General Motors said on Tuesday it expected a substantial rise in profits in 2026 and planned to buy back up to $6 billion worth of its own stock. The news appeared to please investors who bid up its stock price.

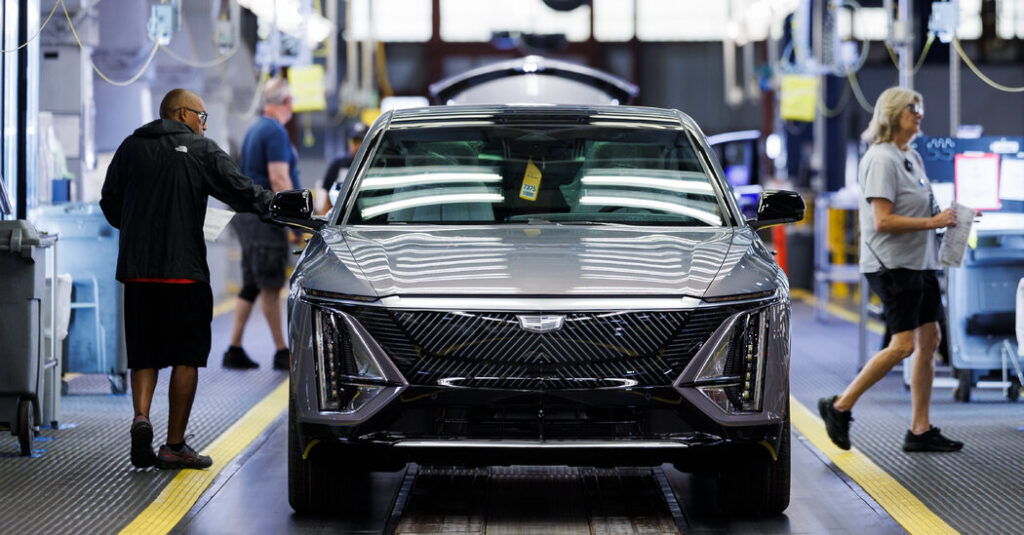

G.M. said it made $2.7 billion last year, down from $6 billion in 2024. The 2025 total was lowered by some $7.6 billion in losses the company previously reported as it pulled back on its electric vehicle strategy and lowered production of those cars. The losses in part reflected a decline in the value of factories and related investments.

For 2026, the automaker expects to earn $10.3 billion to $11.7 billion, saying sales of high-profit gas-powered pickup trucks and large sport-utility vehicles would rise. G.M. also said it was increasing its quarterly dividend by 20 percent, to 18 cents per common share.

G.M. shares were up more than 4 percent in premarket trading.

“We are operating in a U.S. regulatory and policy environment that is increasingly aligned with customer demand,” Mary T. Barra, G.M.’s chief executive, said on a conference call. “This allows us to onshore more production to meet strong demand for our internal-combustion vehicles.”

G.M.’s decision to pull back from electric vehicles came after Congress and President Trump ended a $7,500 tax credit that was available to buyers of new E.V.s, lowering demand for those models.

The company said it would continue to produce electric cars and trucks and expected its losses on such models to decline by $1 billion to $1.5 billion this year compared to 2025.

While reporting its earnings, G.M. also said it planned to introduce a more advanced version of its Super Cruise driver assistance system in 2028 that would allow drivers to take their eyes off the road while traveling on highways.

“We believe we have everything we need to deliver a safe, reliably and highly capable system that customers will embrace,” Ms. Barra said.

The system will use cameras, radar and laser based sensors to detect objects on the road and signals G.M. aims to challenge Tesla and its advanced driver assist technologies. Tesla’s system, Full Self Driving (Supervised), uses only cameras and that company’s chief executive, Elon Musk, has said for years that laser-based sensors were too expensive and not necessary for safety.

G.M. had tried to develop fully autonomous cars through its Cruise division, but announced in December 2024 that it was shutting down the operation after one of its vehicles hit and injured a pedestrian in San Francisco.

For 2025, G.M. reported $185 billion in revenue, a decline of about 1 percent, as global vehicle sales fell about 5 percent, to 3.8 million cars and light trucks.

The automaker also said the Trump administration’s tariffs on cars and car parts cost the company $3.1 billion in 2025, but the company was able to offset about 40 percent of that sum by moving some vehicle and component production to the United States. It said it expected tariff costs in 2026 of $3 billion to $4 billion.

Neal E. Boudette, a Michigan-based reporter for The Times, has been covering the auto industry for more than two decades.

The post G.M. Shares Rise as Investors Are Encouraged by 2026 Prospects appeared first on New York Times.