Since the founding of the Federal Reserve in 1914, the United States has had 16 Fed chairs, yet rarely has the selection of the nation’s central-bank leader captured such sustained media and political attention as the spectacle which his playing out right now. Of course, this is by design; at least since the debut of The Apprentice in 2004, Donald Trump has reveled in transforming senior hiring decisions into a public spectacle—casting staffing choices as a form of modern gladiatorial entertainment. While this approach has drawn criticism, including my original 2004 critiques in the WSJ, it also has the paradoxical virtue of rendering candidates’ strengths, weaknesses, and temperaments unusually transparent.

Much of the media’s attention has centered on Kevin Hassett and Kevin Warsh as the presumptive front-runners to be next Fed Chair. Both are highly respected, with long track records of public service and honorable character. But whether fairly or not, their perceived weaknesses have been under a magnifying glass, creating an opening for an ascendant dark horse who is drawing growing backing from the top CEOs of the nation’s largest enterprises.

CEOs are gravitating towards that dark horse candidate, current Fed Governor Chris Waller, because while he may lack the White House network of other top contenders; he is quickly emerging as perhaps the only candidate who can cut interest rates with broad-based credibility and build broad consensus around those needed rate cuts, both at the Fed as well as across corporate America and within financial markets.

A great irony in President Trump’s jawboning of the Fed is that Trump is perhaps his own worst enemy in trying to force interest rates down. Ironically, the belief that interest rates need to come down is shared not only among economists across ideological anchoring, and not only among many top business leaders, but even many of Trump’s most vocal critics. We have previously written several publications calling for the Fed to lower interest rates, pointing out that entire sectors, such as homebuilders, are getting hammered unnecessarily from holding rates so high for so long.

CEOs care about interest rates coming down, but they care even more about Fed independence. History is clear: countries that politicize their central banks set themselves on a path towards monetary purgatory and collapse. That’s why Trump’s brazen interventions at the Fed have wreaked havoc in the markets, with bond investors in active revolt and with long-term bond yields rising by 20 basis points after some pointed commentary from Trump.

Chris Waller is perhaps the only choice for Fed Chair who can thread the needle. Unlike other top contenders, Waller’s calls for rates to come down reflect not convenient political posturing nor obsequious flattery, but genuine intellectual conviction. Waller has been incredibly consistent and correctly prescient across his entire career at the Fed; he correctly pointed to signs that the economy, and in particular employment, was softening, and has been calling for rates to come down for far longer than any of his peers at the Fed.

Yet, at the same time, Waller has emphasized and defended central bank independence time and time again, building off his own academic research which was focused on the importance of central bank independence. Indeed, prior to Waller’s public service at the Fed starting in 2009, he was a renowned academic with a long track record of groundbreaking economic research, including as professor and the Gilbert F. Schaefer Chair of Economics at the University of Notre Dame.

Financial markets have already offered a preview of how they would respond to a potential Waller nomination — decidedly positively. When CNBC broadcast live Waller’s hour-long plus Q&A with 200 top CEOs in attendance at our Yale CEO Summit last week after a moderated Q&A with CNBC’s Steve Liesman; stocks rallied and bond yields fell in real time as Waller called for rates to come down, pointing to softening employment numbers, while simultaneously pledging to defend central bank independence. No other contender for Fed Chair has sparked such a positive market reaction.

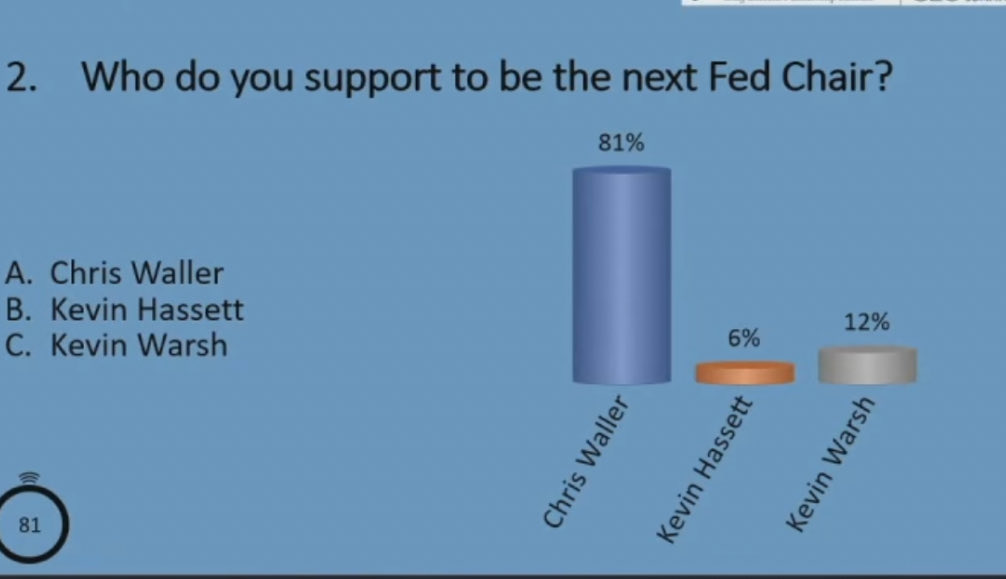

Waller is a lifelong Republican who has a knack for getting along with very different constituencies, all of whom respect his genuine expertise, personal humility and willingness to listen. Even CEOs who disagreed with certain aspects of Waller’s arguments clearly appreciated his constructive engagement, as well as his intellectual honesty and independence. When we polled the room, as reported by Nick Timiraos of The Wall Street Journal, a whopping 81% of CEOs picked Waller as their top choice for Fed Chair, building on prior polls done by CNBC showing a majority of market participants prefer Waller, as well as prominent endorsements from publications such as The Economist.

Many CEOs at our Yale CEO Summit expressed their appreciation for Waller’s long track record of partnering effectively with business leaders on challenges as well as opportunities. Take crypto innovation as one such example. As the Fed Governor who oversees the payment system, Waller was once again correctly prescient as an advocate of stablecoins dating back to before 2021, when few knew what stablecoins even were, and he convened the first ever Payments Innovation Conference earlier this year, bringing in top leaders from industry to help shape the future of stablecoin payments.

President Harry Truman lamented, “Give me a one-handed economist. All my economists say, ‘on ONE hand…’, then ‘but on the other.’” Business leaders appreciate Waller’s serious and decisive style, his systemic economic knowledge, his track record of constructive engagement, his clarity of message, and his credible presence, which transcend political or personal career agendas.

The opinions expressed in Fortune.com commentary pieces are solely the views of their authors and do not necessarily reflect the opinions and beliefs of Fortune.

The post Why over 80% of America’s top CEOs think Trump would be wrong not to pick Chris Waller for Fed chair appeared first on Fortune.