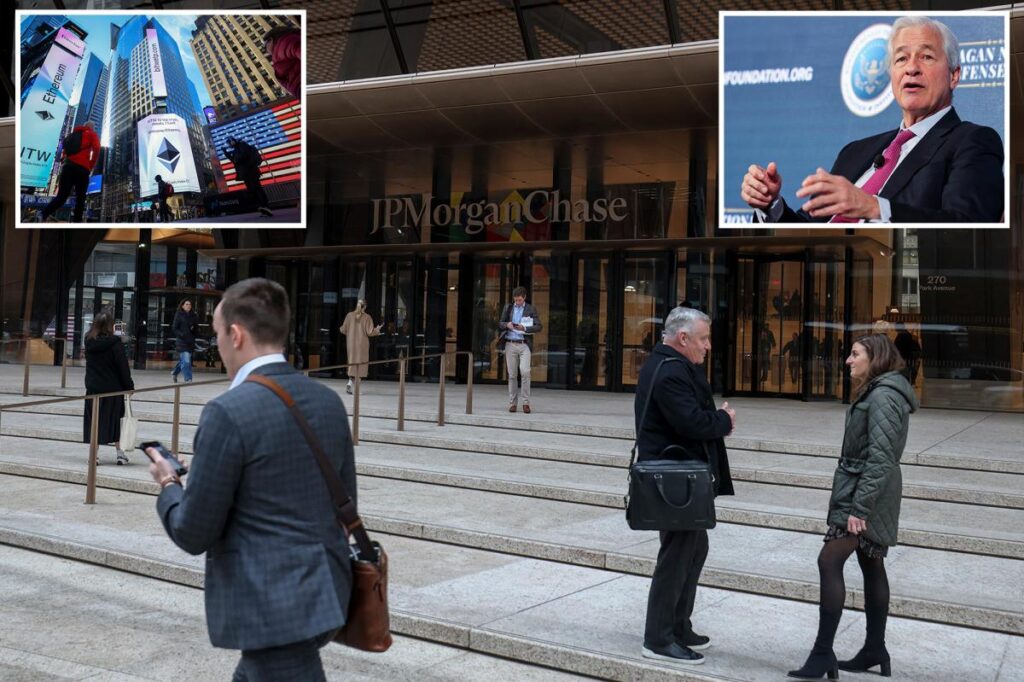

JPMorgan Chase — whose CEO Jamie Dimon once dismissed bitcoin as a “fraud” and likened cryptocurrencies to a “Ponzi scheme” — is diving further into crypto with a money-market fund that’s based on blockchain.

The bank’s asset-management division, which handles $4 trillion, will start the Wall Street giant’s first tokenized money-market fund — this one on the Ethereum network — with $100 million of its own money, the Wall Street Journal reported.

The fund — called the My OnChain Net Yield Fund, or MONY — will be opened to outside investors on Tuesday, but it’s not aimed at the masses: The minimum investment is $1 million, and individuals need at least $5 million in investments to qualify. Institutions need at least $25 million.

A money-market fund is like a safe savings option that invests in short-term debts from governments or companies, earning a bit more interest than a regular bank account.

A fund is referred to as “tokenized” when those assets are turned into digital tokens on a blockchain, a giant online record-keeping system that does not need a central bank or company to manage it.

Ethereum is one of the main blockchain networks. Investors can buy into the fund through JPMorgan’s online portal and get digital tokens in their crypto wallets, which are like digital storage for online money.

They can use cash or USDC, a stablecoin that holds a steady value tied to the US dollar, issued by Circle Internet Group. The fund pays interest and dividends daily, just like traditional ones.

This move comes after the Genius Act passed earlier this year, setting rules for stablecoins and sparking more tokenization of stocks, bonds, funds, and real estate.

“There is a massive amount of interest from clients around tokenization,” John Donohue, head of global liquidity at JPMorgan Asset Management, told the Journal.

“And we expect to be a leader in this space and work with clients to make sure that we have a product lineup that allows them to have the choices that we have in traditional money-market funds on blockchain.”

Money-market funds have grown popular, with total assets at about $7.7 trillion now, up from $6.9 trillion at the start of 2025, according to the Investment Company Institute.

Stablecoins have a market value of over $300 billion, according to data compiled by CoinGecko.

Tokenized funds appeal to crypto users because they earn yields while staying fully on the blockchain, avoiding idle cash in stablecoins that do not pay interest.

For managers, it reduces costs and speeds up deals. Some funds serve as collateral on crypto exchanges, helping to attract new clients to digital assets.

JPMorgan’s move highlights a shift in its approach to digital assets, despite past criticisms from Dimon, its long-serving chief executive.

In January 2023, he called bitcoin “a hyped-up fraud, it’s a pet rock,” and once branded crypto tokens “decentralized Ponzi schemes.”

The veteran banker has said blockchain technology itself is real and useful, separate from cryptocurrencies like Bitcoin. Other firms are doing similar things.

BlackRock runs the biggest tokenized money fund with over $1.8 billion. In July, Goldman Sachs and Bank of New York Mellon teamed up to create tokens for funds from BlackRock, Fidelity, and others.

JPMorgan recently tokenized a private-equity fund for rich clients.

Companies like Robinhood, Kraken, and Gemini launched tokenized stocks and exchange-traded funds for investors outside the U.S. earlier this year.

The post JPMorgan launches new crypto fund for wealthy investors — after Jamie Dimon called bitcoin a ‘fraud’ and ‘Ponzi scheme’ appeared first on New York Post.