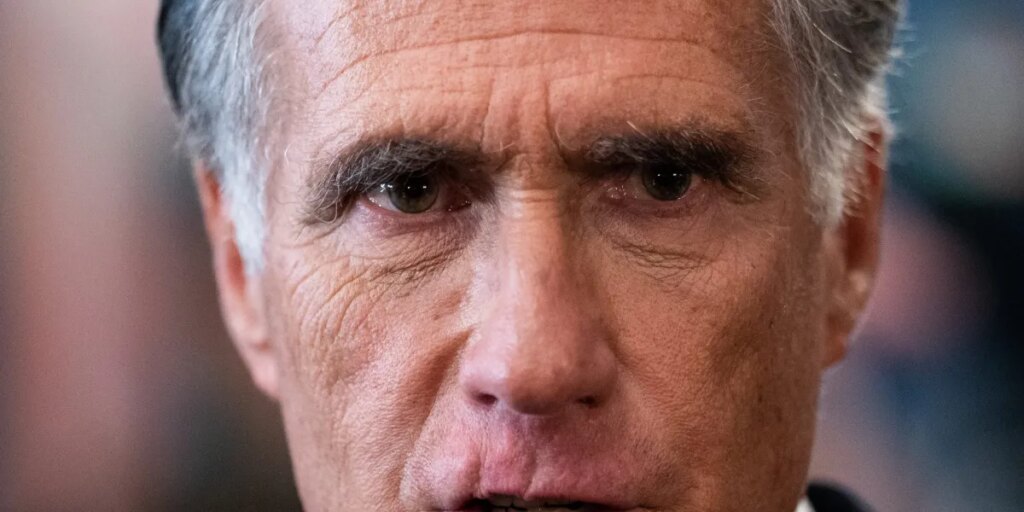

Mitt Romney, the 2012 Republican presidential nominee and former U.S. senator from Utah, has long been known for fiscal conservatism and tax cuts. But in a Friday op-ed for The New York Times, he reversed course, calling for higher taxes on rich Americans like himself to address the looming national debt crisis and prevent the collapse of Social Security.

Romney said the U.S. is headed for an economic cliff as the Social Security Trust Fund races toward insolvency in 2034, according to a projection from the CRFB. Without congressional intervention, benefits would be slashed by roughly 23%, forcing the government to borrow trillions at potentially exorbitant interest rates or print money that could trigger hyperinflation.

“Today, all of us, including our grandmas, truly are headed for a cliff,” he warned. “Typically, Democrats insist on higher taxes, and Republicans insist on lower spending. But given the magnitude of our national debt as well as the proximity of the cliff, both are necessary.”

America’s national debt has swelled to more than $38 trillion; in 2025 alone, it increased by about $1.8 trillion. Last year, interest payments on the debt surpassed $1 trillion for the first time, exceeding spending on Medicare and national defense. Annual debt-servicing costs are projected to climb to $1.8 trillion over the next decade.

”DOGE took a slash-and-burn approach to budget cutting and failed spectacularly,” Romney wrote. Indeed, a Yale University Budget Lab report earlier this year said DOGE was likely costing the government more than it was saving.

Romney devoted most of his op-ed to tax proposals aimed at high earners. He reversed his longstanding opposition to raising the income cap on payroll taxes, which currently stands at $176,100.

“I long opposed increasing the income level on which FICA employment taxes are applied (this year, the cap is $176,100). No longer; the consequences of the cliff have changed my mind,” he explained.

The 78-year-old former presidential candidate also called for closing what he described as tax “caverns” or “caves” that benefit multibillionaires. He singled out the step-up in basis provision, which allows heirs of large estates to avoid capital gains taxes on inherited assets. Using Tesla CEO Elon Musk as an example, Romney argued this loophole should be eliminated for estates valued above $100 million.

“If he had originally purchased his Tesla stock with, say, $1 billion and held it until his death and if it was then worth $500 billion, he would never pay the 24% federal capital gains tax on the $499 billion profit,” he said. “Why? Because under the tax code, capital gains are not taxed at death. The tax code provision known as step-up in basis means that when Mr. Musk’s heirs get his stock, they are treated as if they purchased it for $500 billion. So no one pays taxes on the $499 billion capital gain. Ever.”

Romney said the “unusual provision” makes sense if you’re talking about helping families keep the farms they’ve passed down for generations, “but it’s being used by billionaires to avoid capital gains taxes.”

He also proposed reforms to carried interest rules—a tax provision that allows private equity and hedge fund managers to treat management fees as capital gains taxed at 15% rather than ordinary income taxed at up to 37%. He suggested ending certain like-kind exchanges and depreciation rules that shelter income from taxation.

“I believe in free enterprise, and I believe all Americans should be able to strive for financial success,” Romney concluded. “But we have reached a point where any mix of solutions to our nation’s economic problems is going to involve the wealthiest Americans contributing more.”

Romney, who is worth an estimated $254 million and was among Congress’s wealthiest members before leaving the Senate in January of this year, famously paid an effective tax rate of 13.9% during his 2012 presidential run.

On Sunday, The Wall Street Journal editorial board wrote a searing response to Romney’s essay, saying “Mr. Romney made his fortune at Bain Capital, and good for him. He can afford to pay more now, but would the 28-year-old Mitt still on the make have thought so? Raising taxes makes it harder for others to get rich.”

The post Mitt Romney says the U.S. is on a cliff—and taxing the rich is now necessary ‘given the magnitude of our national debt’ appeared first on Fortune.