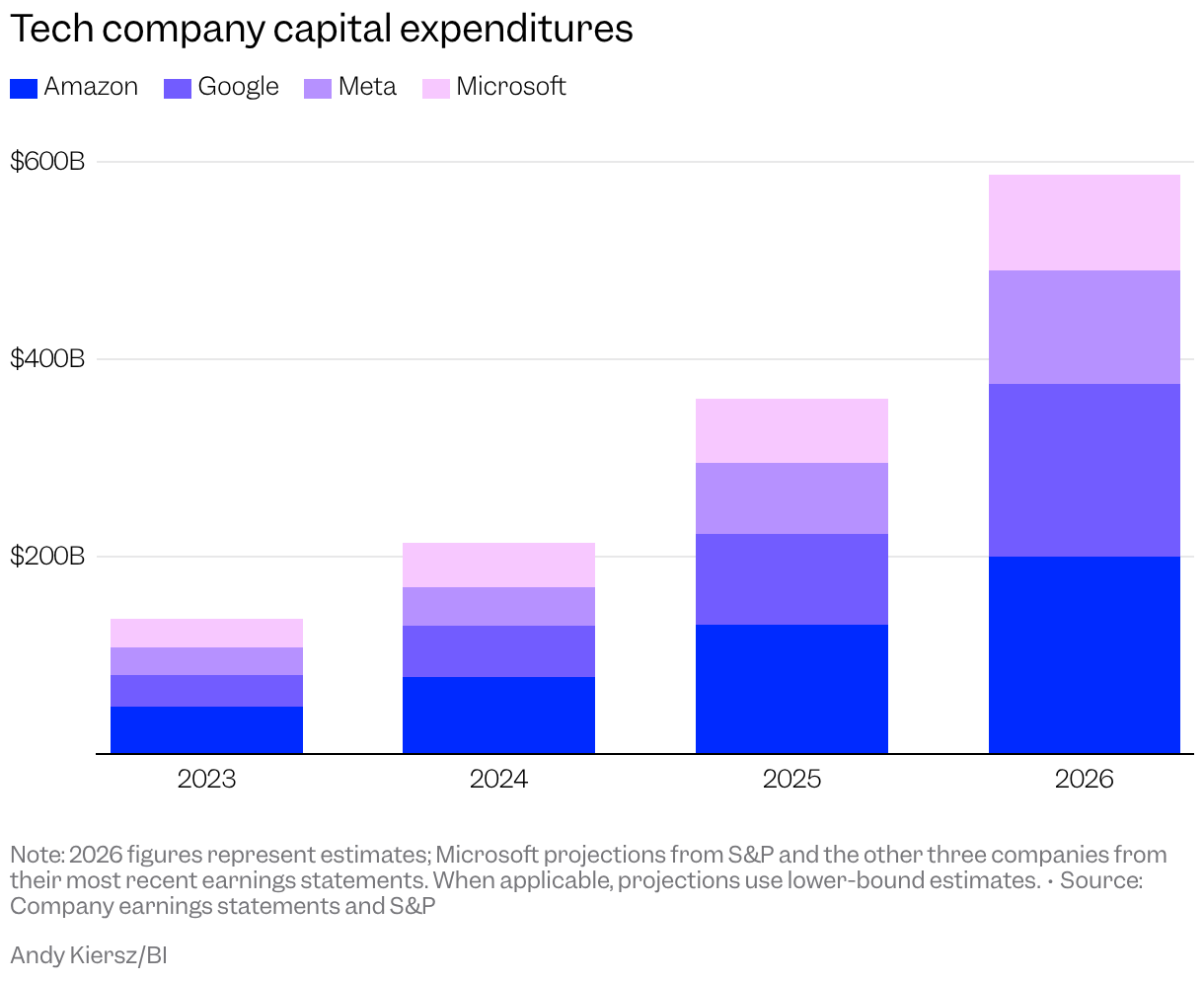

Big Tech’s latest capex projections have shocked investors. Look beneath the headline numbers, though, and spending may actually be growing far more slowly.

That’s according to new research on Monday from analysts at RBC Capital Markets.

Amazon, Google, Meta, and Microsoft are expected to spend almost $600 billion this year on data centers, chips, networking, and other related gear to meet surging AI demand.

On the surface, this may look like a relentless acceleration, but RBC’s analysis suggests these growth numbers are being flattered by an unusual culprit: runaway memory prices.

The RBC analysts found that soaring prices for data center memory chips — including DRAM, high-bandwidth memory (HBM), and NAND flash — could account for about 45% of the dollar growth in cloud capital expenditures for 2026. Crucially, most of that increase isn’t coming from companies buying dramatically more hardware, but from paying much more for the same components, the analysts said.

RBC estimates that data center memory spending across the top 10 hyperscalers will jump from about $107 billion in 2025 to roughly $237 billion in 2026. That $130 billion increase would represent about 45% of total capex growth at those companies. Even more striking, around three-quarters of the memory spend increase — roughly $98 billion — is attributable purely to higher prices, not higher unit volumes.

The price shock is severe. TrendForce projections cited by RBC show DRAM prices more than doubling in 2026, while NAND prices are expected to rise more than 85%. Memory has become one of the most constrained inputs in AI infrastructure, as advanced GPUs require large amounts of high-performance DRAM and HBM, while AI data centers consume massive quantities of flash storage.

When RBC strips memory out of the equation, Big Tech’s spending surge looks meaningfully different. Excluding memory costs, capex growth is projected to drop to about 40% in 2026, down from roughly 80% growth in 2025. That’s still a strong expansion, but far less explosive than the raw capex totals imply.

The analysts described this as “a notable deceleration,” while adding that “it’s not necessarily cause for alarm.”

RBC argued that underlying AI investment remains robust, but warned that memory pricing is now the biggest wild card for capex trends heading into 2027.

In effect, Big Tech may be spending vastly more on some equipment — without building proportionally more — as the AI arms race collides with an overheated memory market.

Sign up for Business Insider’s Tech Memo newsletter here. Reach out to me via email at [email protected].

Read the original article on Business Insider

The post Big Tech’s capex growth may be far slower than it looks appeared first on Business Insider.