The House voted Wednesday to block D.C. from decoupling its local tax code from President Donald Trump’s federal tax cuts — an action that city officials warned would cause the nation’s capital to lose out on hundreds of millions of dollars in revenue and require it to suspend the local tax filing season for months.

The GOP measure, known as a disapproval resolution, passed on a party-line vote of 215 to 210.

If it passes in the Senate, the effort would mark the second consecutive year in which D.C. is facing a financial hurdle during its annual budget season because of congressional action — a unique challenge with which no other city must contend.

The disapproval resolution blocks D.C. from opting out of various provisions of Trump’s One Big Beautiful Bill in its local tax code, a step the D.C. Council took in November to boost revenue by roughly $600 million through 2029. The council also committed a portion of the anticipated revenue to funding a local child tax credit, which would make D.C. the first city in the nation to do so, and an expanded earned income tax credit.

Numerous other states have divorced their own tax codes from Trump’s tax cuts, but because D.C. is the federal district, Congress has the constitutional authority to block actions by the local legislature.

The D.C. Council’s decision to opt out meant that residents would not be able to benefit from various exemptions that were part of the sweeping budget legislation when it came to their D.C. tax filing; their federal returns would not be affected. Republicans said they wanted to ensure that Washingtonians would benefit from the exemptions — including no tax on tips, overtime wages and auto loan interest. Other exemptions help seniors and businesses.

“Simply put, the District of Columbia Council doesn’t want its citizens to benefit from the largest working families tax cut in American history,” Rep. Brian Jack (R-Georgia) said on the House floor during a Tuesday debate.

The consequences of the GOP proposal — which Del. Eleanor Holmes Norton (D-D.C.) called “fiscal sabotage” — would be significant for the city, D.C. officials warned in letters to Congress this week. In addition to eliminating more than $600 million in revenue expected through 2029, they said, the measure would cause administrative chaos. The city’s chief financial officer said D.C.’s tax office would have to suspend its tax filing system for months and push local filing deadlines into the fall. Those changes would mean millions in additional expenses for the city, Chief Financial Officer Glen Lee said.

“People have already filed their taxes,” D.C. Council member Christina Henderson (I-At Large) said at a council meeting Tuesday. “We would have to say, ‘Sorry, go back.’”

The council’s legislation decoupling the city’s tax code from the One Big Beautiful Bill came after warnings about the city’s economic trajectory and a revenue shortfall amid high unemployment and federal job cuts. The council’s move garnered some pushback, given that lawmakers were acting on an emergency basis without a public hearing over major tax legislation, while committing the anticipated revenue in part toward a new policy even as some thought it wiser to keep the money in the bank.

Rep. Brandon Gill (R-Texas), who sponsored the disapproval resolution, called the D.C. Council’s bill “anti-working class, anti-senior citizen and anti-business,” requiring Congress to step in.

“They would rather punish their own residents, their own people, than recognize the achievements of President Trump’s legislation,” Gill said.

The D.C. Council’s budget director, Jen Budoff, made the case at a council meeting Tuesday that the new local tax credits would offer residents more tax relief than the One Big Beautiful Bill.

The child tax credit would offer families up to $1,000 per child depending on household income, and a separate earned income tax credit would benefit residents making under $60,000. The policies combined would cost about $239 million through 2029.

“What the congressional action would do is cost working families, low-income families, more money,” said council member Charles Allen (D-Ward 6). “We need be very clear about that.”

Erica Williams, executive director of the left-leaning DC Fiscal Policy Institute, said the disapproval resolution would mean the city would have to “backtrack on addressing child poverty,” as well as “broken promises to thousands of households during uncertain economic times.”

“We faced declining revenue due to a local recession caused by massive federal layoffs,” Williams said. “Decoupling saved us much-needed revenue, and with a portion of that revenue, we were able to expand the D.C. earned income tax credit and adopt a local child tax credit, two proven tools for tackling poverty, reducing racial inequities and boosting inclusive economic growth.”

Both policies could reduce child poverty in D.C. by 20 percent, according to an unpublished analysis that the DC Fiscal Policy Institute commissioned from Columbia University and summarized in a December blog post.

D.C. Council Chairman Phil Mendelson (D) also said the resolution could affect D.C.’s bond rating, which was downgraded by Moody’s last year. The ratings agency cited the Trump administration’s massive federal job cuts and uncertainty over whether Congress would cut Medicaid — two factors outside local officials’ control. Congressional interference has the potential to further erode rating agencies’ confidence in the city’s ability to meet financial obligations, Mendelson said.

It is the second straight year that the D.C. government has sparred with Republicans in Congress over budgeting matters; in 2025, GOP lawmakers omitted routine language from a spending bill, blowing a hole in the city’s active budget that ended up forcing D.C. officials to cut $350 million in spending midyear.

Republicans in Congress have in recent years expressed increasing interest in D.C. affairs, introducing dozens of bills to tackle local issues — including a slate of legislation that would overhaul criminal justice policies and remove the city’s locally elected attorney general.

But it is still rare for Congress to successfully block or amend a D.C. law. The last time Congress did so was 2023, when both chambers prevented a major overhaul of the city’s criminal code that federal lawmakers cast as too lenient on crime. That effort was bipartisan, and then-President Joe Biden signed the bill. That same year, a separate effort to block police reform legislation was unsuccessful because Biden vetoed the measure after it passed both chambers of Congress.

Advocates for D.C. autonomy say the ongoing congressional effort illustrates the consequences of federal control over the District; because Congress is given exclusive authority over D.C. under a law called the Home Rule Act, local legislation is subject to congressional approval.

“This moment underscores a hard truth,” said Stasha Rhodes, public affairs director at D.C. Vote, which advocates for D.C. statehood. “As long as D.C. is not a state, its laws and its residents remain vulnerable.”

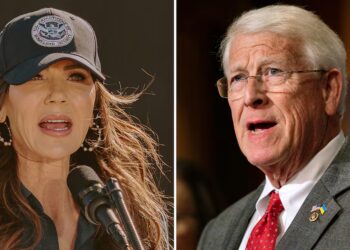

The disapproval resolution advanced out of a Senate committee on Wednesday, clearing the way for a potential vote in the Senate, where Sen. Rick Scott (R-Florida). is leading the effort. The disapproval resolution would not be subject to the filibuster and would need only a simple majority to pass.

The post House rejects D.C. tax changes, potentially costing the city $600M in revenue appeared first on Washington Post.