Elon Musk has long insisted Tesla isn’t a car company. After its latest earnings, it looks less like one than ever.

The billionaire told investors that Tesla would scrap its Model S and X EVs and convert their production lines to build the company’s Optimus humanoid robot, as it continues to shift toward AI and robotics.

Tesla also said it had agreed to invest $2 billion in xAI and to evaluate “potential AI collaborations” with Musk’s AI startup.

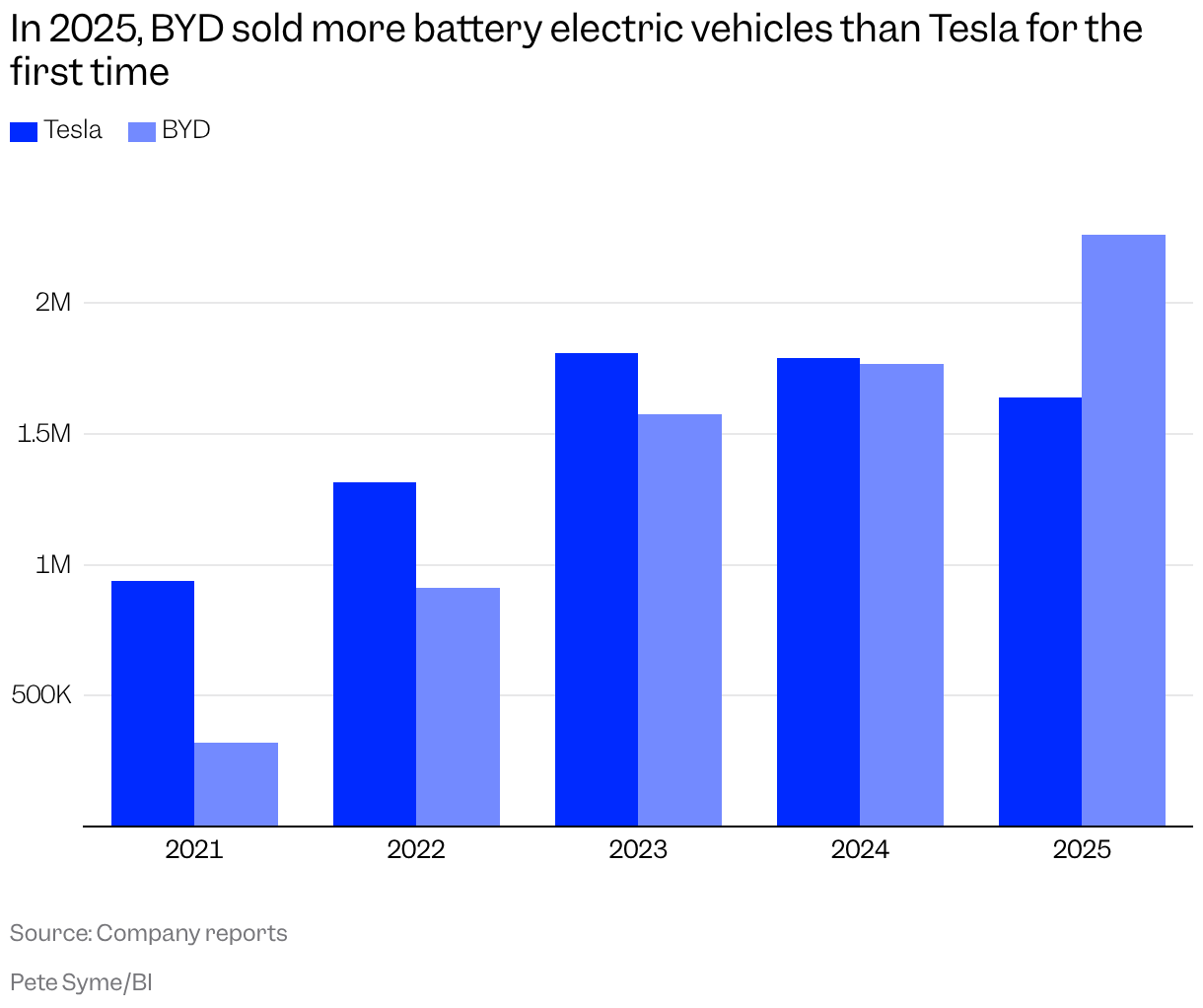

It came as the company’s financial disclosures painted a stark picture of the troubles facing its EV business, which saw sales decline for the second year in a row in 2025.

Tesla beat Wall Street’s expectations, but reported its first-ever decline in annual revenue and said profits fell by 46% last year, while revenue from car sales fell by 11% year-over-year in the last quarter.

Executives largely shrugged off the headwinds, with Musk and other top employees reiterating in the analyst Q&A their belief that autonomous vehicles will shortly render traditional forms of transport obsolete.

“The vast majority of miles traveled will be autonomous in the future,” said Musk, in response to an investor question asking about Tesla’s plans to launch new models.

“I’m just guessing, but probably less than 5% of miles driven will be where somebody’s actually driving the car themselves in the future, maybe as low as 1%,” he added.

Investors reacted positively, with Tesla shares rising around 3% after hours following earnings.

The reaction is another sign of how, for many investors, vehicle sales have become a sidenote to Tesla’s future, as the company executes an ambitious shift toward a new business model built on robotics, AI, and software services.

