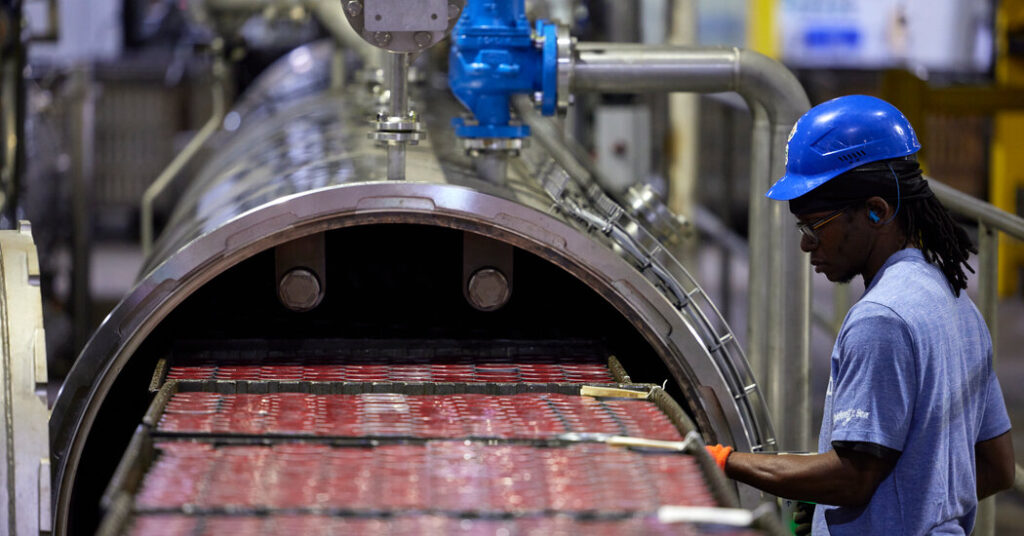

Before President Trump’s tariffs took effect this year, the Chicken of the Sea factory in Lyons, Ga., was running its production lines full speed, canning enough imported tuna to build up four to six months of inventory in warehouses around the United States.

It was an effort to mitigate the effect of tariffs, and it worked — temporarily. But once the president imposed those high levies globally, the costs of the fish, olive oil and steel cans the factory needs all rose. Production has now slowed, with the factory cutting its operating hours to four days a week instead of five. Chicken of the Sea has sold off all the inventory it had stockpiled before the tariffs. Company executives say that has left them with few options other than raising prices, unless they can secure a tariff reprieve.

“It is squeezing us, and it forces us to really make some tough decisions,” said Andy Mecs, the president of Chicken of the Sea International. “Inevitably, I think you will see some inflation coming if we don’t see some relief pretty soon.”

A move by the Trump administration last month to exempt tariffs on some products not made in the United States, like coffee and bananas, gave Chicken of the Sea and other importers paying tariffs some hope. The company and the Georgia lawmakers that represent its district have argued to White House officials that there should be tariff exemptions for foreign products that have no American substitute, like the frozen tuna that the company imports from Thailand, Vietnam, Ecuador and Indonesia. The type of tuna typically used for canning is caught in warm waters around the Equator.

“It’s not like there’s just tuna swimming along in Ohio,” Mr. Mecs said. About tariffs, he added, “I would hope that we have hit the high-water mark, and we’re on the way down.”

Since Mr. Trump’s exemptions, a wave of companies have begun petitioning officials in Washington for similar relief. Businesses that depend on foreign materials — from factories that import machinery to retailers selling artificial Christmas trees — argue that tariffs on their products are simply raising consumer prices and adding to Americans’ dissatisfaction with the economy, rather than encouraging more manufacturing in the United States.

The petitions have raised questions about the strategic direction the president’s trade policy will take in the months to come. Mr. Trump has spent the past year introducing, pausing and then reinstating more tariffs than the United States had seen in nearly a century.

The Supreme Court is expected to soon decide whether many of Mr. Trump’s global tariffs were imposed legally. Some court watchers expect the justices to strike down the tariffs Mr. Trump imposed using an economic emergency law. While the president has many other options to reimpose tariffs, some executives are hoping that a loss at the Supreme Court would encourage the administration to target its tariffs more precisely at crucial goods, rather than nearly everything Americans import.

Everett Eissenstat, a partner at Squire Patton Boggs, a law and lobbying firm, said the administration appeared open to discussing more exemptions for products, like raw materials and machinery that U.S. factories need.

“I think it’s a natural occurrence, now that they’ve got a lot of these tariffs in place, that you’re going to start having more dialogue about how they’re being implemented,” said Mr. Eissenstat, who was an economic adviser to Mr. Trump in his first term.

The effect of tariffs on consumer prices was initially somewhat muted but has become more obvious over time. Trump officials continue to publicly deny that tariffs are raising prices.

But in October, researchers at the Federal Reserve Bank of St. Louis wrote that prices of durable goods affected by tariffs had “increased notably,” concluding, “Tariff measures are already exerting measurable upward pressure on consumer prices.” High prices have weighed on the president’s approval ratings and aided Democrats in elections across the country last month.

