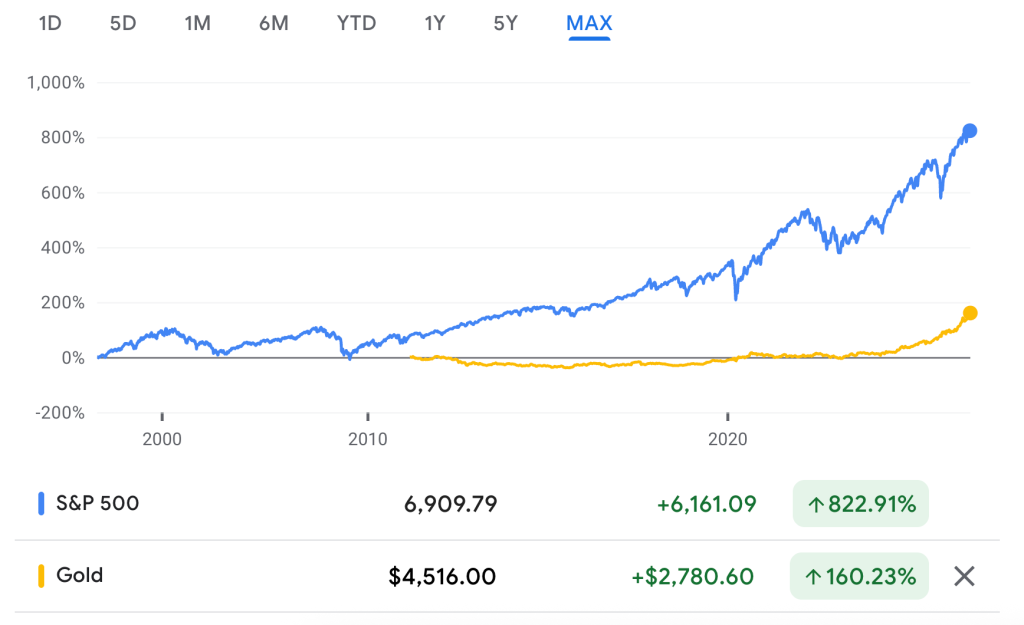

The S&P 500 closed up 0.46% yesterday to hit a new record of 6,909.79. The index is now up 17.48% for the year. With only the quiet Christmas week left before the end of the year it’s likely that investors will mark this down in their spreadsheets as a very good year. Unless, of course, they have a friend who bought gold at or before the beginning of 2025. The price of gold is up an astonishing 71% year-to-date, and is currently hovering around $4,514 per troy ounce. That friend is now laughing at you, the foolish stock investor, for wasting your money on trivia like the Magnificent Seven.

There’s a hackneyed narrative explaining why gold went up: We had a volatile year with President Trump’s tariffs disrupting global trade; Russia’s ongoing invasion of Ukraine; there’s a bubble in AI-related tech stocks; Bitcoin went nowhere this year (it’s down 7%); inflation is trending up; and gold is the safe-haven investment for nervous investors who want a hedge against pretty much all of that.

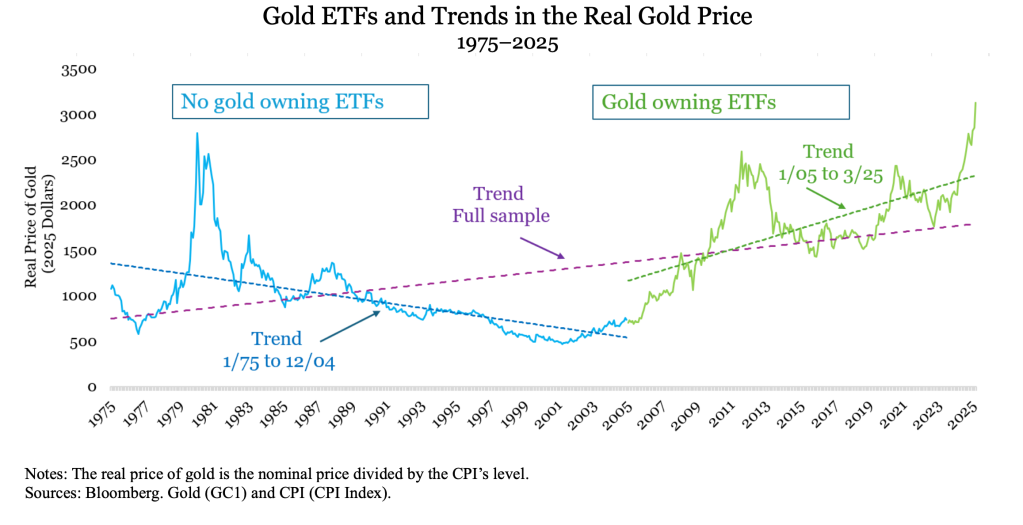

In fact, that is only partially true, according to newish research from Claude Erb and Campbell Harvey of the Fuqua School of Business at Duke University. The reality, they say, is that the introduction in 2004 of gold exchange-traded funds—which make buying gold as easy as buying stocks—has permanently pushed up the price of gold.

“Total North American gold ETFs have almost $200 billion, and ETFs outside the U.S. account for another $175 billion in gold,” they said in an October 2025 research paper.

