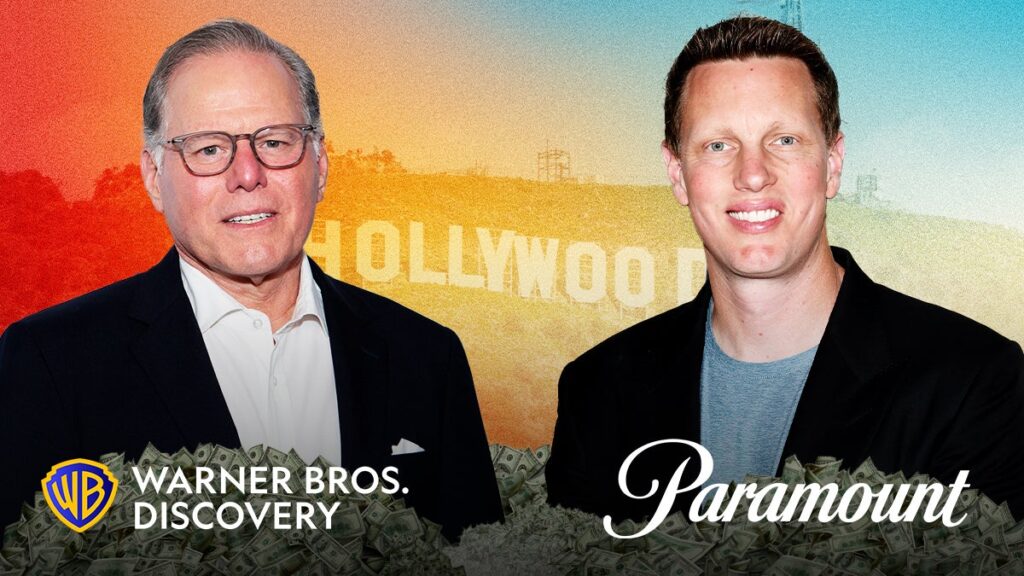

Warner Bros. Discovery’s board has unanimously rejected Paramount’s $30-per-share, all-cash bid for the entire company, determining that the “inadequate” and “illusory” offer is not in the best interest of the company’s shareholders.

“Following a careful evaluation of Paramount’s recently launched tender offer, the Board concluded that the offer’s value is inadequate, with significant risks and costs imposed on our shareholders,” WBD board chairman Samuel A. Di Piazza, Jr. said in a statement. “This offer once again fails to address key concerns that we have consistently communicated to Paramount throughout our extensive engagement and review of their six previous proposals.”

The board reiterated its recommendation for its $82.7 billion deal with Netflix for Warner’s streaming and studio assets.

“We are confident that our merger with Netflix represents superior, more certain value for our shareholders and we look forward to delivering on the compelling benefits of our combination,” Di Piazza Jr. added

The move comes as Paramount’s tender offer will be open for a minimum of 20 business days, or until Jan. 8, with the option for an extension. Under the terms, shareholders have withdrawal rights that expire at 5 p.m. ET on Jan. 8 unless the offer is extended.

Paramount also has the option to increase its current offer, though it remains unclear if they will ultimately do so. Representatives for Paramount did not immediately return TheWrap’s request for comment.

Paramount submitted a total of six bids over twelve weeks for all of Warner Bros. Discovery, while Netflix and Comcast submitted three rounds of bids for the company’s studio and streaming assets.After entering into an $82.7 billion deal with Netflix, Paramount CEO David Ellison took his $108.4 billion bid directly to shareholders in a hostile takeover.

In addition to trashing the Netflix deal in a letter last week, Ellison knocked WBD’s board and CEO David Zaslav for a “murky” sale process, which he says ignored the $30 per share offer – and the company’s statements that it was not “best and final” – to sprint towards a deal with Netflix.

But in Wednesday’s response, WBD laid out its full rationale and a timeline of its communications with Paramount, adding that “none of these reasons will be a surprise to PSKY given our clear, and oft-repeated, feedback on their six prior proposals.”

First, the board reiterated that the terms of the Netflix deal give WBD shareholders $23.25 in cash, plus $4.50 in shares of Netflix common stock based on a collar range of $97.91 to $119.67 at the time of closing. It also includes the additional value of shares in Discovery Global and the opportunity for future participation in that company.

