the early 2000s, said Mayweather spent heavily without setting aside enough to pay his taxes.

In 2017, Mayweather paid the IRS $22.2 million in back taxes, records show. In 2023, Mayweather settled with the IRS to pay $5.5 million in back taxes and another $1.1 million in penalties, according to a settlement filed in US Tax Court.

The core group around Mayweather began to break up once he left the ring. He parted ways with Al Haymon, Mayweather’s legendary boxing manager from the late 2000s until Mayweather’s retirement, and Leonard Ellerbe, the longtime CEO of Mayweather Promotions. His uncle and longtime trainer, Roger Mayweather, died in 2020, and Mayweather has said his father, Floyd Sr. — also a former professional boxer— suffers from dementia.

A more recent key figure in Mayweather’s life is Jona Rechnitz, the scion of a well-connected Los Angeles family who gained notoriety for his role as a government informant following his 2016 guilty plea in a sweeping New York City corruption case.

Rechnitz testified in federal court that he delivered a Ferragamo handbag stuffed with $60,000 in cash to a powerful union boss in exchange for a $20 million investment in a hedge fund, which then lost $19 million of it. He’s scheduled to be re-sentenced in January.

After the scandal, Rechnitz returned to LA and reinvented himself as a jeweler to the stars, including Kim Kardashian and Shaquille O’Neal. Multiple jewelers and other creditors hit Rechnitz and his jewelry business with lawsuits that accused him of failing to repay loans or pay for jewelry. Most of those cases were settled. Three ended in judgments against Rechnitz, including one for $17.7 million awarded by an LA court in 2023. Rechnitz is appealing the decision.

