A pet-supplies entrepreneur turned video-game retailer CEO who’s been dubbed the “Meme King” might seem an unlikely candidate for the next Warren Buffett.

But Michael Burry of “The Big Short” fame told Business Insider in a brief email that he sees Chewy cofounder and GameStop CEO Ryan Cohen as Buffett’s spiritual successor.

That’s because Cohen approaches business and investing in a similar way to Buffett, who retired as Berkshire Hathaway’s CEO at the end of last year.

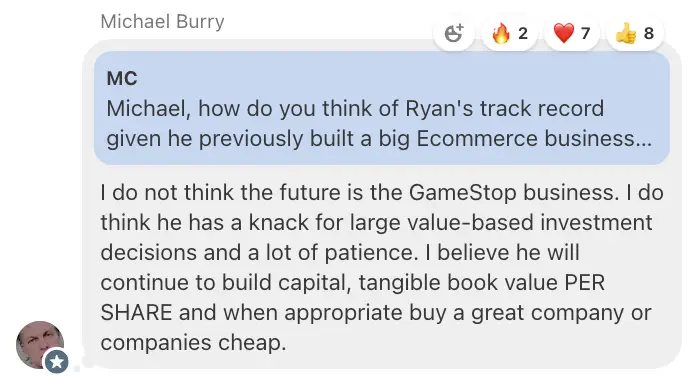

Burry — who shifted from running a hedge fund to writing on Substack late last year — has drawn parallels between Cohen and Buffett, and made the case for applying the Berkshire playbook to GameStop, in recent posts and replies to reader comments.

In a December post, Burry recalled his first phone call with Cohen in October 2019, after both value investors had built sizable stakes in beaten-down GameStop.

Cohen said it didn’t bother him if an investment took years to pay off, signaling to Burry he was “more patient than most.”

“I believed he possibly had the temperament to be the next Buffett, but I did not get to know him that well,” Burry wrote.

Embracing the Buffett model

Cohen told Business Insider in October 2020 that Buffett was one of the “two biggest influences on my professional life,” along with his father.

He credited the legendary investor with shaping his ability to think independently, be greedy when others are fearful, and exercise discipline in capital allocation.

Cohen showed Buffett-style conviction and concentration when, after selling Chewy for more than $3 billion in 2017, he plowed virtually all of his wealth into two Berkshire favorites: Apple and Wells Fargo.

After leaving Chewy, Cohen pivoted to activist investing. He revealed a stake in GameStop in the fall of 2020 and parlayed it into a board seat in January 2021.

His appointment, coupled with Burry’s previous endorsement of the stock, helped galvanize retail traders to turn GameStop into the first meme stock of many.

They catapulted the shares up as much as 2,500% by late January 2021, valuing the retailer at $34 billion at the peak — roughly triple its market cap today.

Cohen became GameStop’s chairman in June 2021 and was appointed CEO in September 2023. He telegraphed Buffett-like ambitions in December 2023, when the board gave the green light for the company to invest in stocks and handed control of its securities portfolio to Cohen.

Signaling his ambitions, GameStop’s investor-relations page has been revamped to mimic Berkshire’s famously spartan website.

Since taking charge of GameStop, Cohen has urged frugality, one of Buffett’s signature values. Cohen doesn’t take a salary, echoing Buffett, who received a modest $100,000 salary as Berkshire CEO for over 40 years.

Similar to Buffett, who keeps more than 99% of his personal wealth in Berkshire stock, Cohen has significant “skin in the game” as GameStop’s largest individual shareholder with a roughly 9% stake.

Also like Buffett, Cohen has many loyal and passionate shareholders who trust him to make the right calls. He has capitalized on that support by issuing shares, 0% convertible debt, and short-term warrants, boosting GameStop’s cash pile to around $9 billion as of November 1.

“What he has done at GameStop in terms of governance, divestiture, and clever accretive dilution through capital raises strikes me as a decent throwback model of Buffett,” Burry wrote on Substack.

Big-game hunters

Understanding what Cohen is cooking up, and why Burry sees shades of Buffett, requires some knowledge of Berkshire’s history.