“They’re definitely moving away from an automotive-oriented company to a tech-oriented company,” Sam Fiorani, vice president of global vehicle forecasting at AutoForecast Solutions, told Business Insider prior to Tesla’s earnings. ‘”This is a company that’s looking to get away from vehicle sales as the focus of their revenue.”

Tesla shakes up FSD

Elon Musk has long said that Tesla should be thought of as an AI and robotics company, not a carmaker. Investors have agreed, driving Tesla’s market cap to $1.35 trillion, more than every other US carmaker combined.

Even before Tesla’s latest AI-focused earnings, there were signs that the company had begun to act more like the tech giant Musk dreams of.

The company overhauled its autonomy offerings in recent weeks, removing the option to buy its premium Full Self-Driving software for a one-off fee of $8,000 and making it subscription-only.

Tesla also killed its basic Autopilot tier, which previously came free on almost all its vehicles, instead replacing it with a more limited form of cruise control. Musk also indicated in a post on X that Tesla owners can expect FSD prices to rise beyond the $99-per-month subscription fee as the technology improves.

Phasing out free features and hiking subscription prices is classic tech giant behavior, and the moves quickly sparked backlash from Tesla fans and customers on social media. Analysts told Business Insider the changes were likely aimed at driving adoption of FSD and monetizing the existing user base.

“I think it’s about monetizing FSD. I think they’re going to look at more ways to monetize what I view as services, autonomous, and really disruptive technology within their installments,” Dan Ives, managing director at Wedbush Securities and a longtime Tesla Bull, told Business Insider ahead of earnings.

Musk has described FSD as crucial to Tesla’s future, but the company has struggled to get drivers to pay for it. In October, Tesla CFO Vaibhav Taneja told investors that just 12% of Tesla owners have bought FSD.

On Wednesday, Taneja said that 1.1 million customers had bought FSD, but added that nearly 70% of those purchases were upfront rather than subscription.

Boosting FSD subscriptions is also a key milestone for Musk’s $1 trillion pay package, which requires the company to hit 10 million active FSD subscriptions by 2035 for the Tesla CEO to unlock the full payout.

Robotaxis rev up

The most critical part of Tesla’s transition to a tech company is its robotaxi and Optimus humanoid robot initiatives, which Musk has said will eventually make Tesla the world’s most valuable company.

Tom Narayan, lead equity analyst at RBC Capital Markets, told Business Insider that nearly 75% of his long-term valuation of the company was based on robotics and autonomous vehicles, with just 8% coming from car sales. Ives put that figure at 80-90%, adding that he viewed Tesla as an “autonomous and robotics company” moving forward.

“That’s why this is such a key transition year for Musk and Tesla. Any delays in autonomous or robotaxis are going to be heavily scrutinized because that’s the key to the valuation,” Ives added.

Tesla launched its robotaxi service in Austin last June, and recently began offering some public rides without a safety driver. However, its service in the Texan city is still small, with around 50 active vehicles, according to a community tracker run by Austin-based robotaxi watcher Ethan McKenna.

Musk said on Wednesday that Tesla would have robotaxis operating in “somewhere between a quarter and half” of the US by the end of the year, pending regulatory approval, and the company is set to begin production on its dedicated Cybercab robotaxi in April.

Ives added that Tesla’s focus this year would be on building out its robotaxi service, noting he didn’t expect the company to begin collecting “meaningful revenue” from autonomous ride-hailing until 2027.

“It’s important that they get into what I believe will probably be roughly about 30 cities this year. 2026 is the build-out of robotaxis, 2027 is where you’ll start to see more monetization,” Ives said.

Once Tesla’s robotaxi service reaches escape velocity, Narayan said he expects it to transform the company’s business model from a traditional carmaker into a high-margin services business more akin to Uber.

“It dramatically transforms the current auto business, which is a capital-intensive, low-margin business, into a high-margin, much higher revenue business,” he said. “The market is bigger and the economics are far better.”

Executing that transition will be expensive. Taneja, Tesla’s CFO, said on Wednesday that the company expects to spend more than $20 billion this year on new production lines and AI compute infrastructure.

Cars become ‘legacy products’

For Tesla’s beleaguered EV business, things look unlikely to improve anytime soon.

Although Tesla continues to dominate the electric vehicle market in the US, the end of the $7,500 tax credit in September has caused that market to slow dramatically, with rivals Ford and GM canceling electric models and taking billions of dollars in charges amid warnings of an EV winter.

Outside of the US, Tesla is losing market share to Chinese carmakers such as BYD, which now dominate China’s booming EV market and are growing rapidly in Europe and the rest of the world.

AutoForecast Solutions’ Fiorani said that Tesla ran the risk of a bumpy transition period if its carmaking business declined faster than its robotaxi and services businesses could grow. However, he added that the company may have no choice but to make the leap.

He pointed to the competition from China and declining income from the regulatory credits that Tesla sells to automakers who have failed to sell enough EVs as evidence that the company’s automotive business was running out of road.

“Musk sees the future of this business as robots and autonomous vehicles,” Fiorani said.

“The physical products themselves, the cars and the automotive side, are all legacy products,” he added. “We’re going to see them going forward to autonomous software, autonomous hardware, things that will move them into the next generation.”

Read the original article on Business Insider

The post Elon Musk insists Tesla is a tech company. It’s starting to look like one. appeared first on Business Insider.