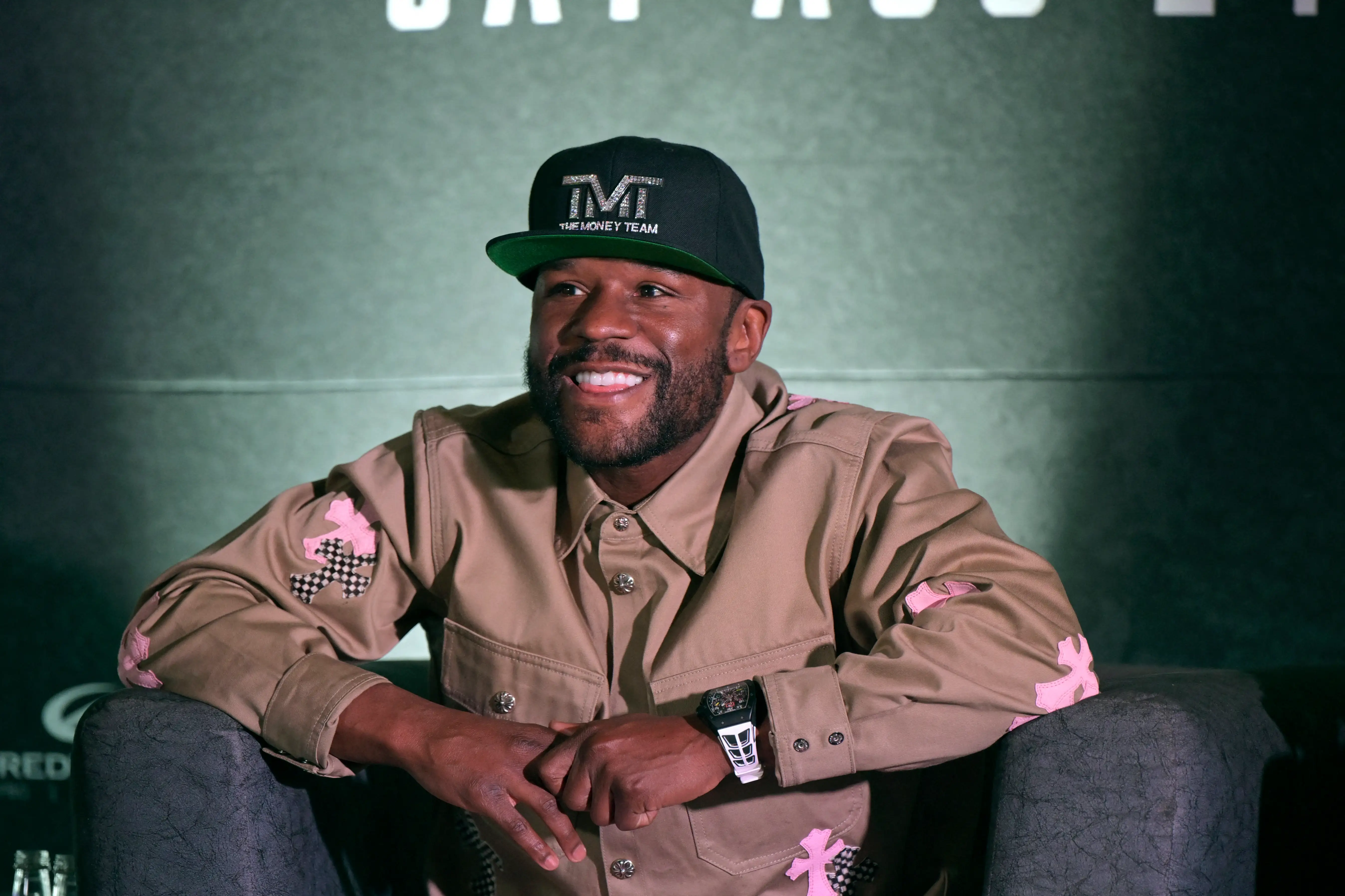

Rechnitz’s relationship with Mayweather, who was a jewelry client, flourished, and Mayweather has credited him as an architect of his post-boxing success. “When your career is over, you got to make smart decisions,” Mayweather said during an appearance on Fox News in February. “But a close friend of mine, Jona Rechnitz — great guy, great person — helped me a lot.”

The two frequently travel together, including a trip to Israel after the October 7 attacks where they were pictured with Prime Minister Benjamin Netanyahu. Closer to home, they attend NBA games, and Rechnitz is often seen sporting baseball caps with the “TMT” logo of “The Money Team,” Mayweather’s apparel brand, and the nickname for his posse of friends, bodyguards, and close associates.

As Rechnitz’s influence has grown, so have Mayweather’s real estate ambitions.

By Mayweather’s account, his foray into commercial property investing began more than a decade ago, when he met two New York City real estate executives courtside at a Knicks game.

In a meeting the next day, one of the executives, Jeff Sutton, enchanted the boxer by explaining that while he earned staggering sums during his fights, real estate generates profits as its investors sleep.

Mayweather has said that he began investing soon after, pouring $5 million into a deal that paid him $50,000 a month in proceeds — an impressive 12% return.

Since late last year, there have been headlines about much bigger deals, including the Go Partners venture.

Last December, he said that he had purchased a building in New York’s Diamond District, for a reported $20 million, as a gift to his then 3-year-old grandson. Property records show that a company tied to jeweler Avi Davidov bought the building in June 2025 from its longtime owners. Davidov declined to comment.

In the months leading up to the real estate announcements, he began freeing up a big chunk of cash against his personal real-estate portfolio and his jet, which he has since sold.

In early 2024, Rechnitz introduced Mayweather to Don Hankey, a billionaire specialty lender based in Los Angeles. Hankey, who rose to prominence in the lending business by providing car loans to buyers with poor credit, is best known for posting a $175 million bond for President Donald Trump.

Over the next year, Mayweather borrowed $54 million from Hankey at a roughly 9% interest rate, to “fund other ventures,” his lawyer told Business Insider. He used as collateral 14 residential homes, his Las Vegas strip club, and his jet, according to Hankey and Business Insider’s review of public loan documents.