Second, it argued that Paramount Skydance has “consistently misled” WBD shareholders that the $40.7 billion of equity financing in its proposed transaction is fully backstopped by the Ellison family.

“It does not, and never has,” the board stated. “PSKY’s most recent proposal includes a $40.65 billion equity commitment, for which there is no Ellison family commitment of any kind. Instead, they propose that you rely on an unknown and opaque revocable trust for the certainty of this crucial deal funding. Despite having been told repeatedly by WBD how important a full and unconditional financing commitment from the Ellison family was – and despite their own ample resources, as well as multiple assurances by PSKY during our strategic review process that such a commitment was forthcoming – the Ellison family has chosen not to backstop the PSKY offer.”

Per Paramount, the equity financing is backed by the Ellison family trust, which contains over $250 billion of assets including 1.16 billion Oracle shares. But WBD said the revocable trust is “no replacement for a secured commitment by a controlling stockholder” and that its assets and liabilities are “not publicly disclosed and are subject to change.”

“The documents provided by PSKY for this conditional commitment contain gaps, loopholes and limitations that put you, our shareholders, and our company at risk,” WBD added.

It also said that the trust’s liability for damages, even in the case of a willful breach, would be capped at 7% of its commitment, or $2.8 billion, but that the damage to WBD shareholders and its stockholders would “likely be many multiples of this amount.”

Fourth, the WBD board took aim at the $55 billion in debt financing of Paramount-Skydance’s bid, noting that it relies on “an unsecure revocable trust commitment as well as the credit worthiness of a $15 billion market cap company with a credit rating at or only a notch above “junk” status from the two leading rating agencies.”

Paramount has said its committed debt partners include Bank of America, Citibank and Apollo Global Management.

WBD warned the Paramount deal would have a high leverage ratio of 6.8 times 2026 debt to EBITDA with “virtually no current free cash flow generation before synergies,” reflecting a “risky capital structure that is vulnerable to even potentially small changes in the PSKY or WBD business between signing and closing.”

“WBD’s merger agreement with Netflix is a binding agreement with enforceable commitments, with no need for any equity financing and robust debt commitments,” the board continued. “The Netflix merger is fully backed by a public company with a market cap in excess of $400 billion with an investment grade balance sheet.”

Lastly, it said that the $9 billion in proposed synergies by Paramount are “both ambitious from an operational perspective and would make Hollywood weaker, not stronger.”

In addition to the rationale, WBD reiterated that its strategic review was “full, transparent and complete – establishing a level playing field that fostered a rigorous and fair process.”

It said that it repeatedly engaged with all the bidders, including ” extensive engagement with PSKY and its advisors over the course of nearly three months,” including dozens of calls and meetings with its principals and advisors and four in-person meetings and meals between CEO David Zaslav and David and Larry Ellison.

“After each bid, we informed PSKY of the material deficiencies and offered potential solutions. Despite this feedback, PSKY has never submitted a proposal that is superior to the Netflix merger agreement,” the board said.

Warner Bros. Discovery also said it does not believe there is a “material difference in regulatory risk between the Paramount offer and the Netflix merger” despite Ellison’s assurances, noting it “carefully considered the federal, state, and international regulatory risks” for both Paramount and Netflix’s bids. It also said Netflix’s $5.8 billion breakup fees is “significantly higher” than Paramount’s $5 billion breakup fee.

The board argued that Paramount’s offer is “illusory,” noting it can be terminated or amended by PSKY at any time prior to its completion. It also said the offer is ” not capable of being completed by its current expiration date,” due to the need for, among other things, global regulatory approvals.

It also pointed out that WBD would have to pay Netflix a $2.8 billion breakup fee, which Paramount did not offer to reimburse, and that it would incur approximately $1.5 billion in financing costs if it does not complete a planned debt exchange with its debt holders, which would not be permitted by the Paramount offer. These $4.3 billion in costs would represent approximately $1.66 per share to be borne by WBD shareholders if the Paramount deal doesn’t close, the company said.

“Nothing in this structure offers WBD shareholders any deal certainty. The PSKY offer provides an untenable degree of risk and potential downside for WBD shareholders,” the board concluded. “We look forward to moving ahead with our combination with Netflix and delivering the compelling and certain value it will create for shareholders.”

The post Warner Bros. Discovery Board Rejects Paramount’s ‘Inadequate’ and ‘Illusory’ $108.4 Billion Cash Bid appeared first on TheWrap.