Both President Donald Trump and Chinese President Xi Jinping declared victory after their recent meeting in South Korea, which resulted in a one year truce in the economic war between the two superpowers. Yet the thaw hides a harsh reality: the United States and China did not return to the status quo ante but entered a new phase in which Beijing has gained the upper hand. To rectify this situation, Washington needs to understand what went wrong—and use the truce, however long it lasts, to strengthen its hand when the next escalation inevitably occurs.

[time-brightcove not-tgx=”true”]

It didn’t have to be this way. The pivotal moment came when Trump briefly imposed 145% tariffs on China in April. These soaring duties were designed to halt trade, force manufacturers to leave China, and coerce Xi into submission. They broke the seal on true “decoupling” between the two economies, with Treasury Secretary Scott Bessent conceding in April that the tariffs were “the equivalent of an embargo.”

Trump was unprepared and wrongly assumed that American tariffs were an unbeatable weapon because our large trade deficits—nearly $300 billion with China in 2024—enable Washington to impose broader tariffs on adversaries than they can impose in response. The duties swiftly sent the U.S. stock market plunging and intensified fears of a recession at home. The Trump Administration just as quickly dropped them.In the following months, China’s exports to the United States nosedived, but the country managed to expand its total exports and found new markets for over 80% of the goods it previously sold to the U.S. Trump had played what he believed was his best card: sky-high tariffs. And it turned out to be a dud.

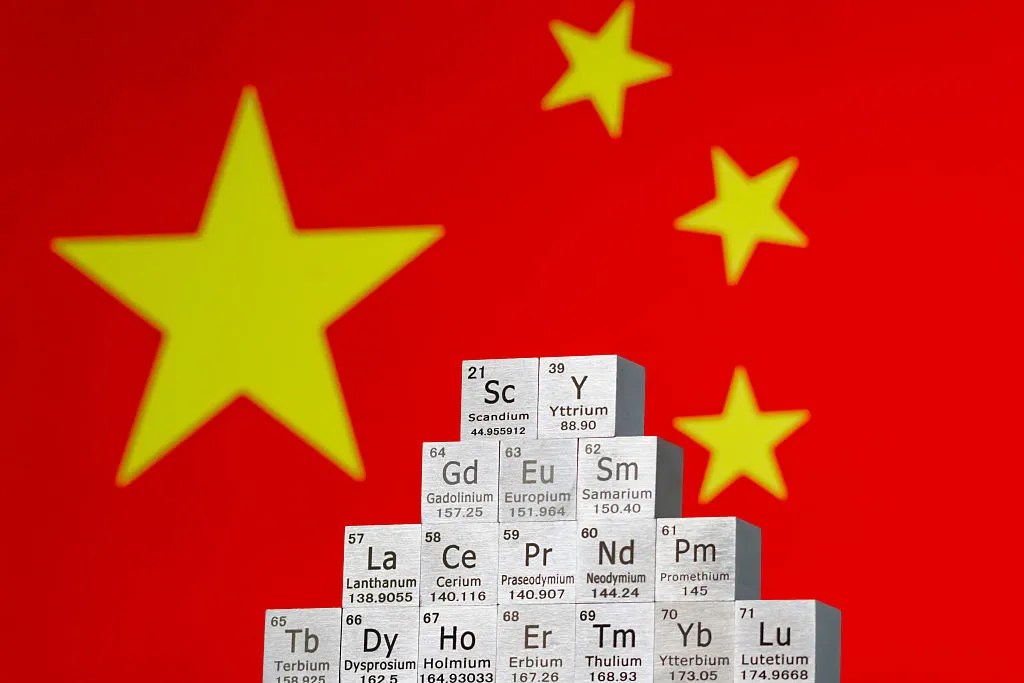

Although this moment is often overlooked in the United States, Trump’s abortive experiment became a turning point for Beijing, which vowed to “fight to the end.” Beijing responded by weaponizing its most powerful chokepoint: the critical minerals and magnets essential to modern industry, a sector in which China has a near-monopoly. In two phases—first in spring, then in autumn—Beijing ramped up a policy designed to control the global industries that depend on these Chinese inputs, from car manufacturing to clean energy. The impact was immediate. “We have had to shut down factories,” Jim Farley, Ford’s Chief Executive Officer, bemoaned, “It’s hand-to-mouth right now.”

Before his Oct. 30 meeting with Xi, Trump admitted that his threat of an additional 100% tariff on China was “not sustainable.” In contrast, Xi had played his best card—and it succeeded beyond his wildest dreams. Trump’s approach to China has run aground, giving Beijing unprecedented advantage in the economic conflict. Remedying this perilous situation will require a degree of discipline and ingenuity that the Trump administration has lacked to date.