In loan documents, and according to Hankey’s description of the deal, a portion of the debt was cross-collateralized, meaning it was taken against a collection of Mayweather’s assets, rather than as smaller loans tied to individual properties. That structure is inherently more risky since, in the event of a default, borrowers can lose multiple properties at once, rather than one asset at a time, experts say.

Hankey said that working with Mayweather gave him some insights into the boxer’s finances. Mayweather’s wealth, Hankey said, for instance, appeared largely anchored in the value of his personal homes. When Hankey searched Mayweather’s credit history, “not much showed up,” he said.

“I think some people buy stocks, some buy bonds and put their money in a bank, and I think he put his money in houses,” Hankey said. “Before he came to us, I don’t think he tried to borrow very much.”

Samini, Mayweather’s lawyer, said that Mayweather had been an “ideal client” for Hankey. “Like many other sophisticated businesspeople, he borrowed against the substantial equity in his portfolio to fund other ventures,” Samini said of Mayweather.

While Mayweather was drawing millions against his real estate portfolio, bills were piling up elsewhere.

In February, a Las Vegas commercial building that Mayweather bought for $3.6 million in 2024 was sold at auction to its previous owner.

This summer, two condos that Mayweather owns at Trump Las Vegas Residences were seized by Clark County for unpaid property taxes — then returned to Mayweather after he made a $21,000 payment. Last month, a $568.63 lien was put on Mayweather’s Las Vegas mansion for unpaid trash collection.

A Texas aviation supplier sued Mayweather companies in June over what it said were $137,000 in unpaid bills, and FAA records show that a lien was placed on the aircraft in July for another $358,000 for maintenance work. That same month, AJ Ramey, Mayweather’s former pilot, complained on social media that the boxer “trashed my reputation and relationships by never paying his jet debts.”

Mayweather has since settled the maintenance bill, and that lien was removed in August. Mayweather did not respond to the jet fuel lawsuit. In October, a default judgment was awarded in favor of the fuel company.

The FAA has not released specific details about the sale of the jet, such as the name of the buyer or the price.

Ramey said that he is still owed money for his work as Mayweather’s pilot.

“Floyd Mayweather harped on loyalty, hard work, determination, doing business the right way,” Ramey said. “To be betrayed and watch that dwindle and have someone that had such a profound impact on you in a good way turn around and burn you like that, I still am working through it.”

Samini denied that Ramey is owed money or that he was betrayed.

In 2023, a Los Angeles court awarded a Nigerian media company a $2.4 million judgment on a claim that Mayweather was paid $210,000 for appearances in Africa that he never made. Mayweather has denied the allegation, and his appeal was denied. The judgment has not been paid and has swelled to almost $3 million with default interest, according to an attorney for the Nigerian firm.

Rechnitz is a recurring character in some of the lawsuits brought against Mayweather in recent years. In 2024, for example, Leonard Sulaymanov, a high-end jeweler in Miami, filed a lawsuit accusing Mayweather of stiffing him on a $3.9 million bill for various jewelry and watches, including a Patek Philip 5980 and two Richard Mille 35-02s. Sulaymanov said in the lawsuit that Rechnitz, though not named as a defendant, set up the meetings where the jewelry was shown. Mayweather never filed a response and the case was settled out of court.

In September, a Las Vegas car dealer sued Mayweather, accusing him of leaving his lot with a $1.2 million Mercedes Maybach G-Wagon and never paying for it. Rechnitz asked for more time, the lawsuit said, and Mayweather ultimately signed a legal document promising to settle the bill. Mayweather then sued the dealer for fraud, alleging that he’d been sold a bad car. Both cases are still pending.

Business Insider found three cases where Mayweather and Rechnitz have together been accused of fraud or misrepresentation, including for promoting a cryptocurrency in an alleged pump-and-dump scheme and allegedly defrauding an investor through a ticket resale operation. In each of those lawsuits, Rechnitz was identified as the person allegedly facilitating the deals on Mayweather’s behalf. Rechnitz and Mayweather have denied wrongdoing.

