The public markets are thinning, the private markets are exploding, and AI is wholly destabilizing both.

Consider the past week’s software meltdown: AI fears and stalled market dynamics vaporized $1 trillion in market value, rippling down to private companies.

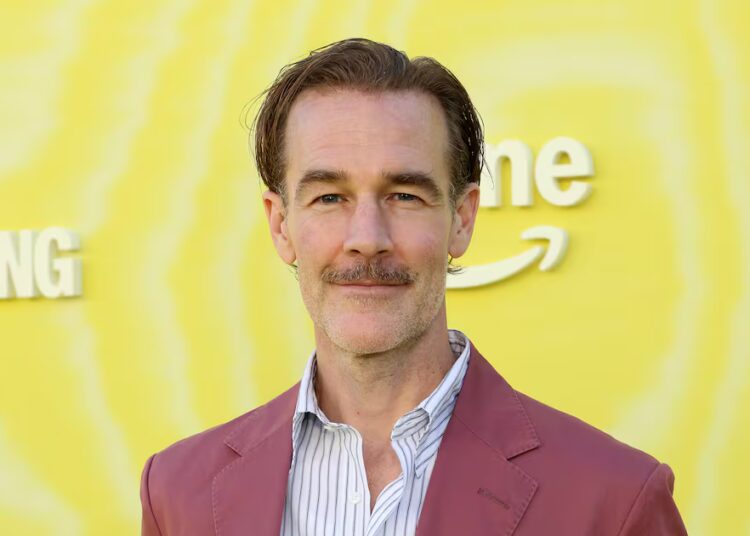

“The funding mechanism for the software LBO complex has short-circuited, IPO markets have been weak, and it’s gummed up the machinery,” said Paul Wick, chief investment officer at $30 billion investment firm Seligman. “There’s no more red line where software stocks won’t go below a certain point… It’s a psychological shift, as well. People are more fearful.”

Wick has long been watching the public and private markets intersect and diverge—he started investing in tech in the 1990s. In 1999, he first met Umesh Padval, then CEO at public semiconductor company C-Cube Microsystems. The pair kept in touch over the years, bonding over a shared love of wine and a realism about tech.

“I had wanted to do something in VC for a long time, but it’s hard to find the right people and the right opportunity,” said Wick. “And then Umesh was available.”

Seligman, today, is launching venture arm Seligman Ventures, a $500 million fund emphasizing early-stage AI investing, Fortune has exclusively learned. Padval—an early investor in Cohere, Relyance AI, Exaforce, and Harness—will lead the charge, joined by Ashish Kakran and Eddie Ackerman.

Unlike Lightspeed and Andreessen Horowitz which deploy billions, Padval is looking to stay considerably smaller: “I’ve always believed in the Benchmark-type model, stay in the $400 million to $800 million-range, build those companies, and get 10x from there. I’m a firm believer in not having too much money, because discipline goes away.”

The idea is for Wick and Padval, united under one LP, to share information, with Padval bringing what he sees early in the pipeline to Wick, and vice versa. To this end, Seligman Ventures will focus on AI infrastructure, cloud infrastructure, cybersecurity, and modern data center hardware. And it may seem counterintuitive, but from Wick’s seat: The real value is showing up early, before later-stage investors fun-house-mirror a company’s value.

“There’s a tendency for late-stage funding rounds to be aggressively valued, and the earlier-stage VCs love to see their investments marked up, so they don’t put up a fight,” said Wick. “But when you see these companies finally go public, their IPOs are not a resounding success. Many times, they’ll be at the same price four or five years ago. No one’s making money flipping IPOs. So, bringing Umesh and his colleagues on board with their focus on early stage resonated with me.”

Padval and Wick, in some sense, are trying to solve a problem that everyone is trying to solve: As companies stay private longer, swallowing more capital than ever, where does value actually lie?

A point in their favor is that, in a historic sense, the firm has been here before: Seligman has its roots in J. & W. Seligman & Co., an investment bank founded in 1864. And J. & W. Seligman & Co. helped finance the Panama Canal and railroads through the Industrial Revolution—another era when new tech was destabilizing markets faster than anyone could map them.

See you tomorrow,

Allie Garfinkle X: @agarfinks Email: [email protected] Submit a deal for the Term Sheet newsletter here.

Joey Abrams curated the deals section of today’s newsletter. Subscribe here.

The post Exclusive: Seligman Ventures debuts with $500 million and a new model for the blurring line between public and private markets appeared first on Fortune.