Bank of America’s “Bull & Bear Indicator” rose from 7.9 to 8.5 in the last few days, triggering its contrarian “sell” signal for risk assets, according to a note from analyst Michael Hartnett and his colleagues seen by Fortune this morning. The indicator is derived from BofA’s regular fund manager survey, which asks 200-plus investment managers about their appetite for risk. The logic of the Bull & Bear Indicator is that when everyone in the market is bullish, it’s time to leave. S&P 500 futures were up 0.25% this morning. The last session closed up 0.79%. The index remains a little less than 2% beneath its all-time high. Markets in Asia largely closed up this morning. Europe and the UK were flat in early trading. Whether stocks are overvalued—especially tech stocks—has been a running theme in the equity markets all year long. BofA’s sell signal has been activated 16 times since 2002, Hartnett says. On average, the MSCI All Country World Index (an index that represents stocks globally) declined by 2.4% afterwards, the bank says, with a maximum average drawdown of 8.5% by three months later.

The indicator has a record of being right 63% of the time—so it isn’t flawless. But BofA also notes that investors are in an unusually “risk-on” mood in equities right now: Last week saw a record inflow of $145 billion into equity exchange-traded funds, and the second-highest ever weekly inflow of money into U.S. stocks ($77.9 billion), Hartnett wrote. The indicator thus implies that a smart investor might want to become fearful given that others are too greedy.

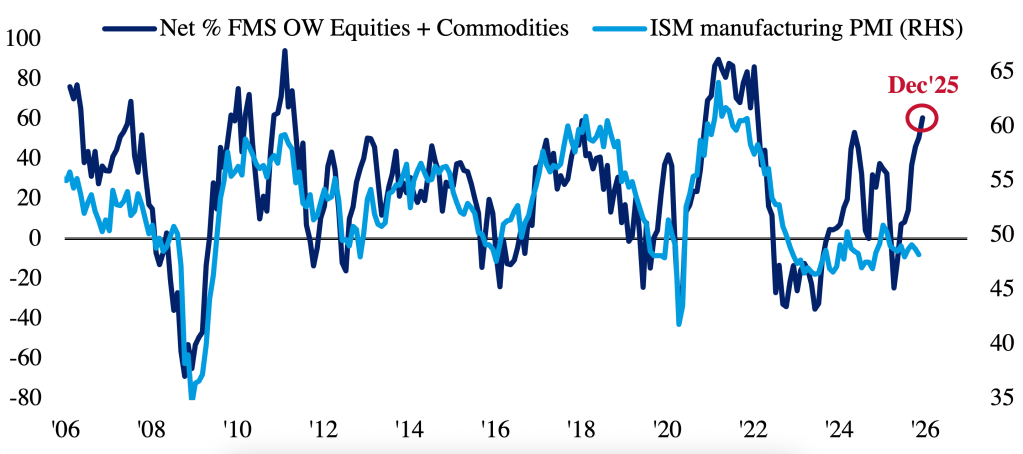

Investor sentiment roughly correlates with sentiment in the Purchasing Managers Index, a survey of supply chain managers responsible for corporate buying. Right now, investors have broken ranks with the PMI, with the former being much more positive about future than the latter. They appear to be expecting the PMI to follow their lead, Hartnett argues.

“Investors [appear to be] bull positioned for ‘run-it-hot’ PMI & [earnings per share] acceleration on rate cuts, tariff cuts, tax cuts,” he told clients.

Conversely, assuming the market does not pull back—or a revesal is temporary—he predicts EPS growth of 9% for stocks in 2026 despite increased U.S. unemployment, and the threat of “bond vigilantes slowing [the] AI capex boom.”

Here’s a snapshot of the markets ahead of the opening bell in New York this morning:

- S&P 500 futures are up 0.33% this morning. The last session closed up 0.79%.

- STOXX Europe 600 was flat in early trading. The U.K.’s FTSE 100 was flat in early trading.

- Japan’s Nikkei 225 was up 1.03%.

- China’s CSI 300 was up 0.34%.

- The South Korea KOSPI was up 0.65%.

- India’s NIFTY 50 was up 0.59%.

- Bitcoin was at $88K.

The post The bulls are too bullish: Bank of America warns 200-plus fund managers just triggered a contrarian ‘sell’ signal appeared first on Fortune.