The price America paid

The geopolitical consequences have been significant. By agreeing to delay its new critical minerals policy by a year—in effect, leaving the weapon on the table and promising not to use it as long as the U.S. behaves—Beijing has managed to entrap Washington in an open-ended negotiation in which both sides are acting as ifChina has the upper hand. Even if the U.S. pursues its usual China policy—supporting Taiwan in line with its longstanding commitments or penalizing Beijing for supporting Russia’s brutal war in Ukraine—the Chinese government may again try to exercise a veto by brandishing its rare earth chokehold.

To extricate ourselves from this predicament, the U.S. must intensify efforts to increase its supply chain security and industrial strength. In recent years, the United States has been gradually “de-risking” from China, including by investing in industrial policy at home, imposing tariffs on the most relevant Chinese exports such as electric vehicles, and restricting exports of the highest-risk items such as advanced semiconductors. This steady, methodical approach was working because the U.S. economy and society could bear the adjustments, many allies were on board, and it did not trigger a rapid escalation with China.

Today, this effort needs to accelerate, especially in pressing areas such as developing critical minerals supply chains that don’t rely on China. Washington’s recent investments in rare earth firms MP Materials and Vulcan Elements as well as minerals agreements with Australia and Southeast Asian countries are a good start. Yet even in the best-case scenario, America is likely three to five years away from breaking this Chinese chokepoint. De-risking alone is not enough.

The art of economic war

The U.S. needs a China strategy fit for purpose at a time when China has demonstrated an increased willingness to weaponize its leverage. Trump’s impulsive, go-it-alone approach is uniquely ill-suited to the long-term and cross-cutting nature of the challenge that China poses. The costs to the U.S. strategic position are already apparent.

China will be watching several areas closely. Will the U.S. make meaningful investments at home? How will Trump’s strained relationships with longstanding U.S. allies evolve? Beijing is especially focused on gauging whether the U.S. uses this break from brinksmanship to devise credible, hard-hitting escalation options that could be employed against China in the future. Beijing fears that Washington will deploy the threat of powerful chokepoints and retaliatory measures of its own—the kind of U.S. leverage that would make Beijing hesitate before wielding its critical minerals weapon again.

Despite its best efforts, China remains highly dependent on U.S. software and semiconductors. This year, the U.S. produced 25 times more high-end artificial intelligence chips than China, and Chinese AI start-up DeepSeek was forced to delay its latest model because of a shortage of semiconductors. Most significantly, China is still dependent on the dollar. Although it has tried to lessen its reliance on the greenback for over a decade, China continues to settle roughly two-thirds of its foreign trade in dollars.

Beijing is aware of its vulnerabilities. It worries that broader U.S. high-tech export controls could further constrict China’s access to older AI chips from firms like Nvidia, as well as to cloud computing services and chip design software that Chinese companies still rely on to build and train advanced AI systems.

China also fears that America could start wielding its most powerful chokepoint: the dollar. Beijing has been predicting an intensifying “financial war” for years. Yet despite years of rising economic confrontation, the U.S. still has not targeted any major Chinese company—not even perennial candidates such as the surveillance firm Hikvision—with full-blocking sanctions, which would cut them off from the dollar system entirely.

Thus far, Trump has been reluctant to use these more powerful levers to push back against Beijing, and has chosen to lean heavily on his preferred tool of tariffs. That is somewhat surprising, as he has seen first-hand how effective America’s chokepoints can be in delivering targeted, high-impact pressure. In 2018, Trump’s penalties on the Chinese telecommunications firm ZTE nearly put the company out of business and compelled Xi Jinping to appeal directly to Trump for a reprieve. There may, of course, be other reasons not to deploy these tools—such as the risk of collateral damage to diplomatic allies—but Trump has not been sensitive to such concerns in other policy areas.

The United States finds itself in a profoundly worrying strategic position. Unless Washington can signal a serious plan to counterpunch, Beijing will keep pressing its advantage. But this administration may simply not be equipped to take this on, given its propensity to shoot from the hip, Trump’s penchant for tariffs, and the lack of a rigorous policy process to weigh tradeoffs and assess risks. Without a meaningful China strategy, Washington will struggle to match Beijing’s determined, focused efforts to increase its own global influence and box in the United States.

And by the time Trump realizes that Beijing has outplayed him, it may well be too late.

The post How to Win the Economic War with China appeared first on TIME.