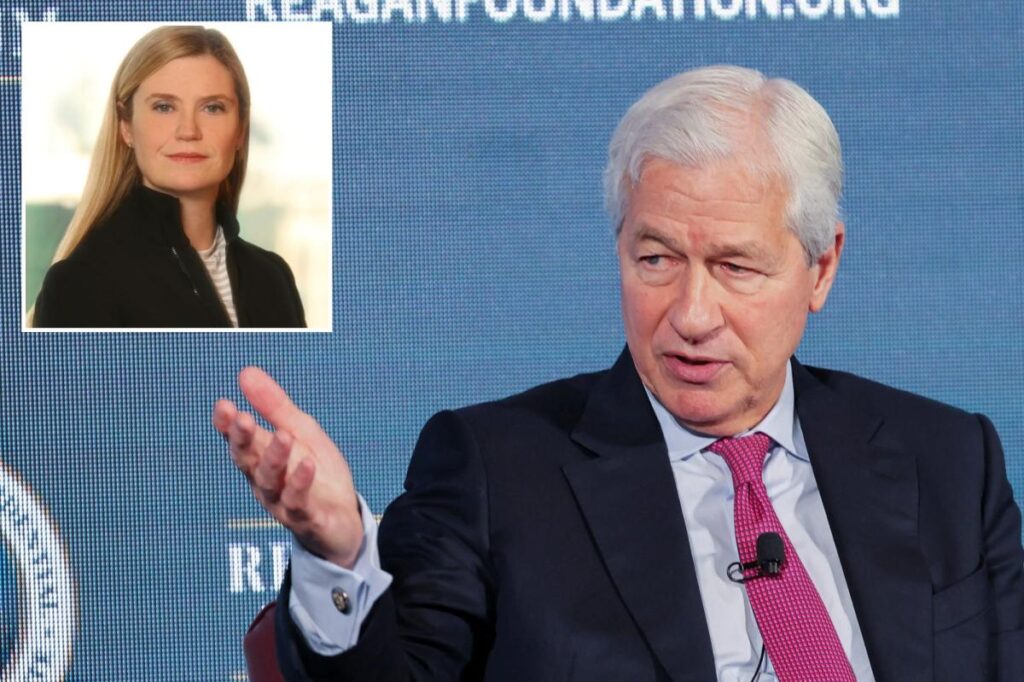

One of the execs considered a possible successor to Jamie Dimon as JPMorgan’s CEOwarned Tuesday that the bank expects to spend a higher-than-expected $105 billion next year, sending shares lower.

Marianne Lake, the US financial giant’s head of consumer and community banking, told a major banking conference in the Big Apple that “volume and growth-related expenses” were the biggest drivers of the higher costs.

The British-American banker also pointed to strategic investments and what she called the “structural consequence of inflation” as the cause of the expected increase in costs.

She cited incentive compensation for advisers, product marketing, building branches and investing in artificial intelligence as examples of why the lender needs to spend more money to grow its business.

Analysts, on average, expect JPMorgan’s expenses to total $100.84 billion next year, according to LSEG data.

JPMorgan shares were down about 4% in afternoon trading on Tuesday, sitting at $302.84 just before the closing bell on Wall Street.

That echoed a similar episode in 2022, when the firm’s cost guidance drove shares down. It prompted Dimon and his executive team to host an investor day to clarify their spending plans.

Lake hinted that JPMorgan’s investment-banking fees could rise by a percentage in the “low single digits” from a year earlier.

Analysts have been expecting a 6.3% jump. Trading revenue, meanwhile, could climb by a percentage in the “low teens,” according to Lake.

In the first nine months of this year, the bank’s investment banking fees rose 11% and trading revenue jumped 20%.

M&A bankers were optimistic in the wake of President Donald Trump’s election, but their outlook soured after his sweeping tariff announcements in April.

Dealmaking appetite returned in the third quarter and has continued into the last three months of the year.

On the US economy, JPMorgan’s Lake said consumers and small businesses look healthy, but that the environment is “a little bit more fragile.”

“There’s less capacity to weather an incremental stress,” she added. “Cash buffers have normalized, and price levels absolutely are high, even as inflation has come down.”

The post Top JPMorgan executive Marianne Lake, a possible Jamie Dimon successor, warns of higher costs for 2026 appeared first on New York Post.