Over six decades, Buffett transformed Berkshire from a failing textile mill into a $1 trillion conglomerate that owns scores of businesses, including Geico and BNSF Railway, and holds multibillion-dollar stakes in Coca-Cola, American Express, and other public companies.

Buffett and his late business partner, Charlie Munger, structured Berkshire as a web of decentralized, autonomous businesses to allow them to focus on allocating capital between subsidiaries, outside investments such as stocks, and other deals.

They also acquired insurers such as National Indemnity that generate “float” — cash left over after premiums are collected and claims are paid — which they used to make further acquisitions and investments.

As Berkshire expanded, it became harder for Buffett to find needle-moving deals, forcing him to spend more and more of his time “elephant hunting.”

Similarly, Cohen has said in recent days that he’s seeking to make a “transformational” acquisition. He told The Wall Street Journal that he wants to grow GameStop’s market value from about $11 billion today to more than $100 billion, and has a deal in mind that’s “either going to be genius or totally, totally foolish.”

Cohen told CNBC that he envisioned GameStop buying a much larger company than itself — one that’s undervalued, high quality, and has “sleepy” management. He said the right transaction could pave the way for GameStop’s valuation to reach “several hundreds of billions” over time.

Burry wrote on Substack that he expects Cohen to strike deals that will “fundamentally change” the company, leaving GameStop as a “vestigial” limb of a much larger enterprise.

He proposed that Cohen might buy a company like Berkshire-owned See’s Candies. Buffett has called the boxed-chocolate seller his “dream business” because it has modest capital needs, possesses brand-driven pricing power, and provides excess cash for future investments.

Burry sketched out how GameStop might acquire a trio of businesses: ADT, Wayfair, and Assured Guaranty. He dubbed the approach “Instant Berkshire,” which he defined as “creating a portfolio of great companies that generate excess capital or float for additional investment beyond what is required for their growth.”

Imagining himself in Cohen’s shoes, Burry wrote that he would close a deal like that, then “proceed to live my life doing my best Warren Buffett impression. Patiently buying all or in part great businesses and doing sweetheart financing deals in tough times.”

‘Tremendous optionality’

Cohen’s compensation package was revamped this month to include several performance-based milestones. He now stands to earn stock awards potentially worth up to $35 billion if he can lift GameStop’s market value by nearly 10-fold to $100 billion, and boost its annual adjusted profits to $10 billion. The company made $179 million by that measure in the nine months to November 1.

Burry flagged on Substack the risk of capital misallocation, or Cohen cutting the wrong deal. But he said that he’s been adding to his GameStop stake in recent weeks, calling the stock a rare bargain.

“I believe GME gives me tremendous optionality in a young properly incentivized CEO/chairman with the right mindset to do something special,” he wrote. “It seems to me far less speculative than most stocks in the market today.”

Burry added that GameStop trades close to its tangible asset value, so that betting on it is “almost as asymmetric as it gets these days” in US stocks.

GameStop’s shares are up 24% this year but have whipsawed in recent days. They closed at around $25 on Friday, down 80% from their meme-stock peak in January 2021.

David Kass, a finance professor at the University of Maryland and longtime Buffett blogger, told Business Insider that Cohen has an “outstanding track record” of investments to date.

“Although there is only one Warren Buffett, Ryan Cohen has the potential to succeed following a similar game plan,” he added.

Larry Cunningham, the author of several books about Buffett and the director of the University of Delaware’s Weinberg Center, told Business Insider that it would be extremely challenging for anyone to emulate Buffett’s singular career.

“History counsels caution in anointing any ‘next Buffett,’ since his record reflects a rare mix of temperament, discipline, structure, and historical circumstance that is essentially impossible to replicate,” he said.

As a longtime Buffett acolyte himself, Burry knows what a daunting comparison he’s made — but nonetheless sees an opportunity for Cohen to pursue a familiar yet unprecedented path.

“Just about every investor that knows Buffett’s story well has thought of doing something like this,” Burry wrote. “I believe this is the first time someone is poised to do it — and is doing it in a most unusual and fairly ingenious way.”

Read the original article on Business Insider

The post Why ‘Big Short’ investor Michael Burry’s pick for the next Warren Buffett is GameStop’s Ryan Cohen appeared first on Business Insider.