Trump officials have portrayed new tariff exemptions as a positive, arguing that the administration’s success in striking more than a dozen trade and investment deals with countries including Japan, Switzerland and El Salvador has created room to make such adjustments.

Kush Desai, a White House spokesman, said the goods that had been exempted “largely cannot be physically grown or extracted in the United States.”

“Comparative disadvantages can be overcome with innovation and investment, but weather patterns prohibiting the cultivation of cinnamon and saffron cannot,” he added.

So far, exemptions have been offered only for a tiny portion of Mr. Trump’s tariffs. An analysis by the Peterson Institute for International Economics found that exemptions announced in November on coffee, bananas, cocoa beans, tomatoes and other products would save each American household just $35 a year, compared with an added annual cost of $1,700 for Mr. Trump’s tariffs overall.

Ed Gresser, a former U.S. trade official who is the director for trade at the Progressive Policy Institute, described the exemptions as “a cosmetic gesture.”

Mr. Trump previously called himself the “affordability president” and hailed his efforts to cut prices. But in a cabinet meeting on Tuesday, he downplayed cost-of-living issues, declaring that affordability “doesn’t mean anything to anybody.” He called the issue a “fake narrative” created by Democrats.

Elsewhere, the president has reiterated his belief in the benefits of taxing imports. “Tariffs have made our Country Rich, Strong, Powerful, and Safe,” Mr. Trump wrote on Nov. 29.

While the administration has laid the groundwork for more exemptions to the “reciprocal” tariffs it placed on other countries, it is also steadily expanding other tariffs, such as levies on the steel and aluminum contained in a vast array of imported goods, including balance beams and cans of condensed milk. And it is still weighing new tariffs on semiconductors and electronics, critical minerals, medical devices and other products.

Kelly Ann Shaw, a partner at Akin Gump and a White House official in the first Trump administration, said that “some degree of tariff recalibration was always part of the plan.” However, she cautioned that these more minor adjustments should not be mistaken for “a pivot.”

Given the strength of the stock market and economic growth figures along with the billions in promised foreign investment, Ms. Shaw said, the Trump administration has “good reason” to believe its economic policies are working, and little reason to change them.

“From their perspective, they’ve bucked all orthodoxy and landed the plane,” she said.

The cost of ignoring comparative advantage

When Trump officials first imposed broad-brush tariffs globally this year, they insisted there would be no exemptions and no exclusions. It was an effort to avoid an onslaught of requests by companies to carve the levies up.

In Mr. Trump’s first term, companies applied for hundreds of thousands of tariff exemptions with the help of Washington’s high-priced law firms. Especially initially, the process was often criticized as opaque, unfair and messy, though it gave some companies what they considered to be an essential lifeline.

In Mr. Trump’s second term, some influential companies and industries have been given lucrative exemptions from tariffs. But most firms have been forced to pay them, regardless of whether the product they import can be produced in the United States or not.

While the idea of using tariffs to protect strategic manufacturing has growing support, many economists and executives have condemned putting tariffs on products Americans can’t or won’t make themselves. They say there is a high cost to ignoring the law of comparative advantage — an economic principle that says that some countries are better suited to making certain products than others, and that everyone can be better off if nations specialize in what they’re good at and trade for the rest.

Mac Harman, the founder of Balsam Brands, which sells holiday décor, said he understood the Trump administration’s push to make strategic goods like minerals or syringes in the United States. But he questioned tariffs on artificial trees with pre-strung lights, which he said had never been made in America.

Ever since pre-lighted trees were created, they had been made overseas, first in Thailand and then in China, he said. American workers simply don’t want to do the job, he said.

“The U.S. is really developed, so we should be doing advanced manufacturing,” he said.

Like other companies contending with double-digit tariffs, Mr. Harman made tough choices this year. The company raised prices more than 10 percent on average, laid off 10 percent of its work force, suspended office lunches and canceled expansion plans. It stopped ordering certain high-tariff goods, like snow globes and fancy lights.

Like Chicken of the Sea, Balsam Brands had stockpiled inventory before levies took effect — a trick companies will not presumably be able to repeat next year.

The firm is still feeling the effects. Higher prices and fewer products on the shelves mean the company’s sales are 8 percent in the United States this year, compared with double-digit growth in France, Germany, Australia, Canada and Britain, Mr. Harman said.

Mr. Harman said Washington officials he had spoken with had concerns about consumer sentiment and whether affordability during the holidays would become a political issue. He expressed hope that a ruling against the president’s tariffs at the Supreme Court could provide an opening for broad-brush tariffs to be replaced with more narrowly focused levies.

“I think there’s really good reasons to do it,” he said of imposing tariffs. “I just don’t think it should be on nonstrategic goods that have never been made in the U.S., like Christmas trees.”

Ana Swanson covers trade and international economics for The Times and is based in Washington. She has been a journalist for more than a decade.

The post Have Trump’s Tariffs Hit the ‘High-Water Mark’? appeared first on New York Times.