This chart shows the apparent effect on the price of gold following the introduction of gold ETFs. The chart shows the “real” price of gold, which discounts inflation from its price:

The more recent introduction of tokenized gold stablecoins—crypto tokens backed by gold reserves and thus pegged to the price of gold, which can be “staked” or locked up as investments in other risk assets like bonds—is likely to push the price up further, they say.

But don’t get too excited.

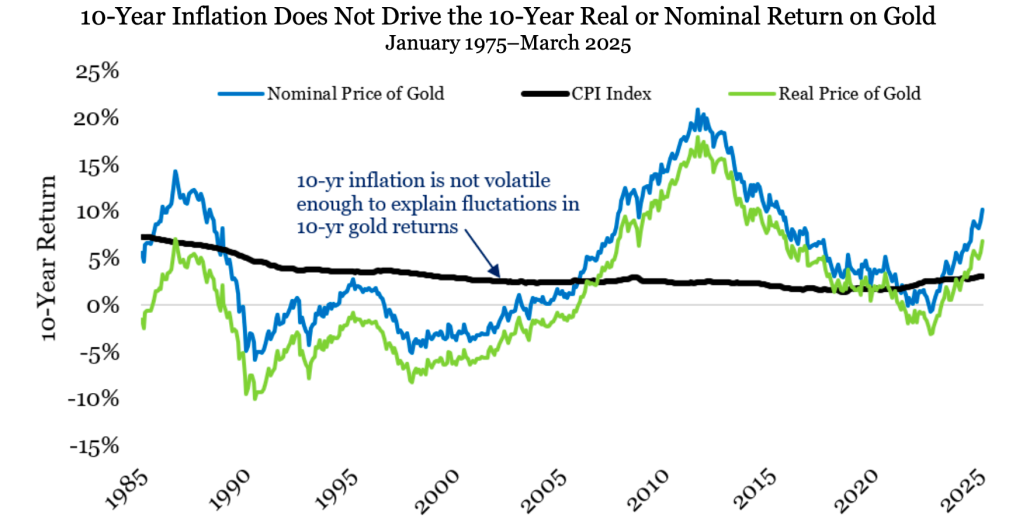

Gold isn’t actually a great hedge against inflation over the long run, Erb and Harvey argue. The price of gold has high volatility, whereas inflation is a low-vol phenomenon. Gold investors can thus spend years losing money if they are trying to beat inflation:

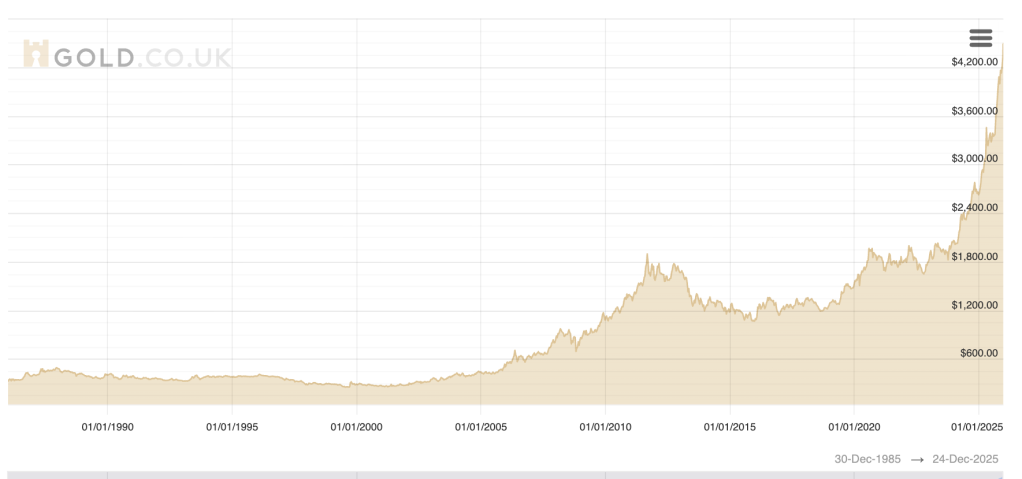

And then there is the performance of gold generally, in nominal dollars, versus stocks. This chart shows the price of gold over the last 40 years. Note that gold can spend years and years in long-term price declines:

And here is the Comex continuous contract for gold versus the S&P 500 index over the last 20 years. Clearly, the winner ain’t gold:

So has gold peaked? No one knows, obviously. But it is interesting that investment banks like Société Générale, Morgan Stanley, and Mitsui have all expanded their precious metal trading teams this year, and other banks are exploring getting back into the “vault” business of storing gold reserves, the Financial Times reports.

Here’s a snapshot of the markets ahead of the opening bell in New York this morning:

- S&P 500 futures were flat this morning. The last session closed up 0.46% to hit a new record of 6,909.79.

- STOXX Europe 600 was up 0.39% in early trading.

- The U.K.’s FTSE 100 was down 0.12% in early trading.

- Japan’s Nikkei 225 was down 0.14%.

- China’s CSI 300 was up 0.29%.

- The South Korea KOSPI was down 0.21%.

- India’s NIFTY 50 was down 0.14%.

- Bitcoin was at $87K.

The post Why gold went through the roof this year—and why its price may have been permanently raised appeared first on Fortune.