In the third case, Miami entrepreneur Jayson Winer sued Rechnitz, Mayweather, and Ayal Frist, the CEO of Mayweather’s property investment company, accusing them of hawking access to celebrities, including Elon Musk, and failing to deliver.

Winer creates NFT art — digital creations stored on a blockchain — and hoped Musk could promote an online auction. “I know everyone. And have access bc of Floyd,” Rechnitz allegedly wrote in a text to Winer. In a call, Rechnitz reiterated that Mayweather had a personal relationship with Musk, whom he had trained ahead of a rumored fight with Meta CEO Mark Zuckerberg, the lawsuit said.

Winer, who said he paid $20,000 and handed over two high-end watches to Mayweather’s security guard, sued Rechnitz and Frist in January and added Mayweather to the suit in August.

Rechnitz and Frist have responded that they held up their end of the deal but Winer’s “banal” and “uncreative” art failed to catch on with buyers. Mayweather asked a judge in November to drop him from the suit. Samini said that Mayweather denies all of Winer’s claims and notes that, in April, a judge issued a temporary restraining order prohibiting Winer from making direct contact with Rechnitz and Frist.

Meanwhile, news of Mayweather’s lavish spending irked John Berman, a businessman who sold Mayweather an LA warehouse for $4.5 million in late 2022.

Berman said he provided Mayweather with a loan to finance the purchase and that Mayweather defaulted on a December 2024 deadline to pay off that debt.

A month later, in January, Berman said he received a call from Rechnitz, who tried to persuade him to refund Mayweather’s $1.5 million down payment on the property.

Berman said he considered cutting Mayweather a break — until he received a call from his own attorney. The lawyer had heard about Mayweather’s purchase of an expensive car, which made Rechnitz’s plea seem absurd.

“Foreclose on the building now,” Berman’s attorney told him.

“That was the nail in the coffin,” Berman said.

Berman initiated a foreclosure and seized the building in August, wiping out Mayweather’s ownership and investment, records show.

Real estate isn’t Mayweather’s only business interest. His One of One supplements brand, which he launched in February, is now carried at GNC and Dick’s Sporting Goods. On his Instagram, Mayweather advertises partnerships with Agua Plus Premium Alkaline Water and Betify, a sports betting platform.

He has loaned his name to a personal injury law firm, which hosted a gala with him in November. He’s also endorsed several cryptocurrency coins; one deal resulted in a $600,000 settlement with the Securities and Exchange Commission in 2018, and another sparked an investor lawsuit.

Mayweather Boxing and Fitness, a retail gym chain modeled on Mayweather’s fitness routines, was sold in August. As Business Insider previously reported, more than half of Mayweather Boxing and Fitness studios, which once boasted more than 70 locations, have shut down, and a group of four franchisees have sued Mayweather and company executives for allegedly making false and misleading statements about the business — allegations Mayweather denied.

His bigger post-retirement paychecks have come from a string of multimillion-dollar exhibition fights, including against Logan Paul and John Gotti III. In September, it was announced that next year, he will fight former heavyweight champion Mike Tyson, 59, in an exhibition matchup.

Money Mayweather’s take was totally on brand.

“I fear NO man but GOD!” he wrote on Instagram. “Let’s get it!! 💰”

Note: Floyd Mayweather filed a defamation lawsuit against Business Insider in connection with a previous story about Mayweather’s real estate investments. The case is pending, and BI stands by its reporting.

Daniel Geiger is a senior real estate correspondent for Business Insider.

Ellen Thomas is a senior reporter on Business Insider’s technology desk.

Read the original article on Business Insider

The post Inside Floyd Mayweather’s lavish, debt-filled post-boxing life appeared first on Business Insider.