On paper, the economy is booming.

Low unemployment, strong consumer spending and steady business investments have helped fuel the largest expansion in years. The U.S. economy grew at a robust annual rate of 4.4 percent in the most recent quarter, defying fears of an imminent slowdown.

But economists caution that growth is increasingly concentrated. The result is a steady but fragile economy, built on a series of narrowing pillars.

“There are one-legged stools everywhere you look and yet when you put it all together, we’re still standing,” said Diane Swonk, chief economist at KPMG, who began using the phrase last summer to describe the economy. “The question is, how long can we keep ourselves upright?”

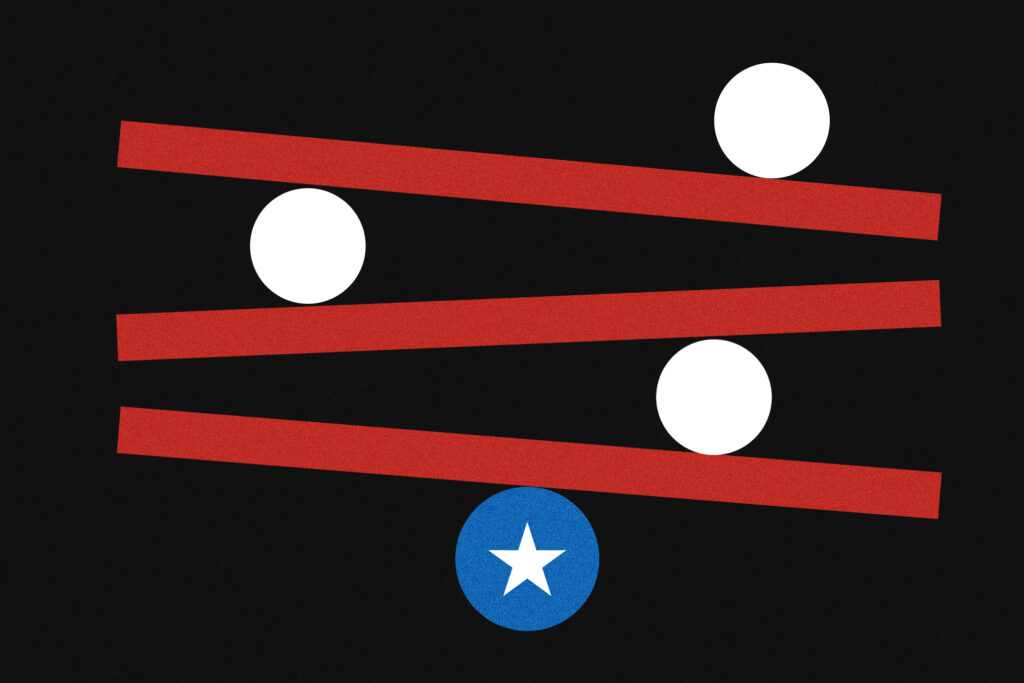

Here, in charts, are three pillars holding up the U.S. economy.

Health care jobs are propping up the labor market

The job market has been surprisingly sturdy, even in the face of high interest rates, changing economic policy and looming uncertainty. The unemployment rate, at 4.4 percent, is near historic lows.

But the bulk of the job market’s recent gains has come from one industry: health care.

Health care and social assistance positions accounted for 97 percent of the 733,000 private-sector jobs created across the economy last year. Hospitals, doctor’s offices and residential care facilities added hundreds of thousands of positions in 2025, helping make up for losses in manufacturing, transportation and white-collar professions such as advertising and computer science.

“It’s really impressive how much job growth has been driven by health care and social assistance,” said Daniel Zhao, chief economist at careers site Glassdoor. “It’s the last remaining pillar of growth.”

But having nearly all job growth concentrated in one sector is risky for the economy, he added. It’d be much better if gains were spread across a variety of industries, especially given that health care hiring has slowed in recent months. Employers added an average 421,00 health care and social assistance jobs a month in the first half of 2025; in the second half, that figure fell to 363,000.

The wealthiest Americans are driving spending

The post-pandemic recovery has favored the richest Americans. Fast-rising home values and a rapid run-up in stock valuations have disproportionately padded the fortunes of the wealthiest, allowing them to keep spending in a way that’s lifting the entire economy.

The top 10 percent of Americans — those earning $275,000 or more — now account for a record 45 percent of all spending, up from about 39 percent before the pandemic, according to Moody’s Analytics. That imbalance helps explain why spending on extras such as dining out and travel has kept rising over the past year, even as many households say they’re cutting back.

“There’s been a dramatic narrowing: The folks at the top account for a much higher share of spending than the folks in the bottom 80 percent, and that gap is widening,” said Mark Zandi, chief economist at Moody’s Analytics. “It very clearly shows that the economy is dependent on spending by the folks at the top.”

Rising consumer spending has been a major driver of growth in recent quarters, accounting for nearly 70 percent of the country’s gross domestic product.

But after adjusting for inflation, spending by lower- and middle-income Americans has largely stayed flat since the pandemic, Zandi said. The top 20 percent, though, are splurging: Their spending is up by more than 4 percent per year since 2020.

That dynamic is worrisome, Zandi said — both because it leads to growing disparities, and also because so much of the wealthiest Americans’ recent spending power is tied to the whims of the stock market.

“Surging stock prices have made the wealthy even wealthier, giving them the willingness to spend,” he said. “But what happens if something were to disrupt that equity party? That source of growth would go away, and it would be enough to send the economy into a recession, or darn close to one.”

AI-related investments are propelling business spending and the stock market

Spending on artificial intelligence is driving billions in business investments and helping lift stocks to record highs, boosting company valuations and Americans’ portfolios.

The four richest companies developing AI — Microsoft, Google, Amazon and Meta — have spent roughly $360 billion, combined, in the past year on big-ticket projects, including building AI data centers and outfitting them with computer chips, software and other equipment, according to a recent Washington Post analysis. (Amazon founder Jeff Bezos owns The Post.) Overall business spending on equipment and software has grown every quarter since January 2025.

“There is one horse drawing the carriage right now, and that’s AI,” said Mark Muro, a senior fellow at the Brookings Institution who studies the AI economy. “But it’s not necessarily a reassuring source of growth. There are worries about a bubble, and a lot of questions about what happens next.”

Although there is growing debate over just how much those investments are contributing to the U.S. economy, experts say it’s clear that AI-related enthusiasm has translated to real gains, especially in the stock market.

Among the biggest beneficiaries of that boom have been the ‘Magnificent Seven,’ a group of tech giants — Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla — that have seen their share prices balloon by nearly 20 percent, on average, in the past year, translating to trillions in value.

“The two engines of today’s economy are the AI ecosystem and wealthy consumers,” Richmond Fed president Tom Barkin said in a recent speech. The two, he noted, are closely linked: AI “has been supporting virtually all of the growth in business investment. And any drop in valuations of the Magnificent Seven would surely flow through to net worth and, in turn, to consumption.”

Shira Ovide contributed to this report.

The post The ‘one-legged stools’ holding up a fragile economy appeared first on Washington Post.