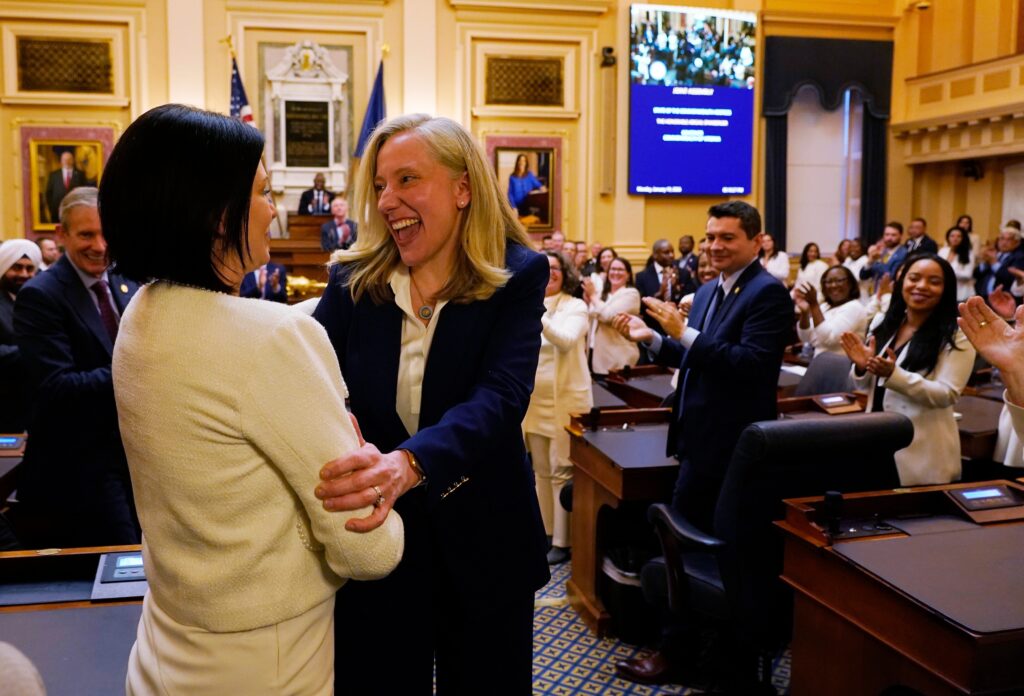

Virginia Gov. Abigail Spanberger (D) won November’s election as the “affordability” candidate, so much so that she once used the word 37 times during a news conference. With major tax increases potentially headed to her desk, the new governor will soon have a chance to show how serious she is about making her state more affordable.

The commonwealth’s income tax brackets have not been adjusted for inflation in decades, and the current top rate of 5.75 percent kicks in at just $17,000 of income. One way to help all Virginians would be to modernize the brackets and peg them to inflation. Instead, pending legislation would keep them the same and add two new brackets: an 8 percent state tax on income from $600,001 to $1 million and 10 percent on incomes over $1 million.

A separate bill would create a new tax of 3.8 percent on investment income for people with incomes over $500,000. If that and the new income tax brackets pass, Virginia’s top rate on investment income would become the highest in the nation.

“Soak the rich, even more than California” was not Spanberger’s vibe on the campaign trail. Jacking up taxes on high earners doesn’t make life more affordable for others. To the extent that higher taxes reduce investment, they’ll also reduce jobs and economic growth. Progressives should understand that many of the taxpayers they’re apparently trying to run out of Virginia are not plutocrats. They’re pass-through small businesses: mom-and-pop shops, pillars of local communities.

What’s especially mind-blowing is that Virginia is not even starving for revenue. The commonwealth ended fiscal year 2025 with a nearly $2.7 billion surplus and beat revenue projections by $572 million. The income tax specifically beat projections by over $300 million last year after beating projections by over $1 billion the year before.

Virginia has had so much income tax revenue in recent years that it sent rebates back to taxpayers in 2023 and 2025 while also increasing teacher pay, funding major highway improvements and maintaining a rainy-day fund of over $4 billion.

If Virginia Democrats forge ahead with tax hikes, they would be bucking a national trend. Most states have seen revenue beat expectations in recent years, and many have cut income taxes in response. In fiscal year 2026 alone, 22 states have enacted net reductions in individual income tax revenue. Only four have enacted net increases.

Going out of their way to raise taxes would a strange starting point to making life more affordable.

The post Step one on ‘affordability’ can’t be tax hikes appeared first on Washington Post.